The Bull Case For Las Vegas Sands (LVS) Could Change Following CEO Stock Sale And Goldman Sachs Upgrade

- In early December 2025, Las Vegas Sands drew attention as Chairman and CEO Robert G. Goldstein sold about US$26.6 million of stock after exercising options, while the company also presented at Macquarie’s Asia Conference 2025 in New York.

- Analyst sentiment turned more constructive as Goldman Sachs upgraded Las Vegas Sands to Buy, reflecting growing confidence in the company’s Singapore and Macau-focused operations despite recent insider selling.

- With Goldman Sachs’ upgrade highlighting confidence in international operations, we’ll now examine how this reshapes Las Vegas Sands’ investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Las Vegas Sands Investment Narrative Recap

To own Las Vegas Sands, you generally need to believe in the long term earnings power of its Singapore and Macau resorts. The main near term catalyst is continued operational strength in these markets, while a key risk is that Macau growth or margins underwhelm expectations. Recent insider selling by the CEO and the Goldman Sachs upgrade do not appear to materially change either the core catalyst or this central risk.

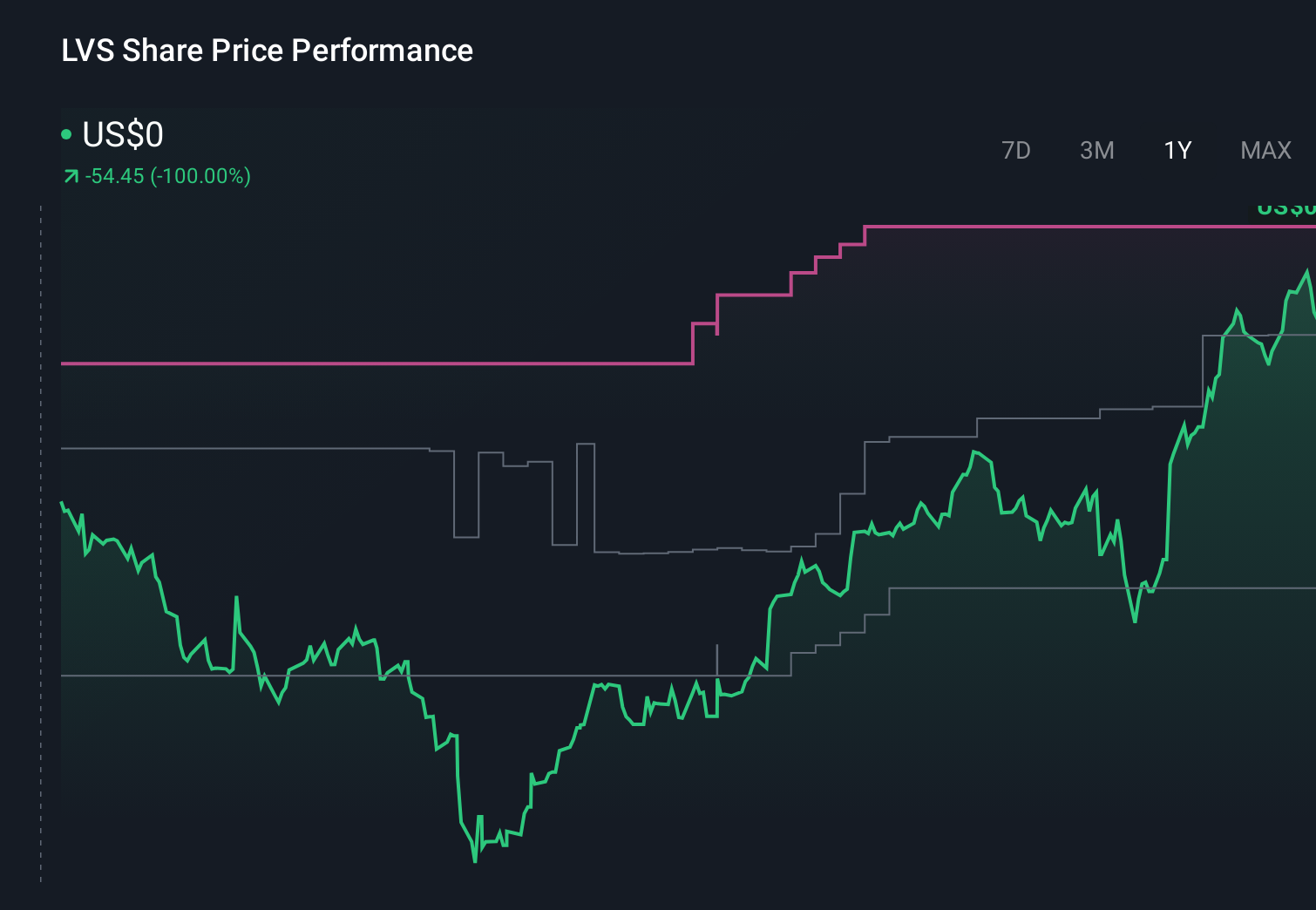

Among the recent developments, Goldman Sachs’ upgrade to Buy, with a higher US$80 price target, most directly ties into the investment story. It reinforces the focus on Singapore and Macau as profit engines at a time when Macau’s recovery pace, competitive intensity and premium mass profitability remain central to how the stock trades around quarterly results.

Yet while analyst confidence is improving, investors should also be aware of how increased competition in Macau’s premium mass segment could...

Read the full narrative on Las Vegas Sands (it's free!)

Las Vegas Sands' narrative projects $14.1 billion revenue and $2.5 billion earnings by 2028. This requires 6.8% yearly revenue growth and about a $1.1 billion earnings increase from $1.4 billion today.

Uncover how Las Vegas Sands' forecasts yield a $65.85 fair value, in line with its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community value Las Vegas Sands anywhere between roughly US$2 and US$131 per share, underscoring sharply different expectations. Against this backdrop, the reliance on Macau’s recovery and margins takes on added importance, since any disappointment there could test the more optimistic views on future performance.

Explore 7 other fair value estimates on Las Vegas Sands - why the stock might be worth as much as 95% more than the current price!

Build Your Own Las Vegas Sands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Las Vegas Sands research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Las Vegas Sands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Las Vegas Sands' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal