Assessing Bitmine Immersion Technologies (BMNR) Valuation After Its Recent Share Price Pullback

Bitmine Immersion Technologies (BMNR) has turned into a wild ride for investors, with the stock sliding about 11% in the past day and over 45% in the past 3 months despite a strong year-to-date gain.

See our latest analysis for Bitmine Immersion Technologies.

That pullback sits within a much bigger move, with the year to date share price return still running in the triple digits and the 1 year total shareholder return above 200%. This suggests momentum is cooling, but the broader blockchain story remains very speculative.

If Bitmine’s swings have your attention, this could be a good moment to scan other high growth tech and crypto names using Simply Wall St’s high growth tech and AI stocks.

With Bitmine’s share price now far below analyst targets despite explosive recent gains, is the market overly discounting its risky crypto pivot, or are investors already paying up for all the future growth on offer?

Price-to-Earnings of 36.2x: Is it justified?

Bitmine Immersion Technologies trades on a 36.2x price to earnings multiple at the last close of $30.95, putting it well above both software peers and the broader market.

The price to earnings ratio compares what investors are paying today for each dollar of current earnings. It is a key yardstick for a newly profitable software and blockchain services business like Bitmine.

With BMNR only recently crossing into profitability and earnings still at an early stage, such a rich multiple suggests investors are already factoring in a steep ramp up in future profits rather than paying for what the company is currently generating.

That optimism shows up clearly in the peer check, where BMNR’s 36.2x price to earnings sits above the US software industry average of 32.4x and the peer group’s 27.9x. This signals the market is assigning it a premium valuation that assumes stronger growth or quality than the sector norm.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 36.2x (OVERVALUED)

However, Bitmine’s tiny revenue base and heavy reliance on volatile crypto cycles mean that any downturn or regulatory hit could quickly puncture today’s optimism.

Find out about the key risks to this Bitmine Immersion Technologies narrative.

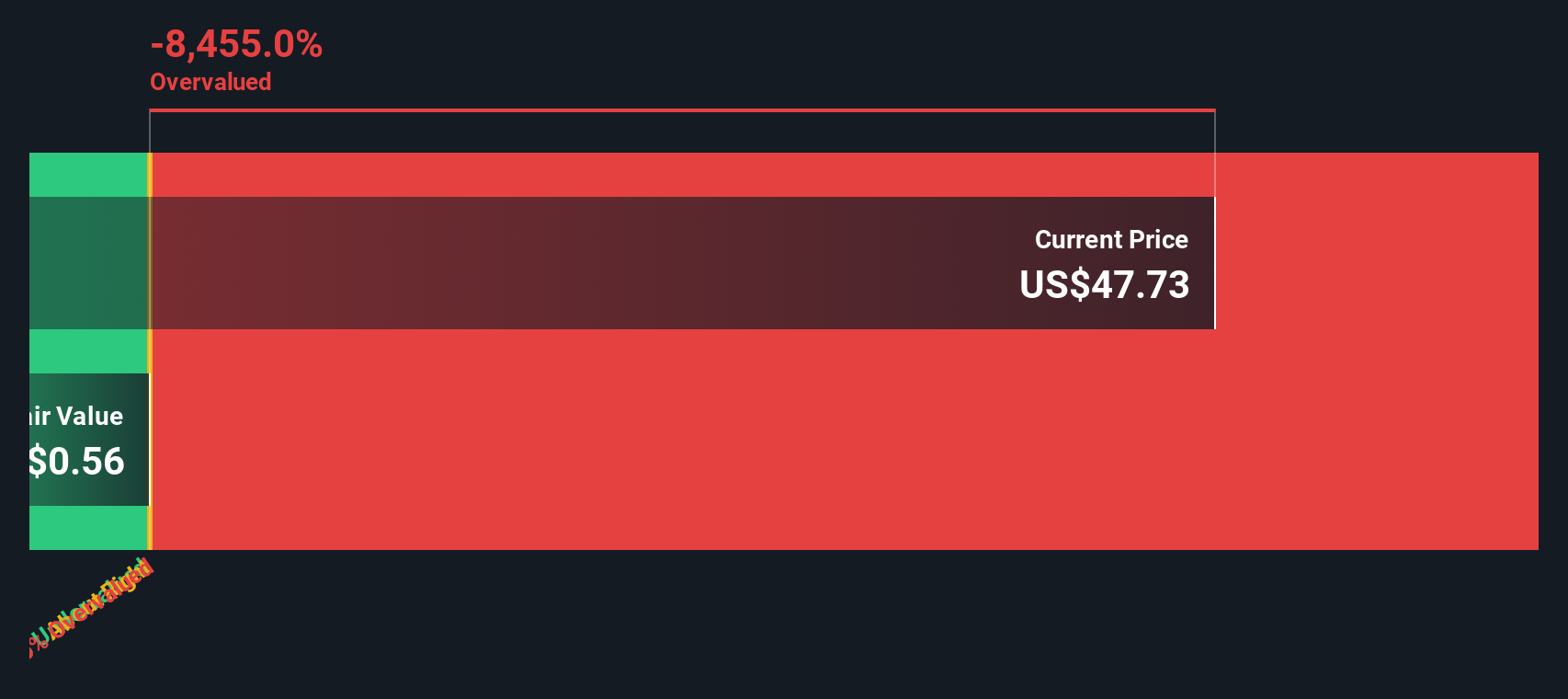

Another View: DCF Paints a Harsher Picture

Our DCF model is far less forgiving, putting Bitmine’s fair value at just $0.18 versus the current $30.95 share price. That implies the stock is significantly overvalued based on cash flow assumptions and raises the question: is recent profitability disguising deeper long term risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you see things differently or want to dig into the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Bitmine might be on your radar, but if you stop here you could miss other powerful opportunities the market is offering right now through focused screeners.

- Capture potential bargains by reviewing these 913 undervalued stocks based on cash flows that look mispriced relative to their future cash flows and long term earnings power.

- Tap into structural growth by scanning these 25 AI penny stocks positioned to benefit from accelerating adoption of machine learning and automation across industries.

- Strengthen your portfolio’s risk reward balance by targeting these 13 dividend stocks with yields > 3% that can add dependable income alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal