Marsh McLennan (MMC): Valuation Check After Mizuho Initiation, Thrive Plan and $6 Billion Buyback

Mizuho’s new coverage on Marsh and McLennan Companies (MMC) spotlights three levers investors care about: ongoing margin gains, the Thrive restructuring plan, and a fresh 6 billion dollars buyback alongside expansion in Hawai’i.

See our latest analysis for Marsh & McLennan Companies.

Those moves come as the share price trades around 187.3 dollars, with a modest positive near term share price return but a weaker year to date backdrop. At the same time, multi year total shareholder returns still point to a solid long term compounding story and gradually rebuilding momentum.

If you like MMC’s steady compounding but want to see what else is out there, this is a good moment to explore fast growing stocks with high insider ownership.

With shares trading below analyst targets and a double digit intrinsic discount, investors face a familiar dilemma: is MMC quietly undervalued after a soft year, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 11.8% Undervalued

Compared with Marsh & McLennan Companies’ last close of 187.3 dollars, the most followed narrative points to a meaningfully higher fair value, built on steady growth and resilient margins.

Strategic investments in digital transformation, advanced analytics, and AI (e.g., proprietary data tools for risk modeling, agentic interfaces) are expected to enhance operational efficiency and improve product/service offerings, enabling margin expansion and net earnings growth through improved client retention and lower cost to serve.

Curious how modest revenue growth, rising margins and a richer earnings multiple combine into this upside case? The narrative stitches these levers into one tight valuation story. Want to see exactly how those moving parts add up?

Result: Fair Value of $212.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer property and casualty pricing and any missteps integrating acquisitions like McGriff could pressure margins and undermine the current upside case.

Find out about the key risks to this Marsh & McLennan Companies narrative.

Another Angle on Valuation

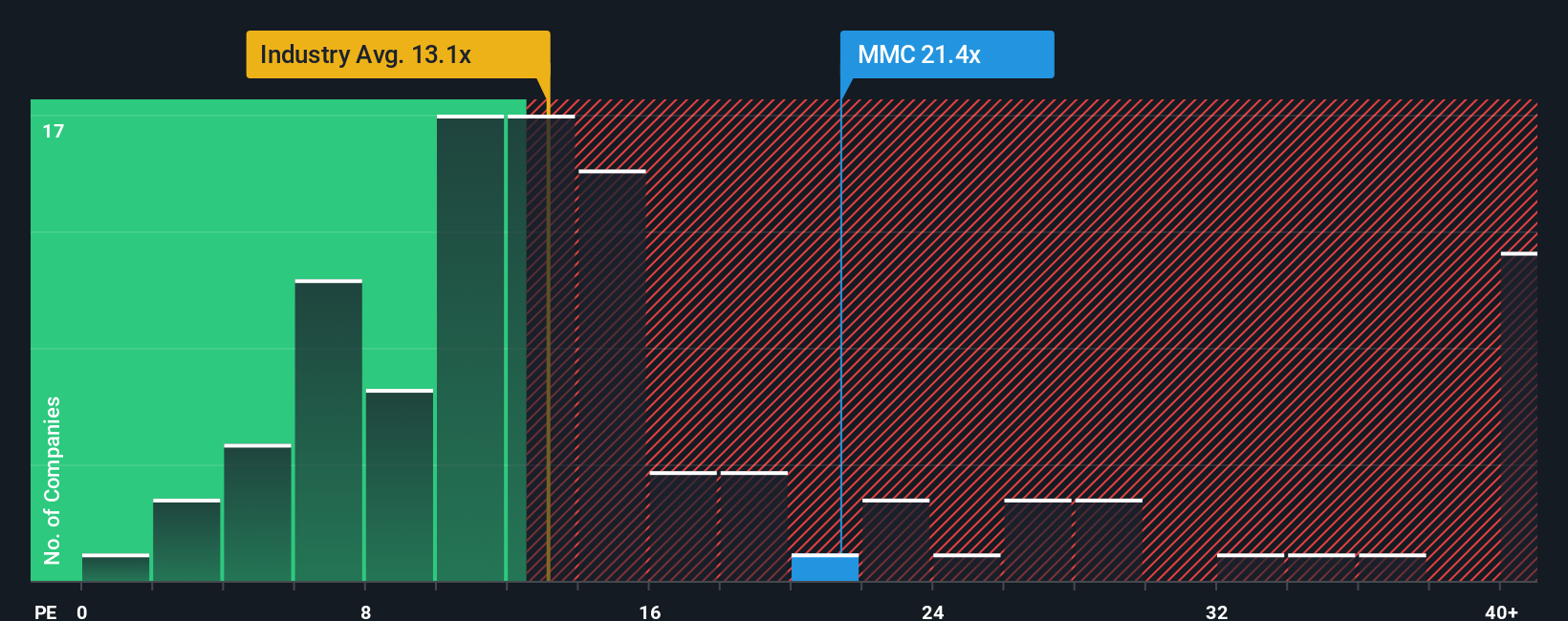

Our fair ratio based on earnings paints a cooler picture. MMC trades on a 22.2x P/E, comfortably above the industry at 13.4x and the 14.8x fair ratio our model suggests, yet cheaper than peers at 28.1x. Is that a premium worth paying or multiple risk waiting to unwind?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marsh & McLennan Companies Narrative

If you see the numbers differently, or want to test your own thesis against the data, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Marsh & McLennan Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy and keep your portfolio one step ahead.

- Capture potential mispricings by reviewing these 913 undervalued stocks based on cash flows that may be trading below their intrinsic value based on cash flows and fundamentals.

- Capitalize on the AI revolution with these 25 AI penny stocks that link cutting edge innovation to real revenue growth and scalable business models.

- Strengthen your income stream by targeting these 13 dividend stocks with yields > 3% that combine healthy yields with sustainable payout ratios and solid balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal