Ford’s EV Writedown and Pivot to Hybrids Might Change The Case For Investing In Ford Motor (F)

- Ford Motor has overhauled its electrification roadmap, halting several larger EV programs, ending the current F‑150 Lightning, and recording about US$19.50 billion in special charges tied to refocusing on affordable EVs, hybrids and a new battery energy storage business.

- This reset shifts capital toward higher-return trucks, vans and a flexible Universal EV Platform, while Ford assumes about US$3.00 billion in pre-tax charges to take full control of two Kentucky battery plants from its BlueOval SK joint venture.

- We’ll now examine how this large EV writedown and pivot toward hybrids and smaller EVs could reshape Ford’s existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Ford Motor Investment Narrative Recap

To own Ford today, you have to believe it can turn its scale in trucks, vans and software-enabled services into steadier earnings while managing a messy transition in electrification. The latest US$19.5 billion EV reset and Kentucky battery JV unwind look material for reported results, but the key near term catalyst remains whether Ford Pro and cost savings can offset EV restructuring noise. The biggest current risk is that repeated EV pivots confuse customers and blunt long term competitiveness.

The most relevant recent announcement is Ford’s sharpened Ford+ plan, which cancels several larger EVs, ends the current F 150 Lightning and leans into hybrids, extended range EVs and a new Universal EV Platform. This move ties directly into the main upside case that Ford can redirect capital toward higher return trucks, vans and software rich Ford Pro offerings, while still keeping a credible path to profitable electrification.

Yet beneath this reset, investors should be aware that Ford’s mixed and frequently revised EV strategy could...

Read the full narrative on Ford Motor (it's free!)

Ford Motor’s narrative projects $183.9 billion revenue and $6.6 billion earnings by 2028. This implies a 0.2% yearly revenue decline and a $3.4 billion earnings increase from $3.2 billion today.

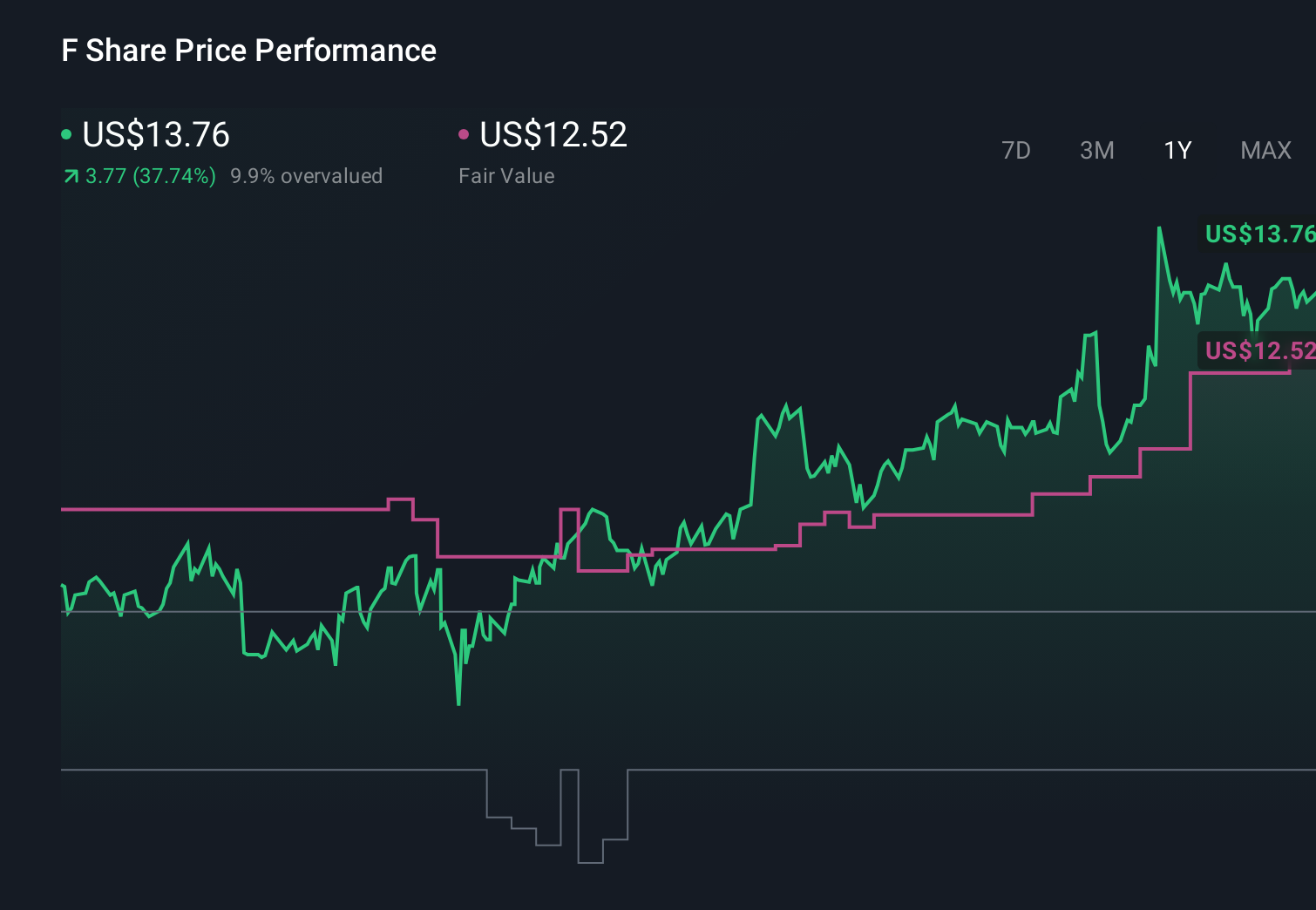

Uncover how Ford Motor's forecasts yield a $12.52 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Thirteen members of the Simply Wall St Community value Ford between US$8.00 and about US$15.67 per share, reflecting very different expectations for its future. Against this wide range, Ford’s ongoing EV rethink and focus on a new Universal EV Platform underline how much future execution on electrification could influence where performance actually lands.

Explore 13 other fair value estimates on Ford Motor - why the stock might be worth 41% less than the current price!

Build Your Own Ford Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ford Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ford Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ford Motor's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal