Value Line (VALU) Net Margin Surge Reinforces Bullish Profitability Narratives After Q2 2026 Results

Value Line (VALU) opened Q2 2026 with total revenue of about $8.6 million and EPS of roughly $0.60, as investors weighed these latest numbers against its steadily profitable track record. The company has seen quarterly revenue move in a fairly tight band around the mid single digit millions over the past six quarters, while EPS has generally held in the low to mid $0.60 range from Q1 2025 through Q2 2026. This signals consistent earnings power that sets the stage for a closer look at what is driving its robust trailing net margins.

See our full analysis for Value Line.With the headline figures on the table, the next step is to line these results up against the key narratives around Value Line to see which stories the numbers back up and which ones they start to challenge.

Curious how numbers become stories that shape markets? Explore Community Narratives

61.1 percent net margin stands out

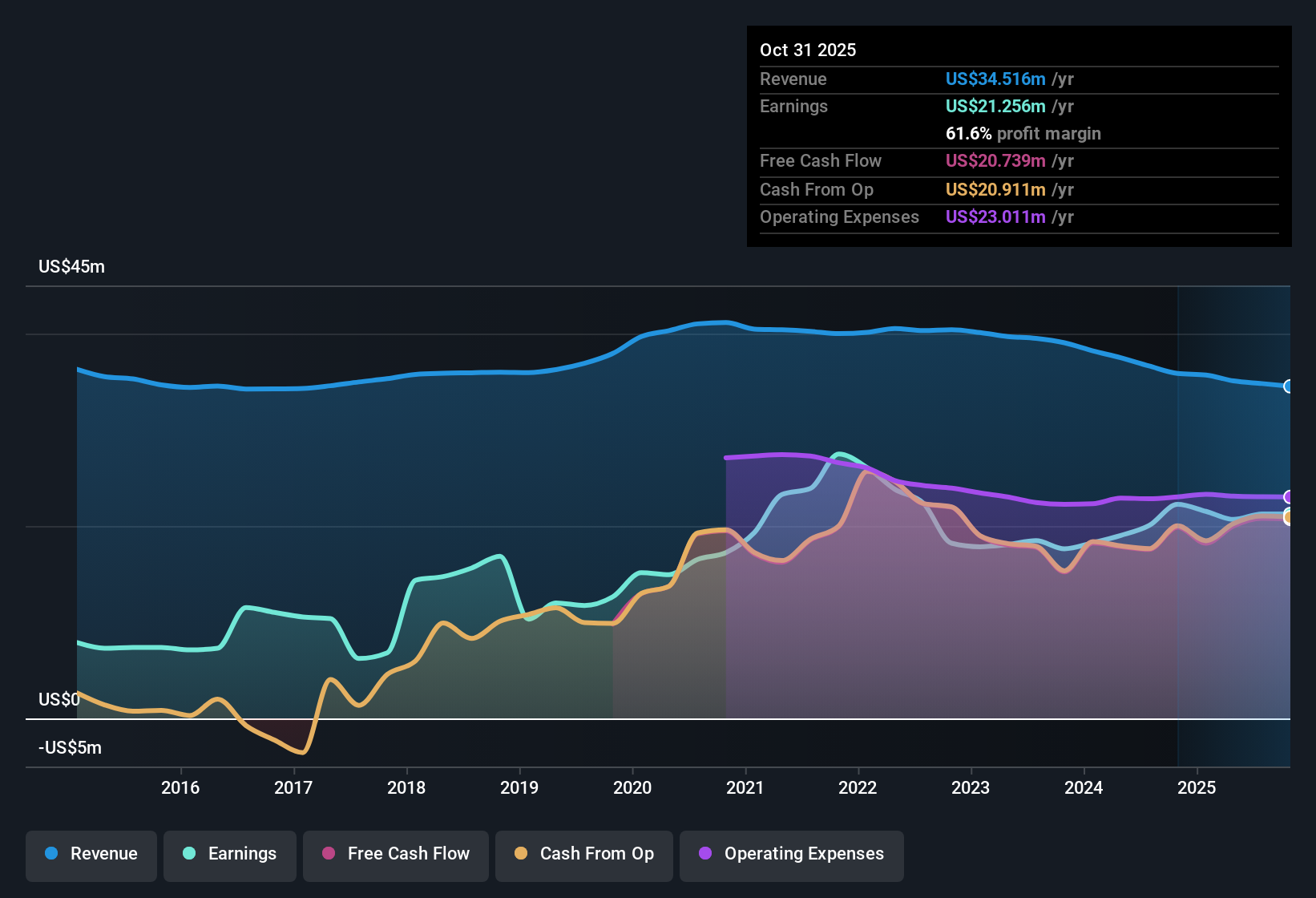

- Over the last 12 months, Value Line converted $34.5 million of revenue into $21.3 million of net income, a 61.1 percent net margin compared with 54.7 percent a year earlier.

- What is striking for a bullish take is how this high margin aligns with 6.1 percent earnings growth over the year, yet

- the five year earnings trend still shows a 0.9 percent per year decline, so the recent improvement has not fully reversed the longer term slide.

- trailing revenue slipped from $36.6 million in early 2025 to $34.5 million by Q2 2026, so stronger margins are offsetting a softer top line rather than riding clear growth.

EPS growth outpaces five year trend

- On a trailing basis, basic EPS rose from $2.13 in early 2025 to about $2.26 by Q2 2026, a 6.1 percent one year earnings increase versus the longer term five year average decline of 0.9 percent per year.

- Critics focused on that five year decline may see it as a warning, yet

- recent quarterly EPS has mostly sat in the low to mid $0.60 range, with Q2 2026 at about $0.60 and several prior quarters near that level, suggesting more stability in the last six quarters than the longer term trend implies.

- net income for the latest reported quarter, at roughly $5.7 million on $8.6 million of revenue, is broadly in line with other recent quarters, which does not obviously match a story of steadily weakening profitability.

DCF gap versus P or E support

- With shares at $39.28 against a DCF fair value of about $35.35, the stock trades above that modelled value, while its trailing P or E of 16.9 times sits below the broader US market at 19 times and below the US Capital Markets industry at 25 times.

- Bears point to the DCF gap and five year earnings decline, but

- the 3.41 percent dividend yield and 61.1 percent net margin are concrete income and profitability supports that do not rely on aggressive growth assumptions.

- the current P or E being below both the market and industry averages suggests investors are not paying a premium multiple despite the stock trading above the DCF fair value estimate.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Value Line's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite standout margins, Value Line is wrestling with shrinking revenue, a negative five year earnings trend and a share price sitting above DCF fair value.

If a flat top line and valuation concerns make you uneasy, use our these 909 undervalued stocks based on cash flows today to quickly zero in on companies where prices still look genuinely attractive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal