Angling Direct Leads 3 UK Penny Stocks To Watch

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices reflecting declines amid concerns over China's economic recovery. Despite these broader market pressures, investors often find opportunities in lesser-known areas such as penny stocks. These stocks, typically representing smaller or newer companies, can offer intriguing prospects for growth when backed by strong financials and fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.145 | £475.52M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.95 | £157.54M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.275 | £329.66M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.79 | £11.93M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6325 | $367.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.444 | £174.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.475 | £71.23M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.475 | £40.94M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £177.02M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Angling Direct (AIM:ANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angling Direct PLC, along with its subsidiaries, sells fishing tackle products and equipment in the United Kingdom, Europe, and internationally, with a market cap of £38.70 million.

Operations: The company's revenue is divided into three segments: UK Online (£39.31 million), UK Stores (£54.81 million), and Europe Online (£5.01 million).

Market Cap: £38.7M

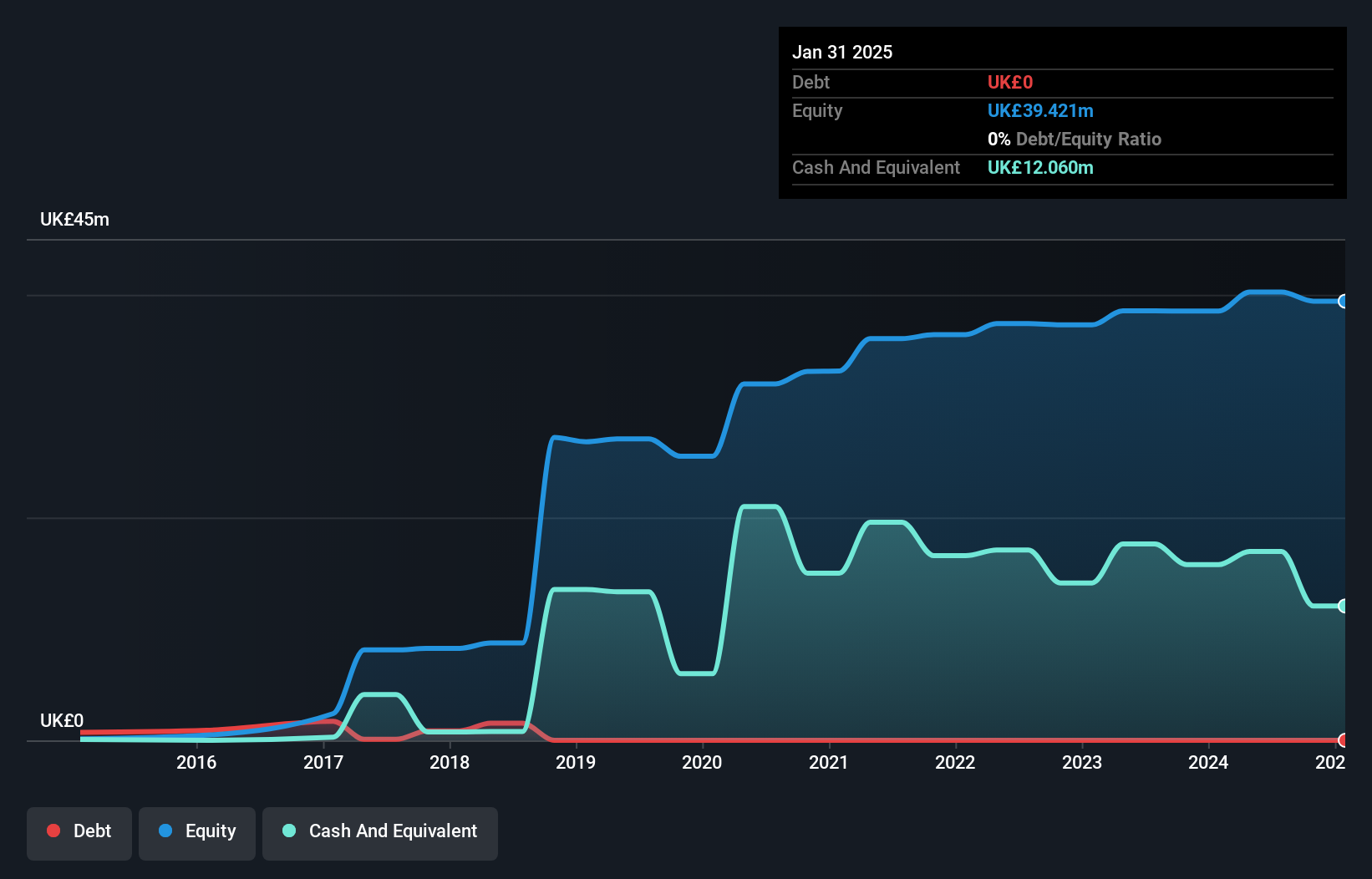

Angling Direct PLC has demonstrated stable financial performance with a market cap of £38.70 million and a diversified revenue stream across UK Online, UK Stores, and Europe Online segments. The company reported sales of £53.63 million for the half year ending July 2025, showing growth from the previous year. It maintains a debt-free position with short-term assets exceeding both short- and long-term liabilities, providing financial stability. Recent share buybacks indicate confidence in its valuation, while earnings growth outpaced industry averages over the past year despite low return on equity at 4.5%.

- Dive into the specifics of Angling Direct here with our thorough balance sheet health report.

- Learn about Angling Direct's future growth trajectory here.

Billington Holdings (AIM:BILN)

Simply Wall St Financial Health Rating: ★★★★★★

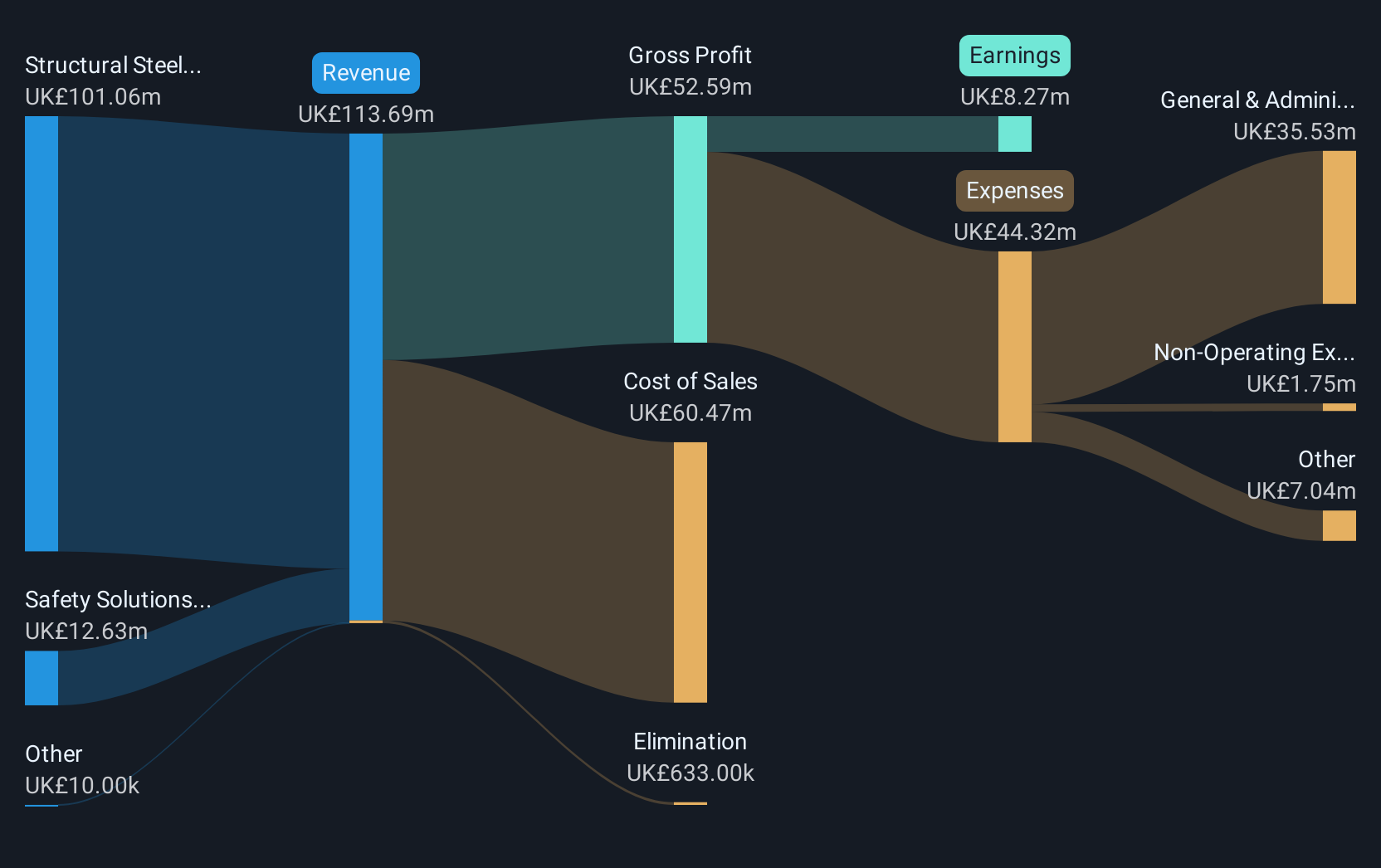

Overview: Billington Holdings Plc, with a market cap of £44.38 million, operates through its subsidiaries to offer structural steel and construction safety solutions in the United Kingdom and Europe.

Operations: The company generates revenue through its Structural Steelwork segment, which accounts for £85.86 million, and Safety Solutions, contributing £11.70 million.

Market Cap: £44.38M

Billington Holdings Plc, with a market cap of £44.38 million, is consolidating its structural steel operations to enhance efficiency and reduce costs by closing its Yate facility and expanding at Barnsley. Despite recent earnings decline, the company has shown significant profit growth over the past five years and remains debt-free, providing financial stability. However, its management team is relatively inexperienced with an average tenure of 0.5 years. Trading significantly below estimated fair value suggests potential for appreciation if operational improvements succeed. The dividend yield of 7.35% isn't well covered by free cash flows, indicating potential sustainability concerns.

- Take a closer look at Billington Holdings' potential here in our financial health report.

- Gain insights into Billington Holdings' outlook and expected performance with our report on the company's earnings estimates.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, specializes in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market capitalization of £1.34 billion.

Operations: The company generates revenue primarily from the United Kingdom, contributing £1.95 billion, and the United States, adding £233 million.

Market Cap: £1.34B

Bakkavor Group, with a market cap of £1.34 billion, faces challenges in the penny stock realm due to a recent one-off loss of £44.2 million impacting its financial results. Despite negative earnings growth over the past year and declining profit margins, the company's debt is well-covered by operating cash flow at 61.8%, and interest payments are adequately managed with EBIT covering them five times over. The board and management team are experienced, averaging tenures of 5.3 and 4.8 years respectively. Bakkavor trades significantly below estimated fair value but struggles with liabilities exceeding short-term assets.

- Click here to discover the nuances of Bakkavor Group with our detailed analytical financial health report.

- Examine Bakkavor Group's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Navigate through the entire inventory of 306 UK Penny Stocks here.

- Seeking Other Investments? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal