Analog Devices (ADI): Valuation Check After Analyst Optimism and Sector-Wide AI Profitability Jitters

Analog Devices (ADI) finds itself at the center of a push and pull between macro jitters and AI optimism, as sector wide worries about AI profitability and rising Treasury yields pressure semiconductor stocks.

See our latest analysis for Analog Devices.

Even with the latest macro wobble, ADI’s 1 month share price return of 19.39 percent and year to date share price return of 32.69 percent show momentum building, backed by strong earnings, upbeat guidance, AI tailwinds, and a robust 5 year total shareholder return of 112.11 percent.

If this AI driven move has you thinking about what else might be setting up for the next leg higher, it is worth exploring high growth tech and AI stocks as potential new ideas.

With Analog Devices trading close to analyst targets after a powerful AI fueled run, the key question now is whether investors are still getting in ahead of the curve or if the market has already priced in the next wave of growth.

Most Popular Narrative Narrative: 0.6% Undervalued

With Analog Devices last closing at $280.44 against a narrative fair value of $282.03, the story leans slightly positive and hinges on powerful secular drivers.

Analysts are assuming Analog Devices's revenue will grow by 11.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 18.8% today to 34.6% in 3 years time.

Want to see what kind of earnings power those assumptions unlock, and which premium multiple they think the market will still pay for ADI? Read on.

Result: Fair Value of $282.03 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and uneven end market demand could pressure margins and inject more volatility into what is currently a smooth recovery narrative.

Find out about the key risks to this Analog Devices narrative.

Another Angle on Value

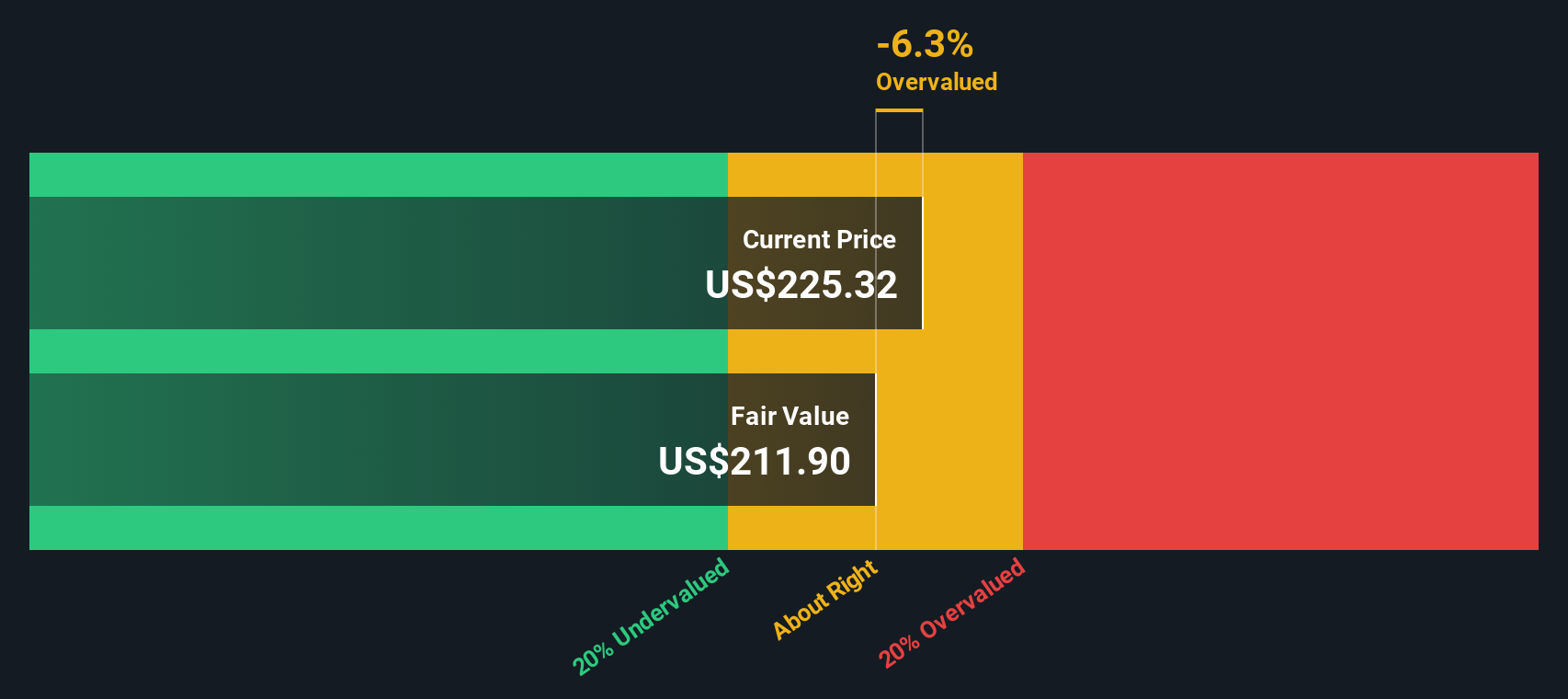

While the narrative fair value pegs Analog Devices as roughly fairly priced, our DCF model is more skeptical and suggests shares are trading well above a fair value estimate of $162.04. If cash flows matter more than story momentum, is today’s price leaving enough margin of safety?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Analog Devices for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Analog Devices Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop at one opportunity. Use the Simply Wall St Screener today to uncover fresh, data led ideas before the crowd moves in.

- Capture potential mispricing early by scanning these 906 undervalued stocks based on cash flows that the market may be sleeping on.

- Ride powerful technology shifts by targeting these 26 AI penny stocks positioned at the heart of the AI boom.

- Strengthen your income strategy with these 13 dividend stocks with yields > 3% that aim to keep cash flowing through changing cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal