Did AFG’s Enlarged 2030 Buyback Plan Quietly Redefine American Financial Group's Capital Return Story?

- On December 3, 2025, American Financial Group increased its equity buyback authorization by 5,000,000 shares to a total of 57,188,938 shares and extended the program through December 31, 2030.

- This larger and longer buyback plan highlights management’s capital-return priorities and may gradually reshape the company’s ownership base over time.

- We’ll now examine how AFG’s enlarged, longer-dated buyback authorization could influence its existing investment narrative around earnings growth and capital returns.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American Financial Group Investment Narrative Recap

To own American Financial Group, you need to be comfortable with a specialty insurer that leans heavily on underwriting discipline, investment income and steady capital returns. The enlarged, longer-dated buyback authorization does not materially change the near term earnings catalyst, which still hinges on stabilizing underwriting profitability, nor does it remove the key risk around elevated catastrophe losses and volatile alternative investment results.

Among recent announcements, the August 2025 increase in the regular annual dividend to US$3.52 per share stands out as closely related to the new buyback plan. Together, higher dividends and a larger repurchase authorization frame AFG as a company prioritizing consistent capital returns even as net income has softened year over year, which keeps the focus on whether underwriting and investment margins can support this payout profile over time.

However, investors should also be aware that if catastrophe losses stay elevated and reserve releases fade, the pressure on AFG’s underwriting margins could...

Read the full narrative on American Financial Group (it's free!)

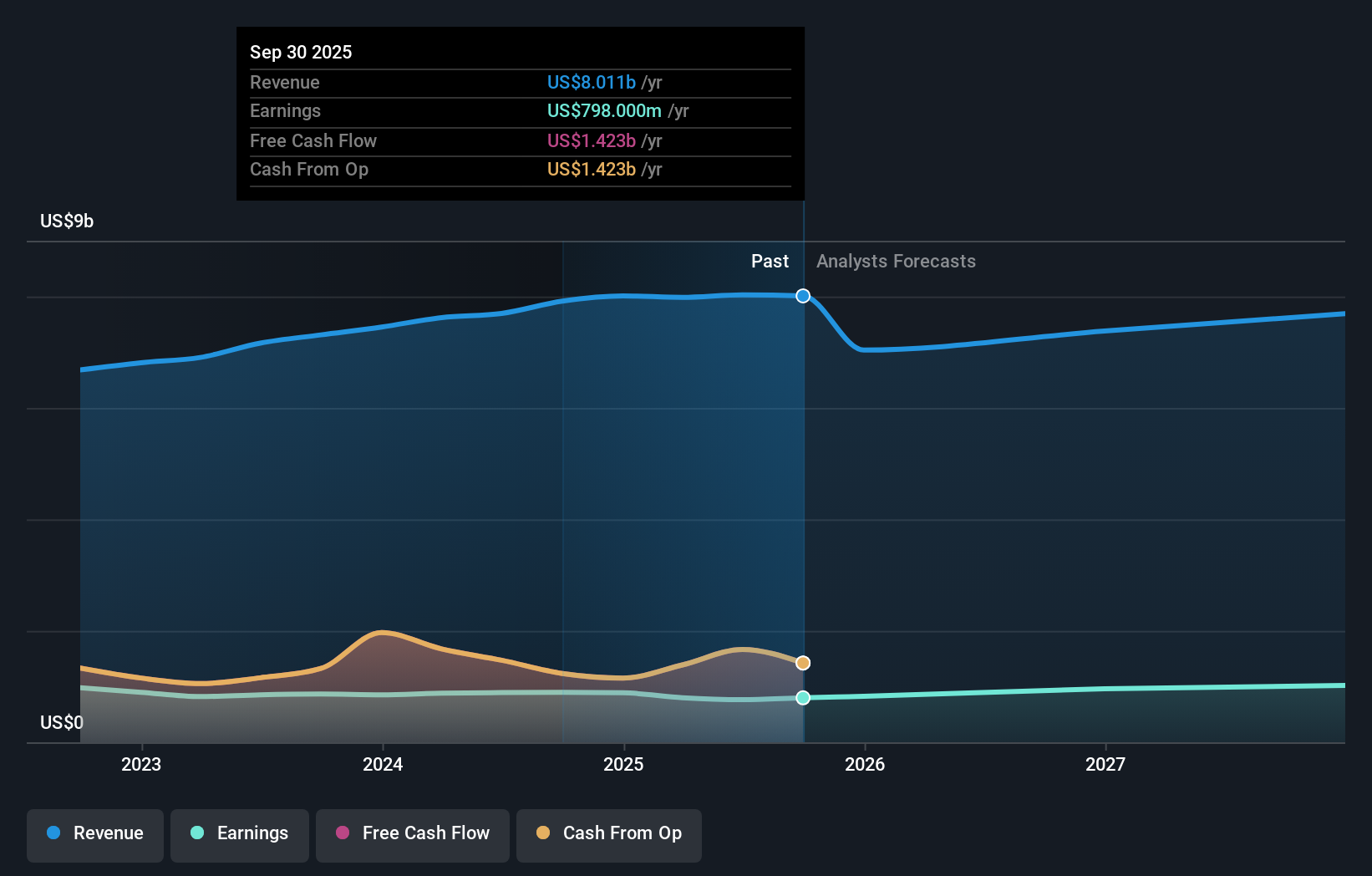

American Financial Group's narrative projects $7.6 billion revenue and $1.1 billion earnings by 2028. This assumes revenue will decrease by 1.8% per year and an earnings increase of about $336 million from $764.0 million today.

Uncover how American Financial Group's forecasts yield a $139.60 fair value, in line with its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for American Financial Group range from US$139.60 to US$270.02, underlining how far apart individual views can be. You can weigh these estimates against the current concerns over weaker underwriting profit and more volatile alternative investments, which may shape how resilient AFG’s earnings and capital return plans prove to be over time.

Explore 2 other fair value estimates on American Financial Group - why the stock might be worth just $139.60!

Build Your Own American Financial Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Financial Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Financial Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Financial Group's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal