ACM Research (ACMR): Revisiting Valuation After a 140% Year-to-Date Rally

ACM Research (ACMR) has quietly turned into one of the better performers in the semiconductor equipment space, with the stock up about 20% over the past month and more than 140% year to date.

See our latest analysis for ACM Research.

That move has come as investors warm to ACM Research’s growth profile. A 30 day share price return of almost 20% has contributed to a 142% year to date share price gain and a 147% one year total shareholder return, suggesting momentum is still firmly on the front foot.

If ACM Research’s run has you thinking about what else could surprise the market, this is a good moment to explore other high growth tech names via high growth tech and AI stocks.

With shares now within single digits of Wall Street’s target and trading at a premium to some peers on growth metrics, the key question is whether ACM Research is still mispriced or if future gains are already fully reflected.

Most Popular Narrative: 7.6% Undervalued

With ACM Research last closing at $37.73 versus a narrative fair value near $40.81, the story frames current pricing as leaving modest upside on the table.

Recent major investments in new manufacturing and R&D capacity (Lingang in China and Oregon in the US), plus strategic inventory buildup to manage supply chain/geopolitical risks, position ACM to support expanding global sales, mitigate supply disruptions, and scale operations efficiently, which will eventually benefit gross margin and earnings stability.

Want to see how resilient growth, steady margins, and a surprisingly restrained future earnings multiple combine into that upside case? The full narrative explains the math behind this fair value estimate.

Result: Fair Value of $40.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on China and mounting export control risks could quickly challenge ACM Research’s growth assumptions and pressure its premium valuation.

Find out about the key risks to this ACM Research narrative.

Another View: Cash Flows Point to Caution

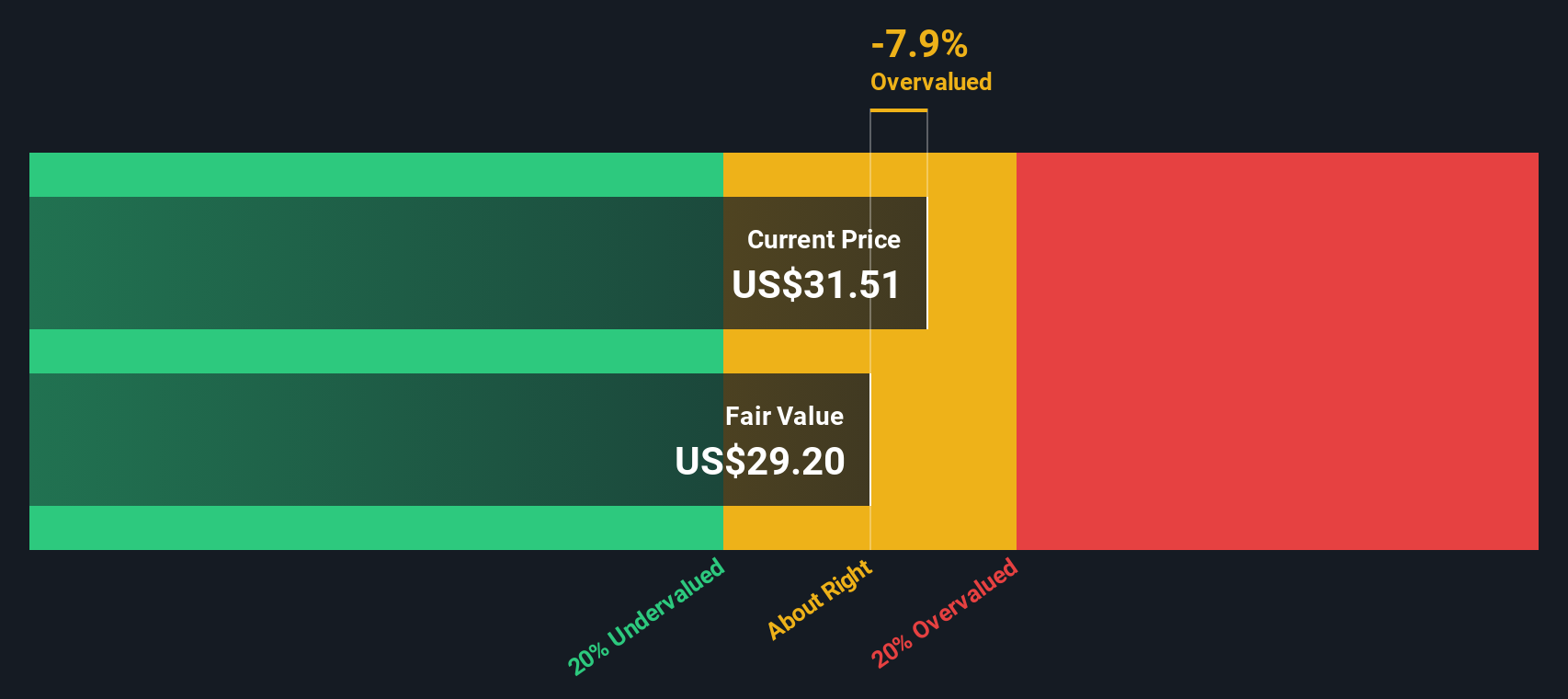

While the narrative fair value suggests ACM Research is around 7.6% undervalued, our DCF model paints a cooler picture, with fair value nearer $30.14, below the current $37.73 share price. If cash flows are right and sentiment is running hot, which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ACM Research for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ACM Research Narrative

If these perspectives do not fully align with your own, you can quickly dig into the numbers yourself and craft a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ACM Research.

Ready for your next investing move?

Before momentum shifts again, consider identifying your next watchlist candidates with targeted screeners on Simply Wall St to stay a step ahead of slower investors.

- Explore early-stage opportunities with strong balance sheets by running through these 3625 penny stocks with strong financials before the market fully catches on.

- Focus on the companies involved in automation and productivity improvements by reviewing these 26 AI penny stocks that align with your long term outlook.

- Identify potential value plays with built-in income streams by filtering for these 13 dividend stocks with yields > 3% that may help support returns during periods when markets are less active.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal