SouthState Bank (SSB): Assessing Valuation After a Recent Short-Term Share Price Rebound

SouthState Bank (SSB) has been quietly grinding higher, with the stock up about 9% over the past month even as its past 3 months performance remains slightly negative, hinting at a sentiment shift.

See our latest analysis for SouthState Bank.

Zooming out, that recent 1 month share price return of 9.24% looks more like a rebound than a breakout, as SouthState’s 1 year total shareholder return is still negative while the 5 year total shareholder return remains comfortably positive.

If this kind of renewed momentum has you thinking about what else might be setting up for a longer run, it is worth exploring fast growing stocks with high insider ownership.

With earnings still growing and the share price trading at a noticeable discount to analyst targets and intrinsic estimates, the key question now is whether SouthState Bank is genuinely undervalued or whether the market is already pricing in its future growth.

Most Popular Narrative: 14.9% Undervalued

With SouthState Bank last closing at $97.08 versus a narrative fair value near $114, the story centers on whether its loan fuelled growth can last.

Substantial pipeline increases and ongoing recruitment of revenue producers in high growth markets signal potential for sustained organic loan growth, bolstering both top line revenue and net interest income.

Want to see what is really powering that loan pipeline optimism? The narrative leans on faster growing revenues, expanding margins, and a punchy future earnings multiple. Curious which specific growth and profitability assumptions have to hold for that valuation to stick?

Result: Fair Value of $114.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained net interest margin pressure or a sharper than expected downturn in commercial real estate could quickly challenge the growth-driven undervaluation story.

Find out about the key risks to this SouthState Bank narrative.

Another View: Valuation Through Earnings

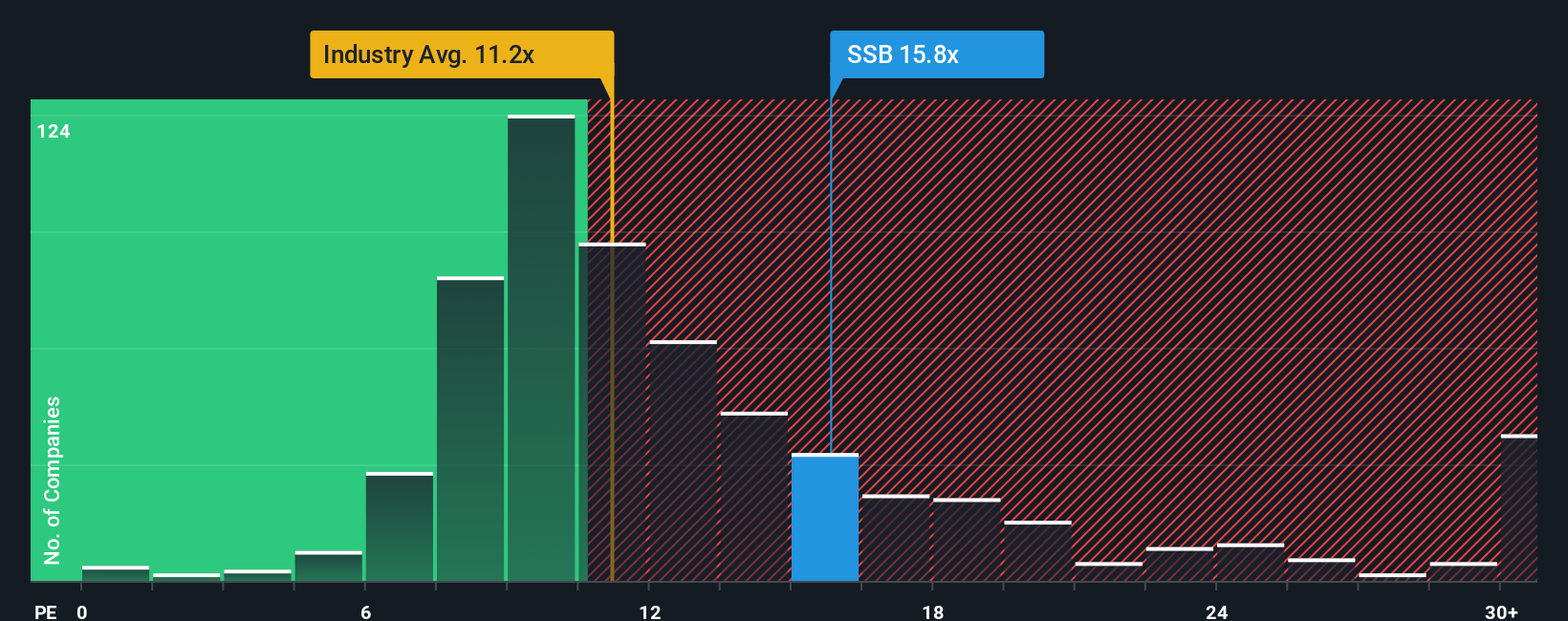

Looked at through its earnings multiple, SouthState Bank appears less clearly undervalued. The shares trade on about 14 times earnings, slightly richer than both the US banks average of 12 times and the peer average of 13.5 times, but close to a 14.9 times fair ratio, suggesting only modest upside potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SouthState Bank Narrative

If this perspective does not quite match your own, or you would rather dig into the numbers yourself, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your SouthState Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You have seen what one bank can offer. Now give yourself an edge by scanning richer opportunities across sectors before the market wakes up to them.

- Capture potential big movers early by targeting attractively priced companies using these 906 undervalued stocks based on cash flows grounded in strong cash flow expectations.

- Ride structural breakthroughs in automation and data by focusing on next generation innovators through these 26 AI penny stocks at the frontier of artificial intelligence.

- Strengthen your income stream by curating reliable payout opportunities via these 13 dividend stocks with yields > 3% with yields that can meaningfully bolster total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal