Japan Exchange Group, Inc.'s (TSE:8697) Shareholders Might Be Looking For Exit

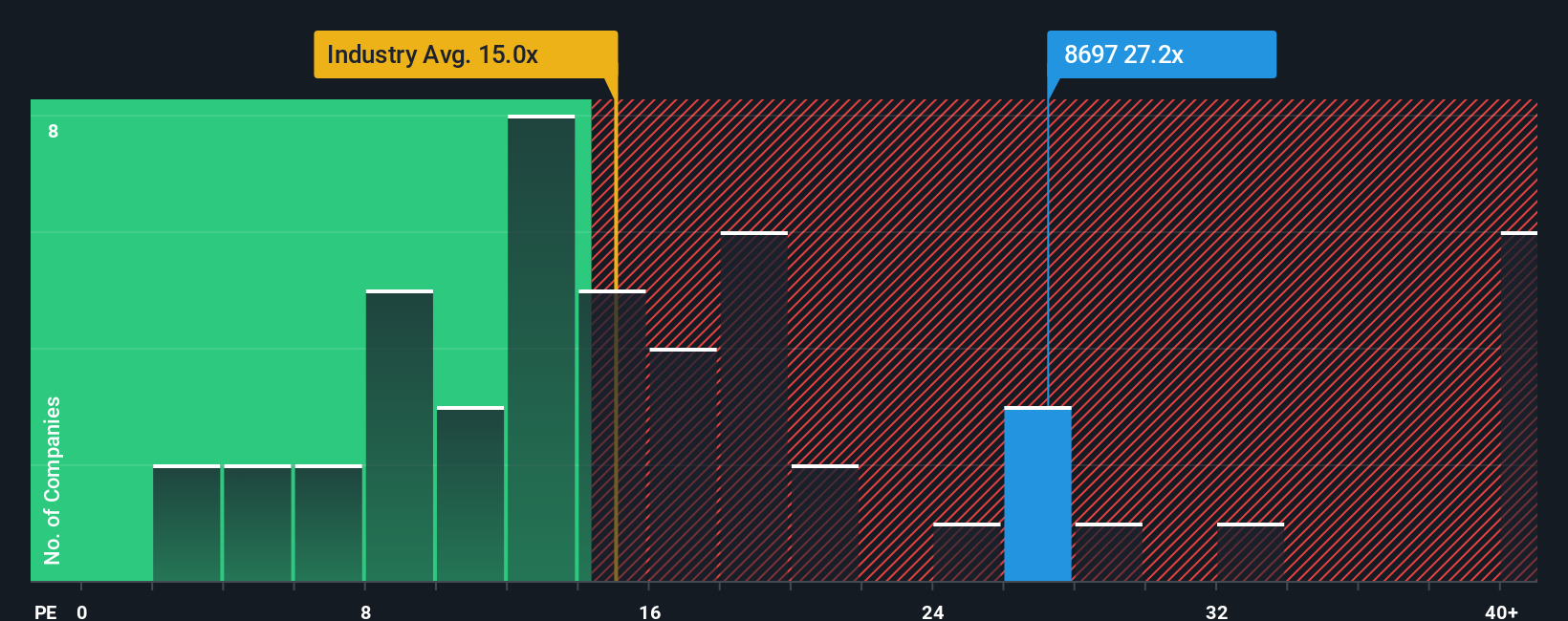

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Japan Exchange Group, Inc. (TSE:8697) as a stock to avoid entirely with its 27.2x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's inferior to most other companies of late, Japan Exchange Group has been relatively sluggish. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Japan Exchange Group

How Is Japan Exchange Group's Growth Trending?

Japan Exchange Group's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 3.0%. This was backed up an excellent period prior to see EPS up by 34% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 3.9% per annum during the coming three years according to the three analysts following the company. With the market predicted to deliver 9.1% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's alarming that Japan Exchange Group's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Japan Exchange Group's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Japan Exchange Group currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware Japan Exchange Group is showing 1 warning sign in our investment analysis, you should know about.

You might be able to find a better investment than Japan Exchange Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal