Reassessing IAC (IAC)’s Valuation After Oppenheimer’s Downgrade and MGM Exposure Concerns

Oppenheimer’s downgrade of IAC (IAC) to Perform, and the roughly 3% slide that followed, has shifted the conversation from upside potential to whether the market is fairly pricing its structural constraints.

See our latest analysis for IAC.

That downgrade lands after a strong 1 month share price return of about 14% and a modest rebound over 3 months. Set against a still negative year to date share price return and a bruising 5 year total shareholder return decline, it suggests recent momentum may be more fragile than it first looked.

If this kind of mixed setup has you rethinking concentration risk, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership

With the stock still trading at a discount to most analyst targets despite weakening revenue and a complex reliance on its MGM stake, is this recent pullback a genuine entry point, or is the market simply pricing in muted growth more rationally?

Most Popular Narrative: 16.6% Undervalued

With the narrative fair value sitting around 20% above IAC’s last close at $38.03, the valuation case leans heavily on margin rebuilding and asset leverage.

The D/Cipher+ product significantly increases IAC's total addressable advertising market by enabling cross-platform ad targeting using proprietary first-party data and intent signals, an increasingly valuable asset as privacy changes disrupt third-party data. This should drive both digital advertising revenue growth and profitability as advertisers continue to favor platforms with strong audience data.

Wondering how shrinking revenues can still justify a richer future multiple and higher fair value? The narrative hinges on a sharp profit swing and disciplined share count reduction that completely reframes what today’s price implies.

Result: Fair Value of $45.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that margin driven upside still hinges on execution, and deeper traffic losses from Google AI changes or stalled Care.com momentum could quickly unwind it.

Find out about the key risks to this IAC narrative.

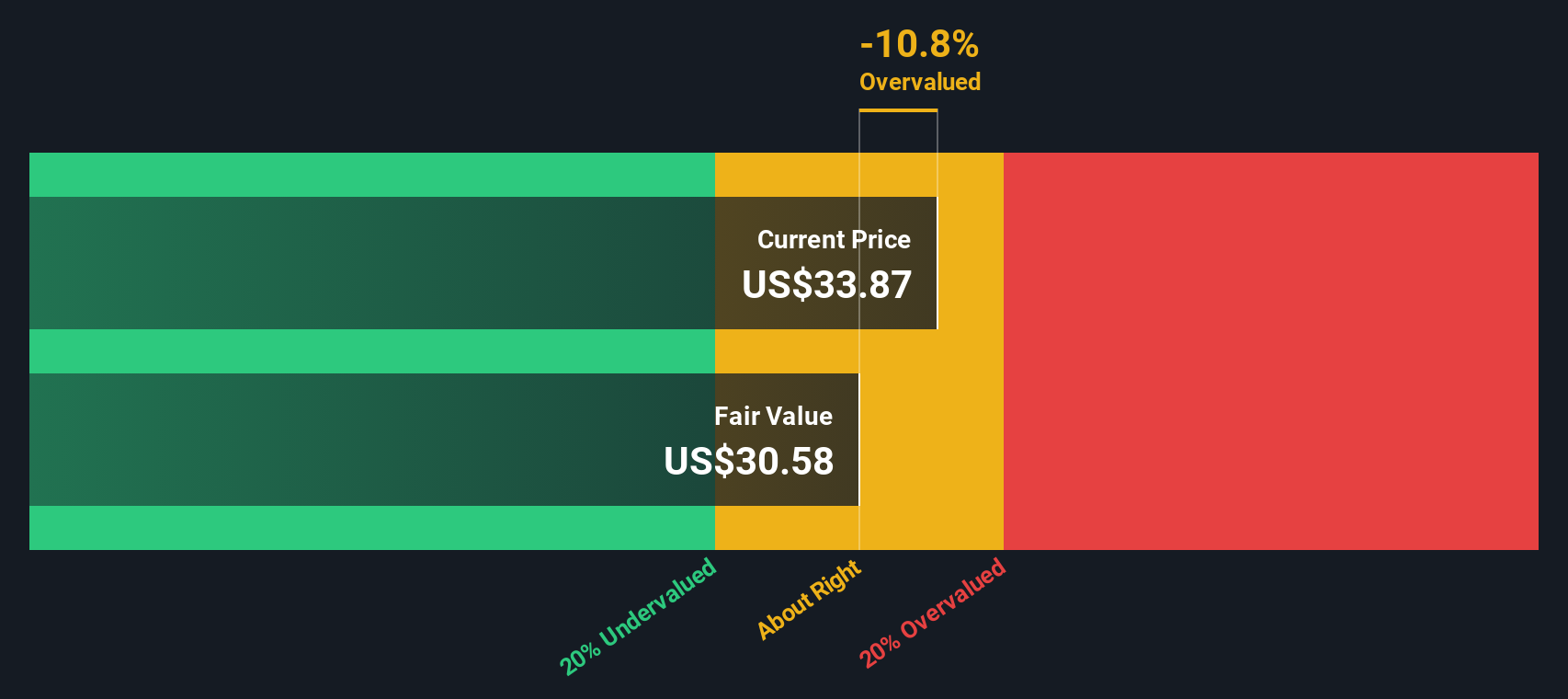

Another View: DCF Flags Overvaluation Risk

While the narrative points to a fair value of about $45.62 and an undervalued setup, our DCF model is more conservative. It puts fair value closer to $31.97, below the current $38.03 price. If cash flows disappoint, is today’s discount really as wide as it looks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out IAC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own IAC Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding IAC.

Ready for more high conviction ideas?

Before you move on, lock in an edge by uncovering fresh opportunities with the Simply Wall Street Screener, built to surface data backed ideas fast.

- Capture potential multi baggers early by targeting rapidly growing, higher risk names using these 3625 penny stocks with strong financials while they are still off most investors’ radar.

- Position your portfolio for structural change by focusing on these 26 AI penny stocks that are pushing real world AI adoption, not just riding the hype.

- Strengthen long term returns with cash flow backed opportunities by zeroing in on these 906 undervalued stocks based on cash flows before the wider market catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal