United Bankshares (UBSI): Evaluating Valuation After Recent Share Price Momentum

Why United Bankshares Stock Is Getting Attention Now

United Bankshares (UBSI) has quietly outperformed many regional peers, with the stock up about 9% over the past month and roughly 7% year to date. This has drawn fresh attention from income focused bank investors.

See our latest analysis for United Bankshares.

The recent 1 month share price return of about 9 percent, alongside a solid 3 year total shareholder return in the mid teens, suggests momentum is quietly building as investors warm to United Bankshares improved growth profile and perceived balance sheet resilience.

If regional banks are on your radar and you want to see what else is gaining traction, now could be a good time to explore fast growing stocks with high insider ownership.

With shares now hovering just below analyst targets and a hefty intrinsic discount suggested by valuation models, the key question becomes whether United Bankshares is still mispriced or if the market is already banking on further growth.

Price to Earnings of 12.9x: Is It Justified?

At a last close of $39.66, United Bankshares trades on a price to earnings ratio of 12.9 times, which places the stock slightly above the wider US Banks industry but below its closest peer group average.

The price to earnings multiple compares what investors are paying today with the company’s current earnings power, a key yardstick for established, profitable banks such as United Bankshares. Because earnings have been growing and are expected to keep rising, this multiple helps frame how much future profit growth is already built into the share price.

United Bankshares looks modestly expensive versus the broader US Banks industry, where the average price to earnings ratio sits at about 12 times. This suggests the market is assigning a small premium for its earnings profile. However, the estimated fair price to earnings ratio of 11.9 times implies that if sentiment normalises, there could be some compression in the multiple as the market moves closer to that fair level.

Against its immediate peers, though, United Bankshares screens as better value, with its 12.9 times price to earnings ratio sitting below the approximately 15.4 times peer average. This indicates investors are not paying top dollar relative to similar sized banks despite the company’s stronger recent earnings momentum.

Explore the SWS fair ratio for United Bankshares

Result: Price to Earnings of 12.9x (ABOUT RIGHT)

However, risks remain, including slower loan growth if economic conditions soften and pressure on net interest margins if funding costs rise faster than expected.

Find out about the key risks to this United Bankshares narrative.

Another View: SWS DCF Fair Value Check

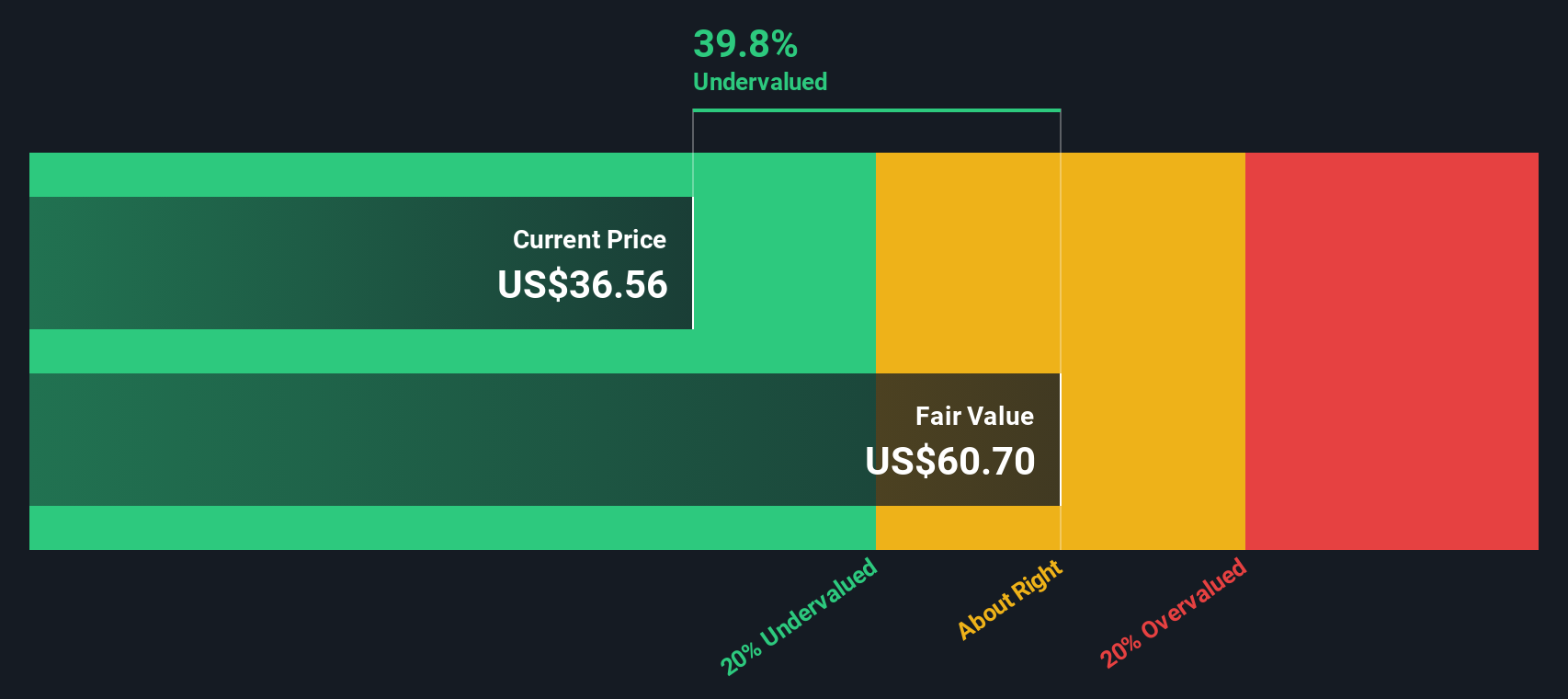

While the 12.9 times earnings multiple suggests United Bankshares is roughly fairly priced, our DCF model presents a different view. It estimates fair value near $59.16 per share, roughly 33 percent above today’s $39.66, which may indicate a deeper mispricing than the ratio implies.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out United Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own United Bankshares Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Bankshares.

Ready for more investment ideas?

Do not stop at one opportunity when a whole universe of potential winners is a click away. Your next outperformer could be hiding in plain sight.

- Capture powerful long term compounding from stable cash generators by targeting these 13 dividend stocks with yields > 3% that can steadily boost your portfolio income.

- Ride the next wave of innovation by focusing on these 28 quantum computing stocks positioned at the frontier of computation and real world problem solving.

- Capitalize on market mispricing by filtering for these 906 undervalued stocks based on cash flows before the crowd notices their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal