Revisiting MYR Group’s (MYRG) Valuation After a Strong Multi‑Year Share Price Run

MYR Group (MYRG) has been quietly rewarding patient investors, with the stock up roughly 49% year to date and about 35% over the past year, far outpacing many industrial peers.

See our latest analysis for MYR Group.

With the share price now at $220.51, MYR Group has cooled slightly in the last month but still shows strong momentum, with a 90 day share price return of 24.56 percent and a five year total shareholder return of 269.24 percent.

If MYR Group’s run has you rethinking what else could compound like this, it is worth exploring fast growing stocks with high insider ownership as your next hunting ground for ideas.

With shares trading just below analyst targets and only a slight premium to some intrinsic value estimates, investors now face a key question: is there still upside left here or is the market already pricing in future growth?

Most Popular Narrative Narrative: 8.3% Undervalued

Compared with MYR Group’s last close at $220.51, the most followed narrative points to a higher fair value, framing upside that hinges on specific growth assumptions.

Strategic capital allocation and a healthy balance sheet (low leverage, substantial borrowing capacity, and new $75 million share repurchase authorization) enable continued investment in organic growth, accretive acquisitions, and share buybacks. This is described as supporting future EPS and shareholder returns. Active response to ongoing labor shortages by internally developing skilled workforce and augmenting capabilities through targeted acquisitions is described as positioning MYR Group to capitalize on sector wide supply constraints, supporting pricing power and sustaining or improving net margins.

Want to see what kind of revenue runway, margin lift, and earnings power are needed to back this higher fair value, and how aggressively future multiples are assumed? Dive into the full narrative to uncover the exact growth path behind that target.

Result: Fair Value of $240.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained labor cost inflation and lumpy commercial backlog could quickly pressure margins and earnings visibility if project execution or demand weakens.

Find out about the key risks to this MYR Group narrative.

Another Angle on Valuation

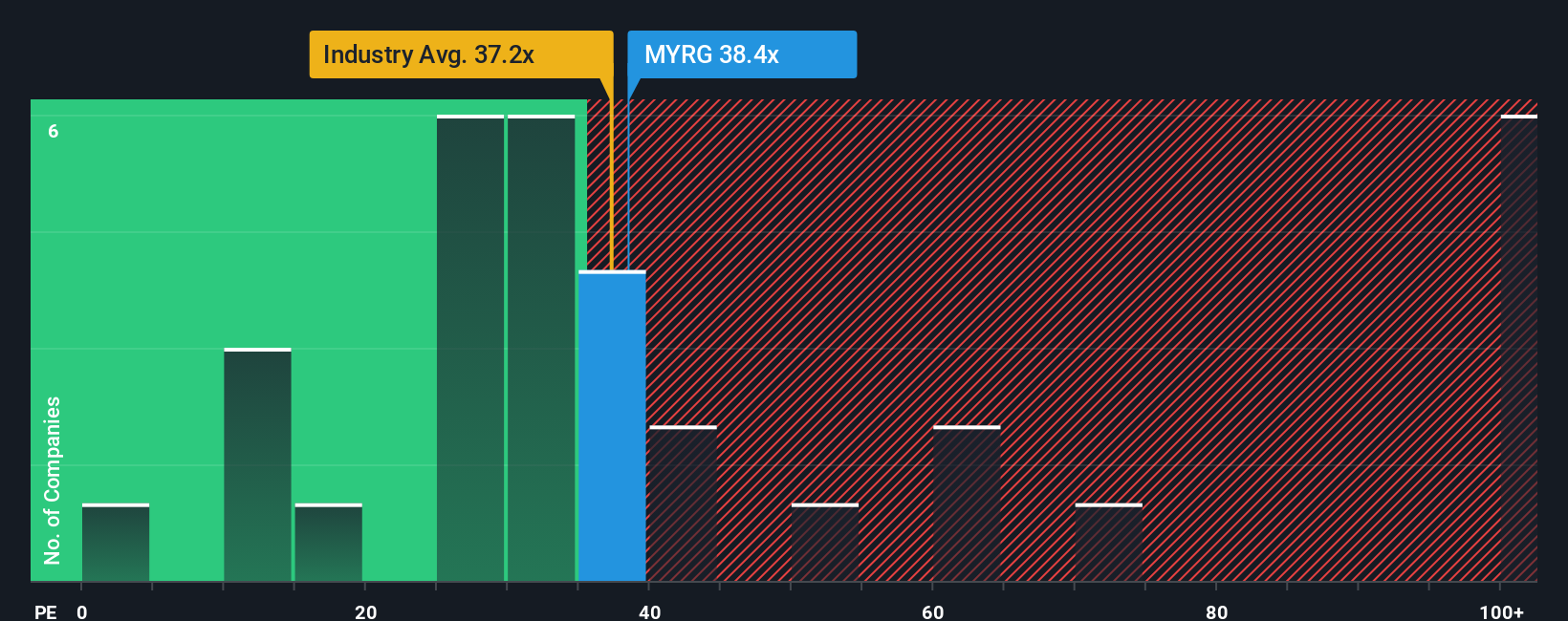

While the narrative suggests MYR Group is around 8.3 percent undervalued, its 35 times earnings multiple paints a tougher picture. It is trading above the US Construction industry at 32.6 times, peers at 26.4 times, and a fair ratio of 27.7 times. Is the story good enough to sustain that premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MYR Group Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom narrative in minutes: Do it your way.

A great starting point for your MYR Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before MYR Group’s story runs away without you, review your next moves on Simply Wall St and keep your portfolio prepared with tomorrow’s potential opportunities.

- Look for potential mispricings early by scanning these 906 undervalued stocks based on cash flows that could offer upside if the market reassesses their fundamentals.

- Seek exposure to structural trends by targeting these 26 AI penny stocks positioned to participate in the adoption of artificial intelligence across industries.

- Support your income stream with these 13 dividend stocks with yields > 3% that may provide yields alongside solid business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal