Reassessing News (NWSA) Valuation After Recent Share Price Weakness

Assessing recent moves in News stock

News (NWSA) has drifted lower over the past 3 months, even though revenue and net income are still growing. This sets up an interesting disconnect between the stock price and fundamentals.

See our latest analysis for News.

Zooming out, the share price has slid from recent highs to around $25.89. That weaker short term share price return contrasts sharply with a still impressive multi year total shareholder return, suggesting momentum has cooled as investors reassess the risk reward trade off.

If this kind of reset has you rethinking where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as a way to uncover fresh, higher conviction ideas.

With revenue and earnings still climbing and the share price lagging, analysts see meaningful upside to their targets. But is the current weakness a genuine value gap, or is the market already factoring in News upcoming growth?

Most Popular Narrative: 29.4% Undervalued

With the narrative fair value sitting around $36.69 versus a $25.89 last close, the valuation case leans heavily on recurring digital growth and margin expansion.

Content licensing and anticipated AI/data partnership deals are creating new diversified revenue streams, leveraging News Corp's high-value intellectual property in an environment where digital and AI content consumption is rapidly expanding, supporting incremental revenue and long-term earnings growth.

Curious how steady top line growth, rising margins, and richer data licensing combine to support that higher value. Want to see the exact earnings path behind it.

Result: Fair Value of $36.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained print decline and weaker engagement at key digital properties could stall growth and undermine the optimistic licensing and margin expansion narrative.

Find out about the key risks to this News narrative.

Another Angle on Valuation

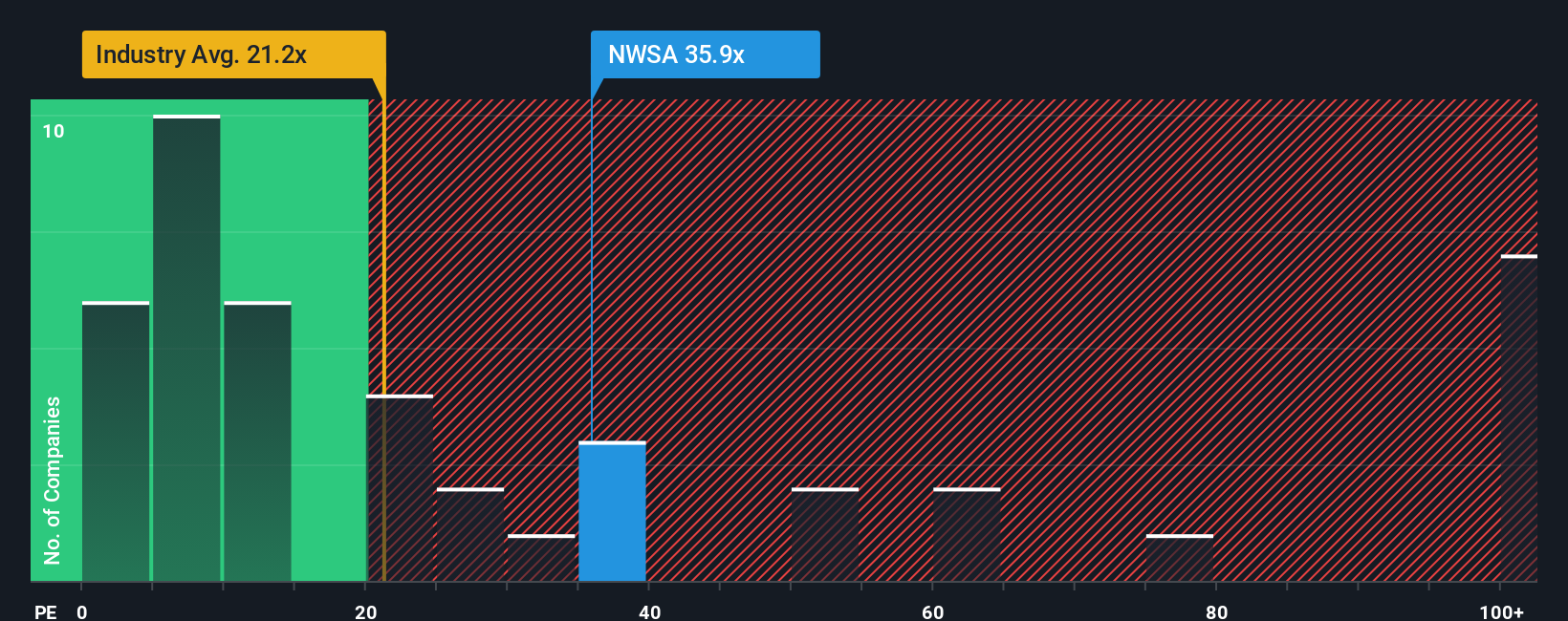

On earnings, News looks anything but cheap. It trades on about 30.5 times earnings, almost double the US Media industry at 15.9 times and well above peers at 18.9 times. The fair ratio of 20.2 times hints the market could eventually price in downside instead of upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own News Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding News.

Looking for more investment ideas?

Before you move on, lock in your next watchlist upgrades using the Simply Wall Street Screener, so you do not miss the strongest opportunities lining up right now.

- Capture potential multi baggers early by scanning these 3627 penny stocks with strong financials that combine tiny market caps with financial strength and signs of momentum.

- Position yourself at the frontier of automation by targeting these 30 healthcare AI stocks transforming diagnostics, treatment planning, and medical data with intelligent software.

- Seek more dependable portfolio income by focusing on these 13 dividend stocks with yields > 3% that pair attractive yields with solid fundamentals and consistent cash generation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal