Are US stocks turning bearish just empty worries? Bank of America survey: Fund managers' sentiment is rare and enters a “full optimism” model

The Zhitong Finance App learned that according to Bank of America's monthly survey, money managers are confident in everything from economic growth to stocks and commodities, and are ready for the new year. In December, the investor sentiment indicator, measured by cash levels, stock allocations, and global growth expectations, rose to 7.4 (the highest level was 10), the most optimistic survey result in four and a half years.

Combined exposure to stocks and commodities (assets that usually perform well during economic expansion) reached their highest level since February 2022, before the impact of inflation led to a sharp rise in global interest rates.

Bank of America strategist Michael Hartnett said that this level of optimism has only appeared eight times in this century. These eight times include the recovery period after the global financial crisis from November 2010 to February 2011, and the boom period after the COVID-19 pandemic from November 2020 to July 2021, respectively.

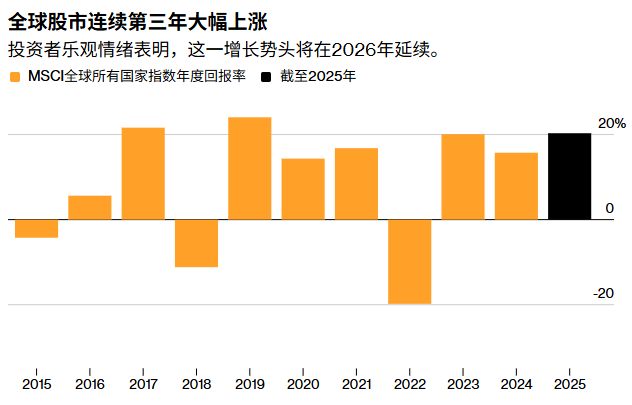

The MSCI Global National Index rose nearly 20% in 2025, achieving double-digit gains for the third year in a row, thanks to global central banks cutting interest rates at the same time as strong economic growth. Despite concerns about a potential tech bubble in the US, confidence in economic resilience has pushed major stock indexes back to near historic highs.

An unofficial survey of US, European and Asian asset managers showed they believe the stock market will be stronger in 2026. Market forecasters are also optimistic. Many banks, including Morgan Stanley, Deutsche Bank, and Citibank, predict that the US stock market will rise by more than 10%.

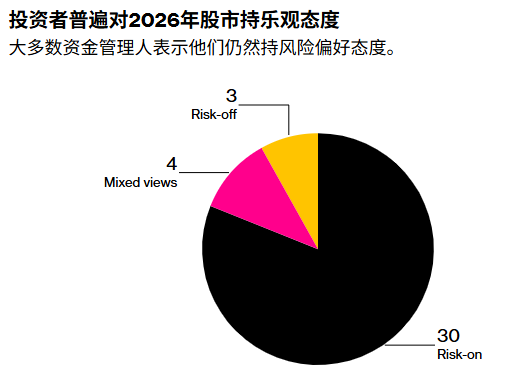

Institutional surveys show that more than three-quarters of asset allocators are adjusting their portfolios for the pre-2026 risk appetite environment. The core of their bet is that the resilience of global economic growth, further development of artificial intelligence, loose monetary policy and fiscal stimulus will bring excessive returns to the global stock market.

According to the Bank of America survey, about 57% of respondents expect a soft landing for the US economy, while only 3% predict a hard landing for the economy, which is the lowest level in two and a half years. The cash holding ratio fell to a record low of 3.3% from 3.7% last month. Furthermore, people are still concerned about the valuation of US technology companies, and the AI bubble is still seen as the biggest tail risk. Although this ratio is lower than last month's record of 20%, 14% of respondents still believe that companies are investing too much in capital expenditure.

The Bank of America survey was conducted from December 5 to December 11. The survey covered 203 participants with total assets of US$569 billion.

Although the three major US stock indices fell on Monday, the S&P 500 index closed at a record high last Friday. This is not unusual in 2025. It has been six weeks since the last time it hit a record high. However, the market pattern on December 12 was indeed very different compared to late October.

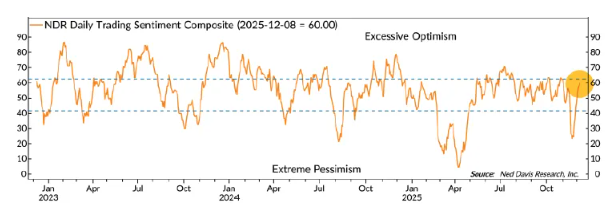

First, the October high was amidst investor fervor, mainly due to a strong earnings season and excitement about the future of artificial intelligence. However, this time, there was no fanaticism, which is certainly a good sign for bulls looking forward to a rebound at the end of the year. The sentiment indicator compiled by Ned Davis Research (which tracks 20 indicators including volatility, investor positions, and institutional investor surveys) is below 62.5 — the bottom of the range reflecting overheated sentiment.

Ed Clissold, chief US strategist at Ned Davis Research, said: “Considering the continued strong profit performance of US companies and the resilience of the US economy, market sentiment is far from being euphoric, which means there is still more room for growth in the market by the end of the year and the beginning of next year.”

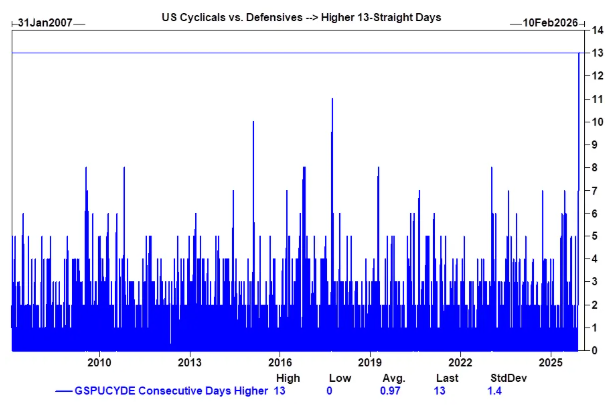

Meanwhile, the range of gains in US stocks is expanding significantly. For example, on Friday, Goldman Sachs's cyclical and defensive stock indices rose for the 13th consecutive trading day on Wednesday, setting the record for the longest continuous rise in history. Goldman Sachs wrote, “This trend won't happen unless the market starts to lean towards better growth prospects.”

Historical data also suggests that this rotation trend is likely to continue. Since 2007, after cyclical stocks outperformed defensive stocks for eight or more consecutive trading days, the S&P 500 index has shown positive returns. The index's median yield of 2% for one month and 6% for three months.

London Stockton, a research analyst at Ned Davis Research, said: “Many sentiment indicators lack signs of extreme optimism and fail to show the fanatical sentiment that usually appears at the top of the market. With this mixed sentiment, optimistic trends, positive seasonal factors, and the Federal Reserve's friendly policies, the stock market will show a bullish trend next year.”

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal