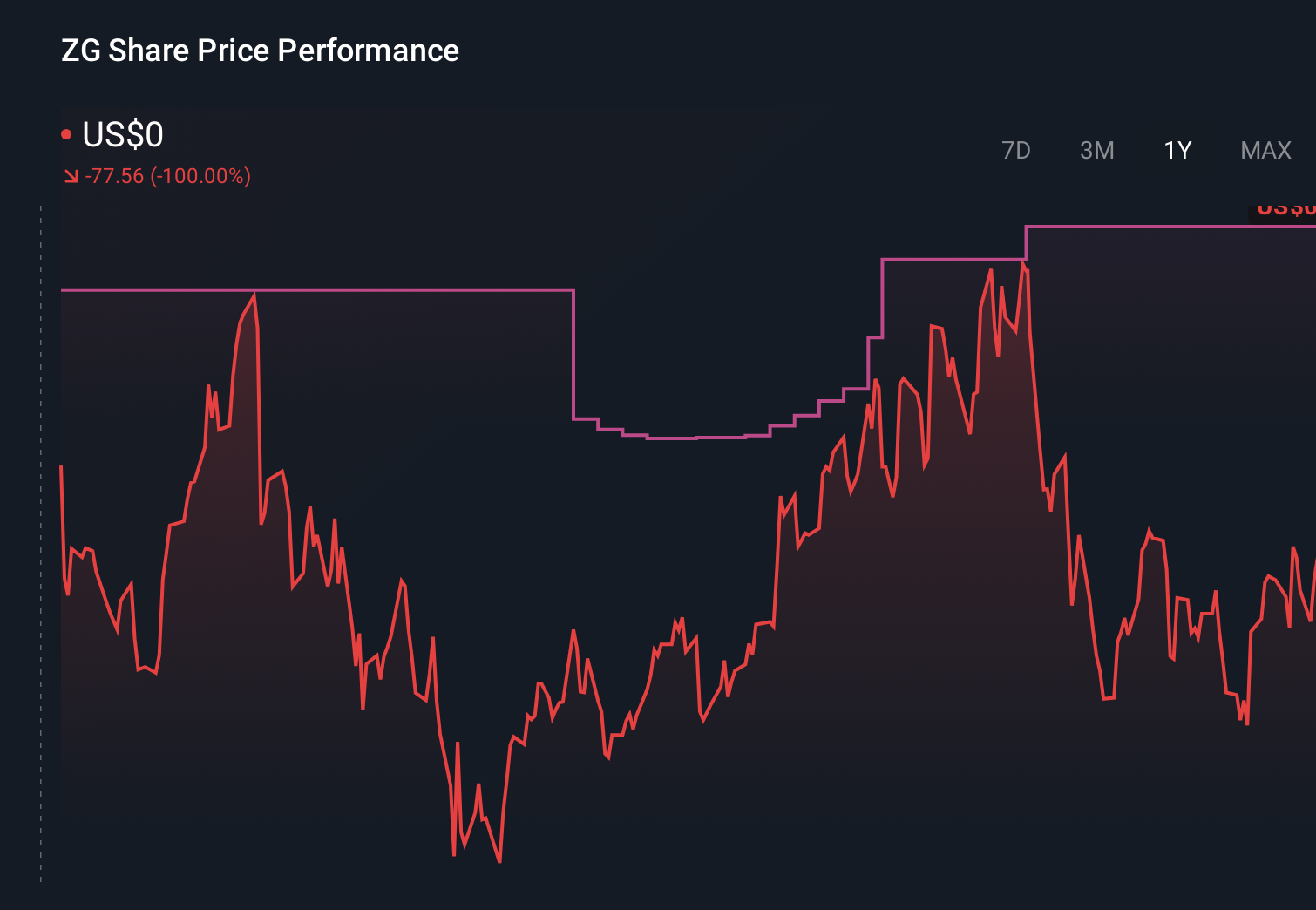

Zillow Group (ZG) Is Down 7.9% After Google Tests Home-For-Sale Ads With Built-In Tools

- Earlier this week, investors learned that Google is testing mobile-first home-for-sale ads with built-in listing details, tour requests, and scheduling tools that overlap with Zillow’s Premier Agent experience and could reshape how buyers and sellers find real estate online.

- At the same time, Zillow is juggling listing-feed tensions with Chicago’s MLS and reevaluating climate-risk disclosures, highlighting pressures on its data advantages and agent relationships.

- We’ll now examine how Google’s potential move into real estate search could influence Zillow’s previously optimistic investment narrative built around digital leadership.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Zillow Group Investment Narrative Recap

To own Zillow today, you need to believe its audience scale and product suite can keep it central to digital real estate, even as competition heats up. Google’s mobile-first listing tests directly touch Zillow’s Premier Agent moat and add to near term uncertainty around its key catalyst: higher monetization of leads as housing activity stabilizes. At the same time, reliance on advertising and agent spend remains the most immediate business risk.

The recent standoff with Chicago’s MLS brings that risk into sharper focus, since consistent, high quality listing feeds are core to Zillow’s traffic and lead volume. As Zillow pushes harder into integrated tools like BuyAbility and rentals credit products, its ability to keep agents and brokerages engaged while preserving data access will influence how much upside management can capture from its digital ecosystem.

Yet beneath Zillow’s consumer brand strength, investors should be aware that intensifying competition for online real estate search could...

Read the full narrative on Zillow Group (it's free!)

Zillow Group's narrative projects $3.6 billion revenue and $415.2 million earnings by 2028.

Uncover how Zillow Group's forecasts yield a $88.46 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span roughly US$29 to US$102 per share, showing wide disagreement on upside. You can weigh those views against the new competition risk from Google’s real estate ad tests and consider how it could influence Zillow’s path toward stronger profitability.

Explore 5 other fair value estimates on Zillow Group - why the stock might be worth less than half the current price!

Build Your Own Zillow Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zillow Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Zillow Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zillow Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal