BioNTech (NasdaqGS:BNTX): Reassessing Valuation After a Recent 9% Share Price Slide

BioNTech (NasdaqGS:BNTX) has quietly slipped about 9% over the past month, extending a choppy downtrend this year. With shares now near 93 dollars, investors are reassessing what the post pandemic pipeline really justifies.

See our latest analysis for BioNTech.

That recent slide sits on top of a tougher backdrop, with the year to date share price return down sharply and the one year total shareholder return also negative, suggesting momentum is still fading as investors wait for clearer proof of the non Covid pipeline.

If BioNTech’s volatility has you rethinking your healthcare exposure, this could be a good moment to explore other healthcare stocks that might balance risk and long term growth potential.

With the stock down heavily from its pandemic peak but still backed by a sizable oncology pipeline and a near 50 percent gap to analyst targets, is this a contrarian entry point, or is the market already discounting future growth?

Most Popular Narrative: 32% Undervalued

With BioNTech last closing at 93.81 dollars against a fair value estimate near 138 dollars, the most followed narrative sees meaningful upside still on the table.

Robust pipeline expansion in oncology, with multiple late stage Phase II and III clinical trials for BNT327 and mRNA cancer immunotherapies across high prevalence cancers such as lung and breast, positions BioNTech to launch multiple new products. This is seen as a potential driver of top line revenue growth and could enhance earnings visibility over the next several years. Strategic partnerships, notably with BMS, Genentech, and Regeneron, provide substantial non dilutive cash infusions, shared development costs, and accelerated global development of key assets. These collaborations are expected to support stable R&D spend while potentially improving profitability and EPS as milestone revenues materialize.

Want to see why a shrinking revenue base can still support a higher valuation? The story hinges on a profit reset and a punchy future earnings multiple. Curious which assumptions really carry this price tag?

Result: Fair Value of $138 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained Covid revenue declines, along with delays or failures in key late stage oncology trials, could quickly erode confidence in that undervaluation story.

Find out about the key risks to this BioNTech narrative.

Another Lens on Valuation

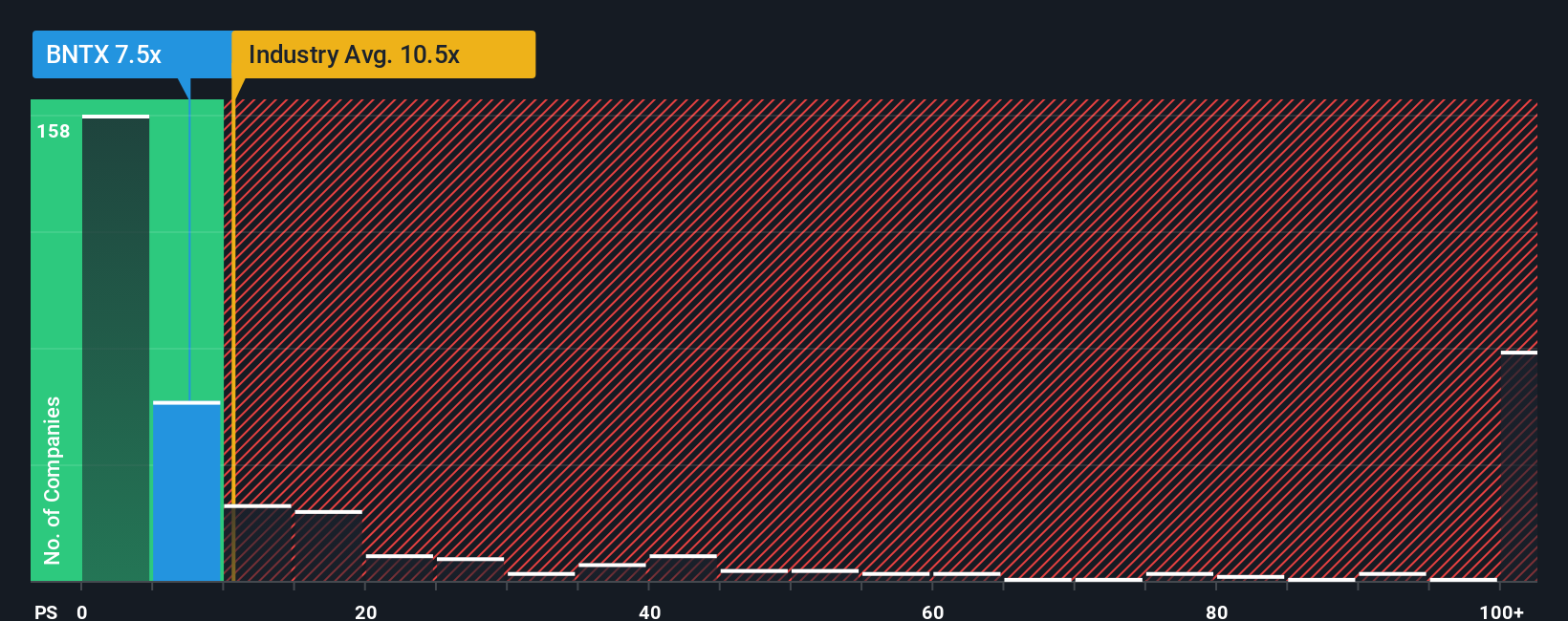

Step away from analyst targets and BioNTech suddenly looks less like a bargain. On a price to sales ratio of 6.1x, it trades richer than close peers at 4.5x and even above its own 5.7x fair ratio. This hints at limited margin for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioNTech Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a fresh narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities with focused stock ideas on Simply Wall Street that many investors overlook until it is too late.

- Capture potential turnaround stories by scanning these 913 undervalued stocks based on cash flows that trade below what their cash flows suggest they are worth.

- Ride the next wave of innovation by zeroing in on these 25 AI penny stocks positioned at the heart of fast moving artificial intelligence trends.

- Strengthen your portfolio’s income engine by targeting these 13 dividend stocks with yields > 3% that can help you build reliable cash returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal