Dayforce (DAY): Has the Recent Share Price Drift Created a Subtle Valuation Opportunity?

Dayforce (DAY) shares have quietly drifted over the past year, slipping about 10% even as revenue keeps growing near double digits and losses narrow, setting up an interesting risk reward discussion.

See our latest analysis for Dayforce.

Zooming out, the modest year to date share price decline contrasts with a still positive three year total shareholder return. This suggests sentiment has cooled recently even as the longer term story remains constructive.

If Dayforce’s mixed momentum has you comparing options, this is a good moment to explore high growth tech and AI stocks that could be riding stronger demand trends.

With shares now trading only slightly below Wall Street targets despite healthy revenue growth but ongoing losses, investors face a key question: is Dayforce undervalued after the pullback, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 1.2% Undervalued

Compared with Dayforce’s last close of $69.29, the most popular narrative sees only a small upside to fair value, hinging on powerful growth drivers.

Advances in AI integration and analytics (including 30+ AI agents in development) are differentiating Dayforce as an indispensable workforce platform for organizations seeking smarter decision support, employee engagement, and productivity gains. This not only drives additional revenue streams but also supports future operating leverage and net margin expansion.

Want to see how steady double digit revenue gains, rising margins and a punchy future earnings multiple all fit together? The full narrative reveals the playbook behind that near term fair value call.

Result: Fair Value of $70.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative depends on Dayforce fending off intensifying competition and avoiding implementation missteps that could slow recurring revenue growth and margin expansion.

Find out about the key risks to this Dayforce narrative.

Another View: Market Ratios Flash a Caution Sign

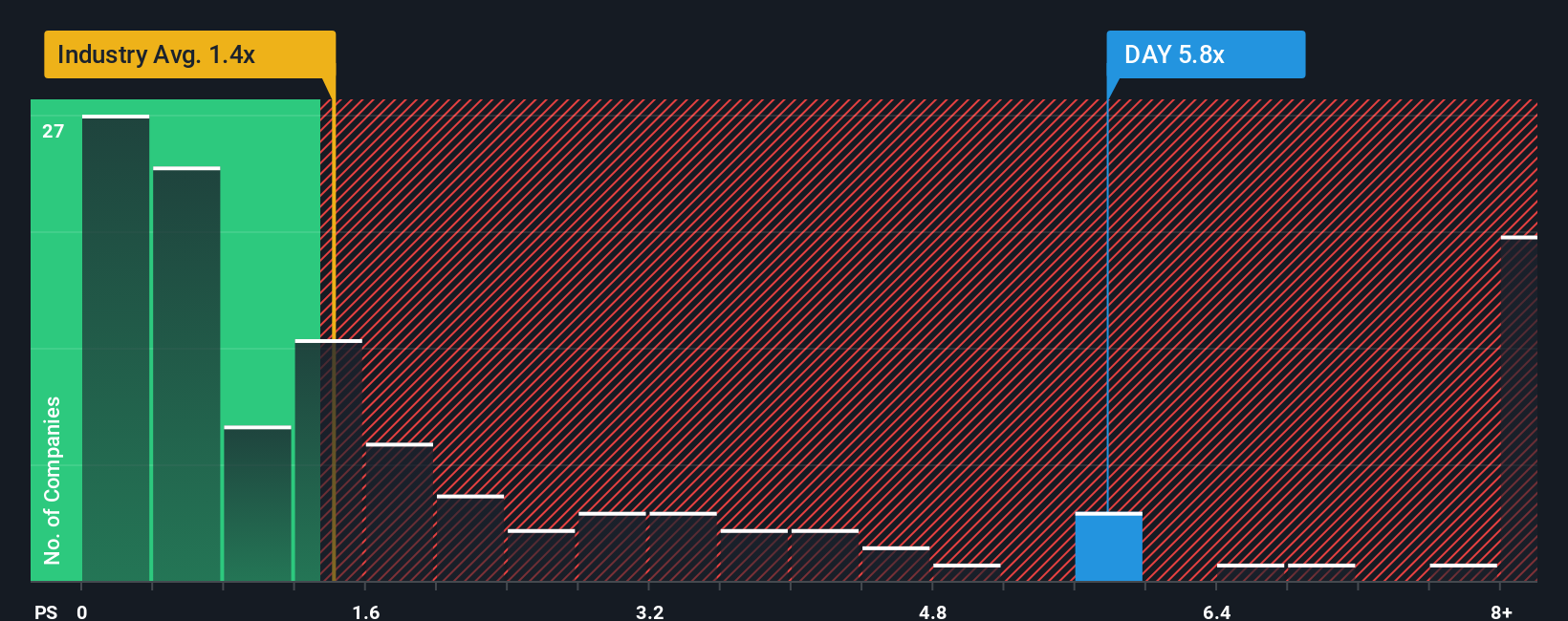

While the narrative and our fair value work suggest modest undervaluation, Dayforce trades at a steep 5.9 times sales versus 1.3 times for the US Professional Services industry and 5.3 times for peers. This is well above a 3.1 times fair ratio the market could drift toward. That gap implies real downside risk if sentiment cools further.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dayforce Narrative

If you see the story differently or want to weigh the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Dayforce.

Ready for more investing ideas?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover stocks that match your style before other investors spot them.

- Capitalize on potential hidden bargains by reviewing these 906 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

- Ride powerful innovation waves by targeting these 26 AI penny stocks that are positioned to benefit from accelerating adoption of artificial intelligence.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help support returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal