Is TransDigm Still Fairly Priced After Recent Share Pullback and Premium Valuation Multiples?

- If you have ever looked at TransDigm Group and wondered whether the high share price is still justified, this breakdown is going to walk you through what the market might actually be paying for.

- The stock has cooled off a bit lately, with shares down around 2.0% over the last week and 3.6% over the past month, though longer term holders are still sitting on gains of 3.0% year to date and 8.4% over the last year, with a large 147.7% and 160.7% over 3 and 5 years respectively.

- Recent headlines have focused on TransDigm's continued role as a key supplier across commercial and defense aerospace, along with ongoing acquisitions that reinforce its niche, mission critical parts portfolio. That backdrop helps explain why the stock has historically been rewarded for its pricing power and cash generation, even when short term sentiment wobbles.

- Right now, TransDigm only scores 1/6 on our basic valuation checks, which might surprise anyone impressed by its long run of returns. Next we will dig into how different valuation approaches look for this business, and finish by exploring a richer way to think about what the market should really pay for its cash flows and competitive position.

TransDigm Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: TransDigm Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today, to see what that stream is worth in present dollar terms.

For TransDigm Group, the model starts with last twelve month Free Cash Flow of about $1.84 billion and uses analyst forecasts for the next few years, then extends those estimates further into the future. By 2030, Simply Wall St projects Free Cash Flow could reach roughly $4.04 billion. Intermediate years are projected to step up from about $2.21 billion in 2026 and $2.69 billion in 2027 as the company continues to grow its aerospace parts franchise.

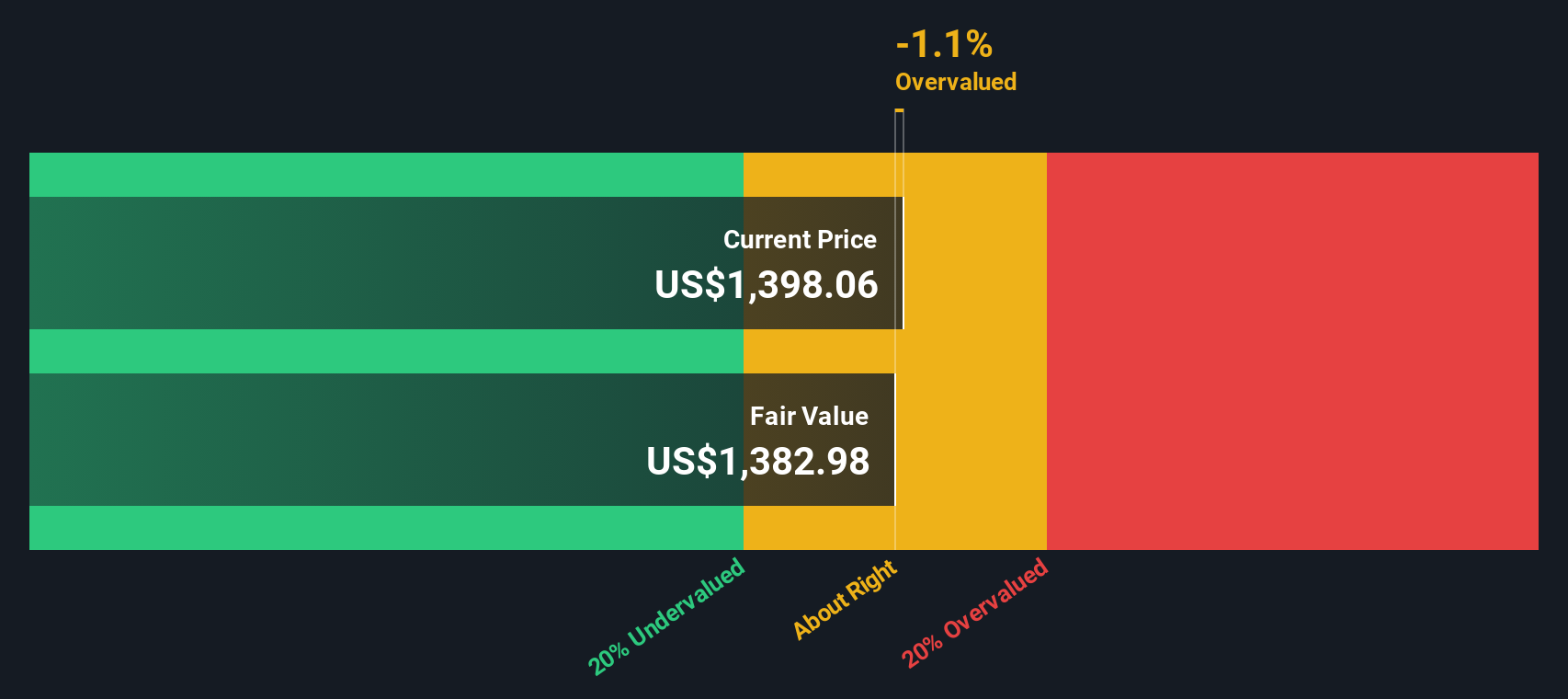

Adding up all those projected cash flows, discounting them appropriately, and dividing by the share count yields an intrinsic value estimate of roughly $1,279 per share. Compared with the current share price, this implies the stock is about 1.0% overvalued, which is effectively a rounding error rather than a strong signal either way.

Result: ABOUT RIGHT

TransDigm Group is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: TransDigm Group Price vs Earnings

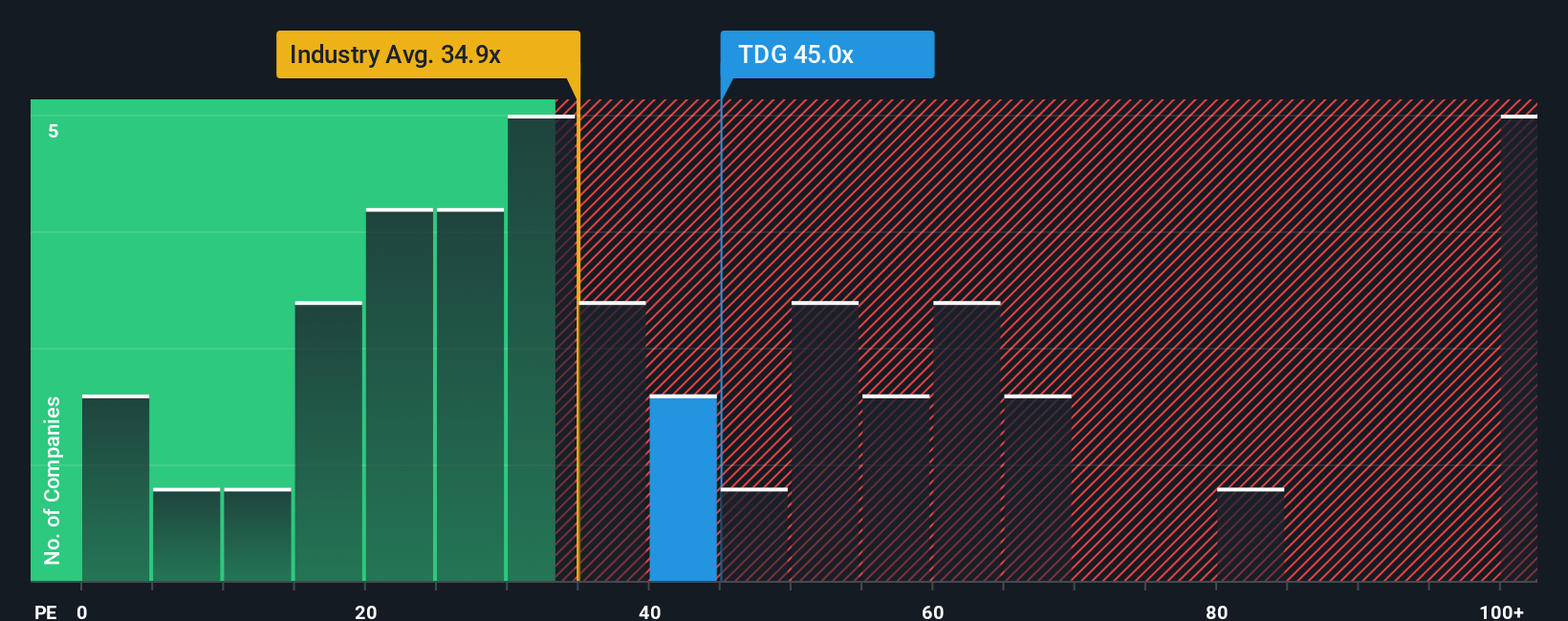

For profitable businesses like TransDigm Group, the price to earnings (PE) ratio is a straightforward way to judge whether investors are paying a reasonable price for today’s earnings power and expected growth. In general, faster growing, less risky companies tend to have a higher PE, while slower growing or more volatile businesses tend to trade on lower multiples.

TransDigm currently trades on a PE of about 39.0x, which is above the Aerospace and Defense industry average of roughly 37.5x and above the peer group average near 31.9x. At first glance, that could make the stock appear somewhat expensive relative to its sector and direct comparables.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE multiple a company might be expected to trade on after accounting for its earnings growth outlook, profitability, risk profile, industry positioning and market cap. For TransDigm, the Fair Ratio is 33.0x, which is meaningfully below the current 39.0x PE. That indicates the market is paying a premium above what those underlying fundamentals would support, even after factoring in its strengths.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your TransDigm Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that helps you turn your view of TransDigm Group into a clear story. It connects the business backdrop and catalysts through a concrete forecast for revenue, earnings and margins, and finally into a Fair Value you can compare to today’s price to decide whether to buy, hold or sell. The Narrative then automatically updates as new news and earnings are released. For example, a bullish investor who believes aftermarket margins will keep expanding and M&A will add substantial upside might set a higher fair value closer to $1,839, while a more cautious investor focused on leverage, regulatory risk and OEM cyclicality might anchor nearer $1,385. Each can see in real time how new information shifts their story, their numbers and their sense of whether the current price offers enough upside.

Do you think there's more to the story for TransDigm Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal