CBIZ (CBZ) Valuation Check as Short Interest Climbs to Nearly 10% of Float

CBIZ (CBZ) just saw its short interest jump to nearly 10% of its float, well above peers. This is putting a spotlight on growing bearish bets and setting up a more volatile backdrop for the stock.

See our latest analysis for CBIZ.

That shift in sentiment comes after a choppy year, with the share price now at $53.38 and a steep year to date share price return of around negative 34% contrasting with a still solid five year total shareholder return above 100%. This suggests long term momentum has not completely broken even as near term pressure builds.

If CBIZ’s volatility has you rethinking concentration risk, this could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With earnings still growing and the share price now trading at a hefty discount to analyst targets and some intrinsic value estimates, is CBIZ quietly becoming a contrarian buy, or is the market already discounting future growth?

Most Popular Narrative: 41.7% Undervalued

With CBIZ last closing at $53.38 against a widely followed fair value near the low 90s, this narrative frames the current price as a steep disconnect from long run fundamentals.

The Marcum acquisition has significantly expanded CBIZ's client base, increased scale, and strengthened capabilities in core tax, accounting, and advisory services, enabling the firm to leverage cross-selling, deepen client relationships, and improve its competitive position in target middle-market segments; this is expected to fuel higher future revenue growth and structural margin expansion as integration synergies are realized.

Curious how this growth engine turns into such a punchy valuation? The narrative leans on bold compounding in revenues, profits, and multiples. Want to see the full playbook behind that upside case?

Result: Fair Value of $91.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure and slower deleveraging after the Marcum acquisition could constrain margins and limit the upside implied by this bullish narrative.

Find out about the key risks to this CBIZ narrative.

Another View: Market Multiples Send a Mixed Signal

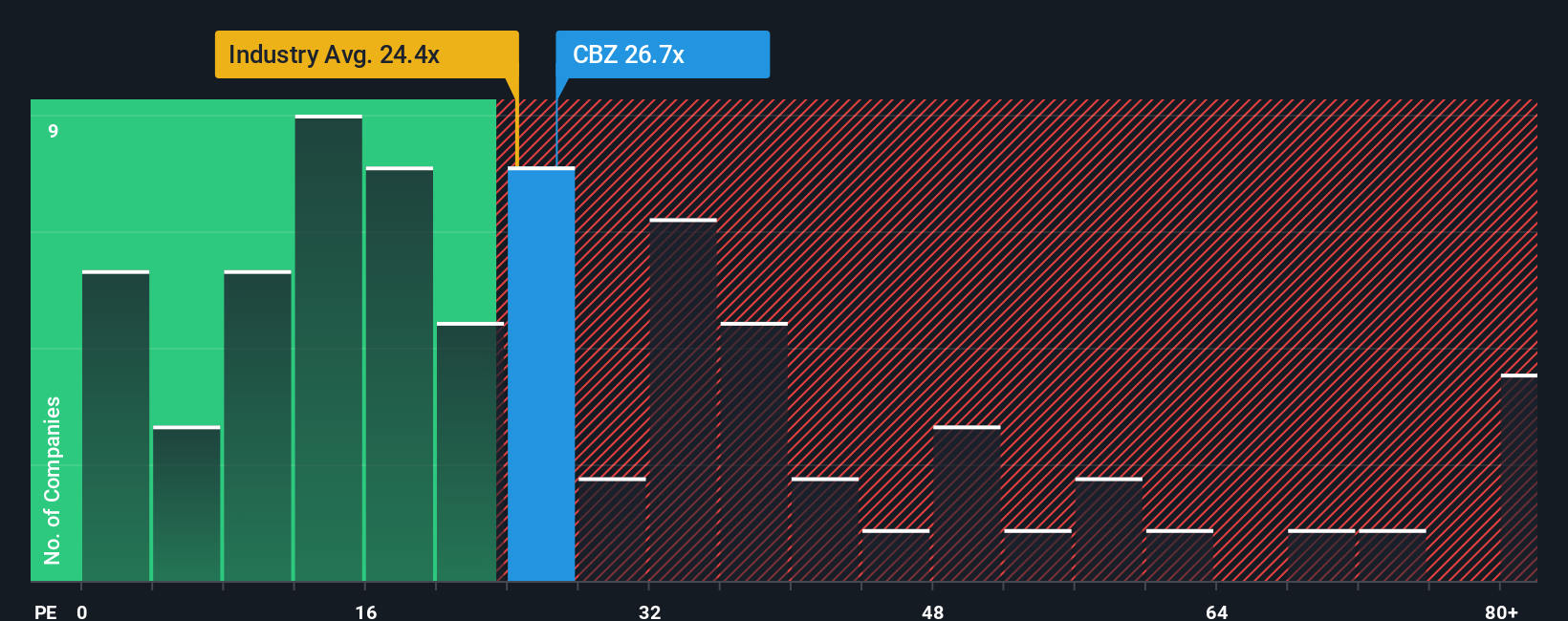

On earnings based valuation, CBIZ trades at about 27.4 times profit, richer than the US Professional Services industry at 25 times but below its own fair ratio of 31.2 times and slightly cheaper than peers at 28.6 times. Is that a safety margin or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBIZ Narrative

If you are not convinced by these angles or would rather dig into the numbers yourself, you can craft a personalized view in minutes, Do it your way.

A great starting point for your CBIZ research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

If CBIZ is on your radar, do not stop there, use the Simply Wall Street Screener now so you are not late to the next opportunity.

- Capitalize on mispriced quality by scanning these 906 undervalued stocks based on cash flows that pair strong fundamentals with compelling valuation upside.

- Ride the next wave of digital disruption by targeting these 26 AI penny stocks poised to benefit from accelerating adoption of artificial intelligence.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that combine attractive yields with solid payout sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal