Is There Still Value in Sandisk After a 460.8% Surge and Recent Pullback?

- Wondering if Sandisk has already run too far or if there is still value left on the table? You are not alone, and this article is going to unpack exactly what the market might be missing.

- Despite being up a massive 460.8% year to date, the stock has recently pulled back, dropping 8.0% over the last week and 20.6% over the last 30 days. This suggests investors are actively rethinking both the upside and the risks.

- Much of this volatility has been tied to shifting sentiment around the broader memory and storage cycle, with investors debating how sustainable the latest demand upturn really is. At the same time, headlines around industry supply discipline and AI driven storage needs have kept Sandisk firmly in the conversation as a potential long term winner.

- Right now, Sandisk scores just 2/6 on our valuation checks. This suggests the stock only screens as undervalued on a couple of traditional metrics, but there is more to the story. Next, we will walk through the main valuation approaches investors are using today, before closing with a more powerful way to think about what Sandisk is really worth in the long run.

Sandisk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sandisk Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back into today’s dollars, aiming to estimate what the entire business is worth right now.

For Sandisk, the model starts with last twelve month Free Cash Flow of about $481 million and then layers on analyst forecasts and longer term extrapolations. Analysts see FCF rising into the low to mid single digit billions, with projections reaching roughly $4.7 billion by 2035. Simply Wall St uses a 2 Stage Free Cash Flow to Equity approach, where the first years rely on analyst estimates and the later years assume moderating growth as the business matures.

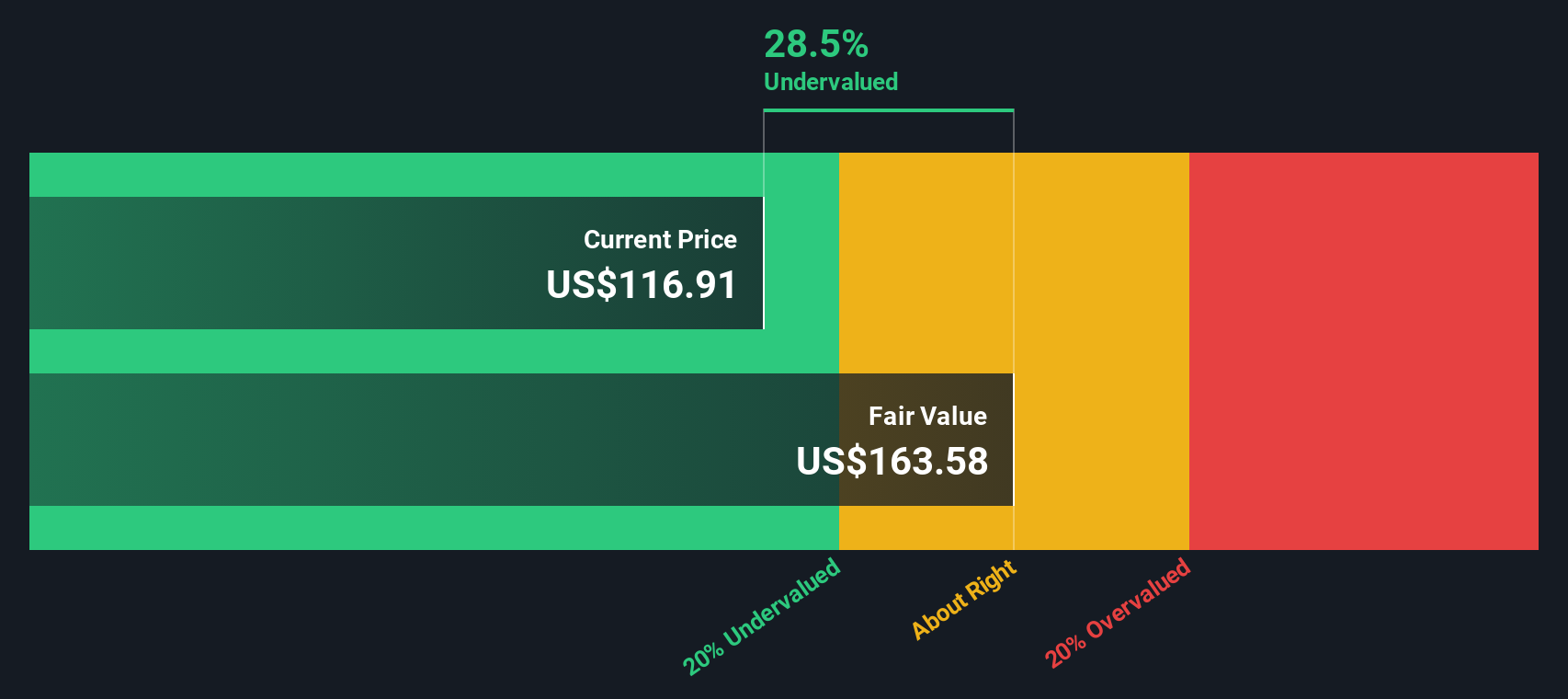

Rolling all those projected cash flows together and discounting them back results in an estimated intrinsic value of about $445 per share. Compared to today’s price, that implies the stock is roughly 54.7% undervalued, suggesting the market is heavily discounting the durability of Sandisk’s future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sandisk is undervalued by 54.7%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Sandisk Price vs Sales

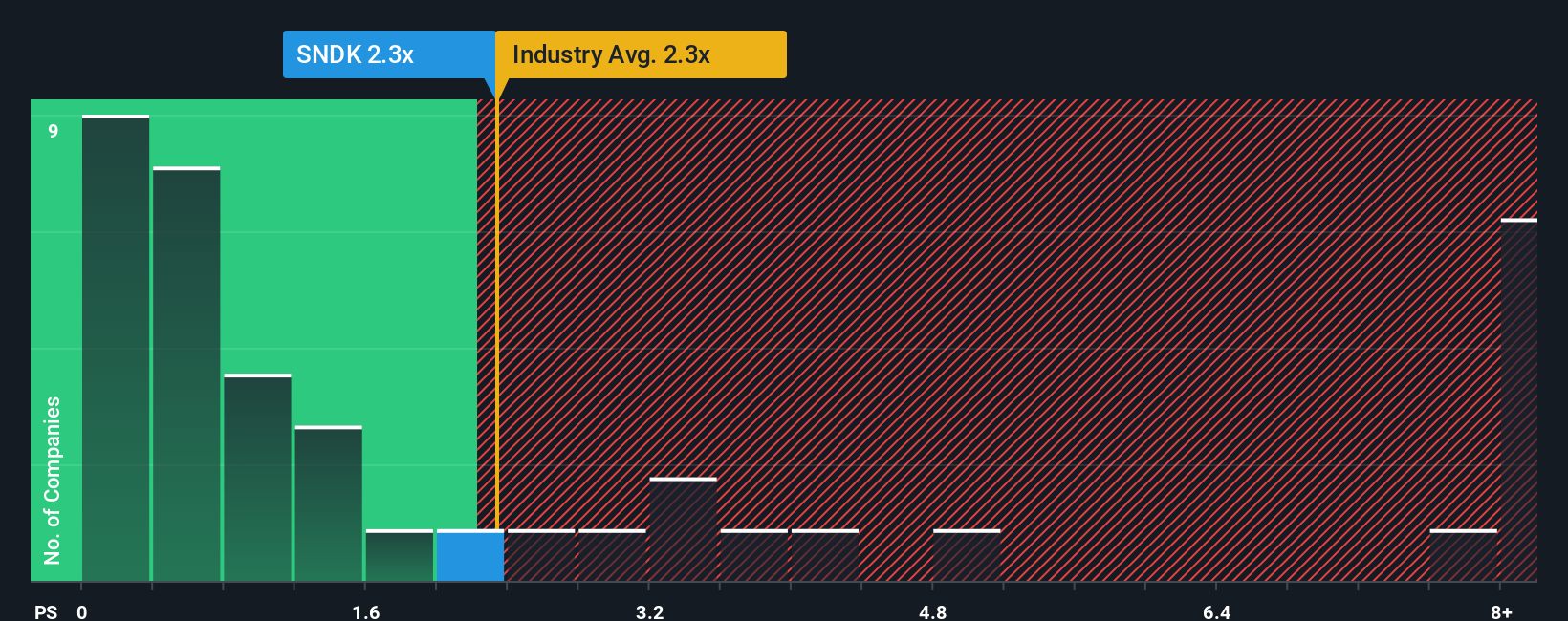

For companies like Sandisk that are still normalizing profitability through the cycle, the Price to Sales ratio is often the cleanest way to compare valuation, because it focuses on the revenue engine before accounting quirks and volatile margins.

In general, investors are willing to pay a higher sales multiple for businesses with faster, more durable growth and lower perceived risk, while slower or more cyclical names typically command a lower “normal” Price to Sales range. Right now, Sandisk trades on about 3.80x sales, which is well above the broader Tech industry average of 1.72x, and also a premium to its closer peer group at roughly 2.83x.

Simply Wall St’s Fair Ratio framework tries to refine this by estimating what multiple Sandisk should trade on, given its growth profile, profitability, industry, size and risk. It arrives at a Fair Price to Sales of 3.31x. Because this Fair Ratio blends company specific drivers with sector context, it is more tailored than a simple comparison with peers or the industry alone. With the actual 3.80x sitting notably above the 3.31x Fair Ratio, the stock screens as somewhat expensive on a sales basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sandisk Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to the numbers you believe in, from Sandisk’s future revenue and earnings to its long term margins and fair value. A Narrative links what you think will actually happen to the business, to a concrete financial forecast, and then to a fair value estimate you can directly compare with today’s share price. On Simply Wall St, millions of investors build and share these Narratives on the Community page, making it easy to see different, fully quantified viewpoints and use them to decide whether Sandisk looks like a buy, a hold, or a sell. As new information arrives, such as earnings releases or major news, each Narrative’s forecasts and valuation are updated dynamically, so your view of Sandisk can evolve in real time. For example, one Sandisk Narrative might see modest growth and a lower fair value, while another assumes rapid AI driven demand and a much higher long term valuation.

Do you think there's more to the story for Sandisk? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal