Oramed Pharmaceuticals And 2 Other Promising Penny Stocks To Watch

As the U.S. stock market navigates a period of volatility, with major indexes closing lower amid AI bubble concerns and upcoming economic data releases, investors are exploring diverse opportunities. Penny stocks, often associated with smaller or newer companies, offer a unique investment avenue that combines affordability with potential growth. Despite being considered an outdated term, these stocks remain relevant by providing access to companies that may have strong financials and growth potential at lower price points.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.05 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.05 | $179.57M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.16 | $531.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.17 | $1.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.76 | $178.24M | ✅ 5 ⚠️ 0 View Analysis > |

| Global Self Storage (SELF) | $4.97 | $56.35M | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (CINT) | $4.73 | $589.37M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.8701 | $6.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.05 | $91.76M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Oramed Pharmaceuticals (ORMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oramed Pharmaceuticals Inc. focuses on the research and development of pharmaceutical solutions utilizing a technology platform for the oral delivery of therapeutic proteins and has a market cap of approximately $122.59 million.

Operations: Oramed Pharmaceuticals Inc. has not reported any specific revenue segments.

Market Cap: $122.59M

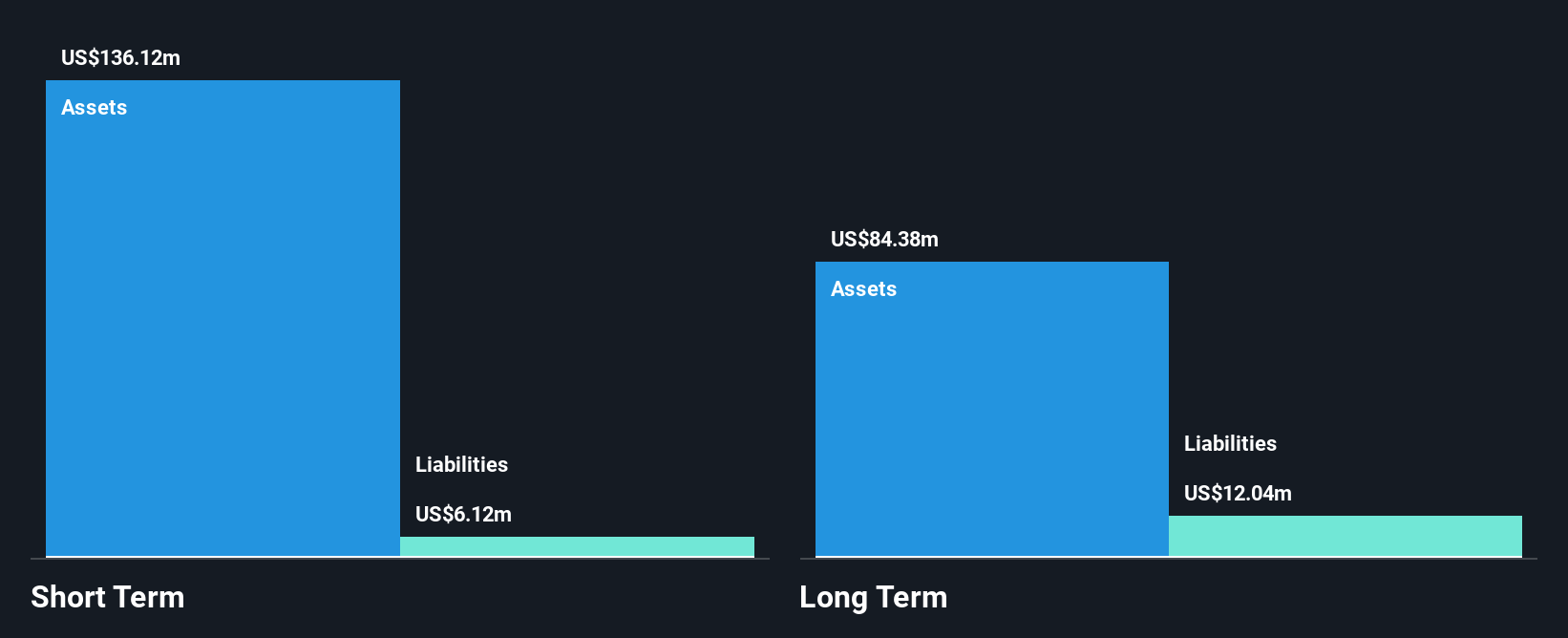

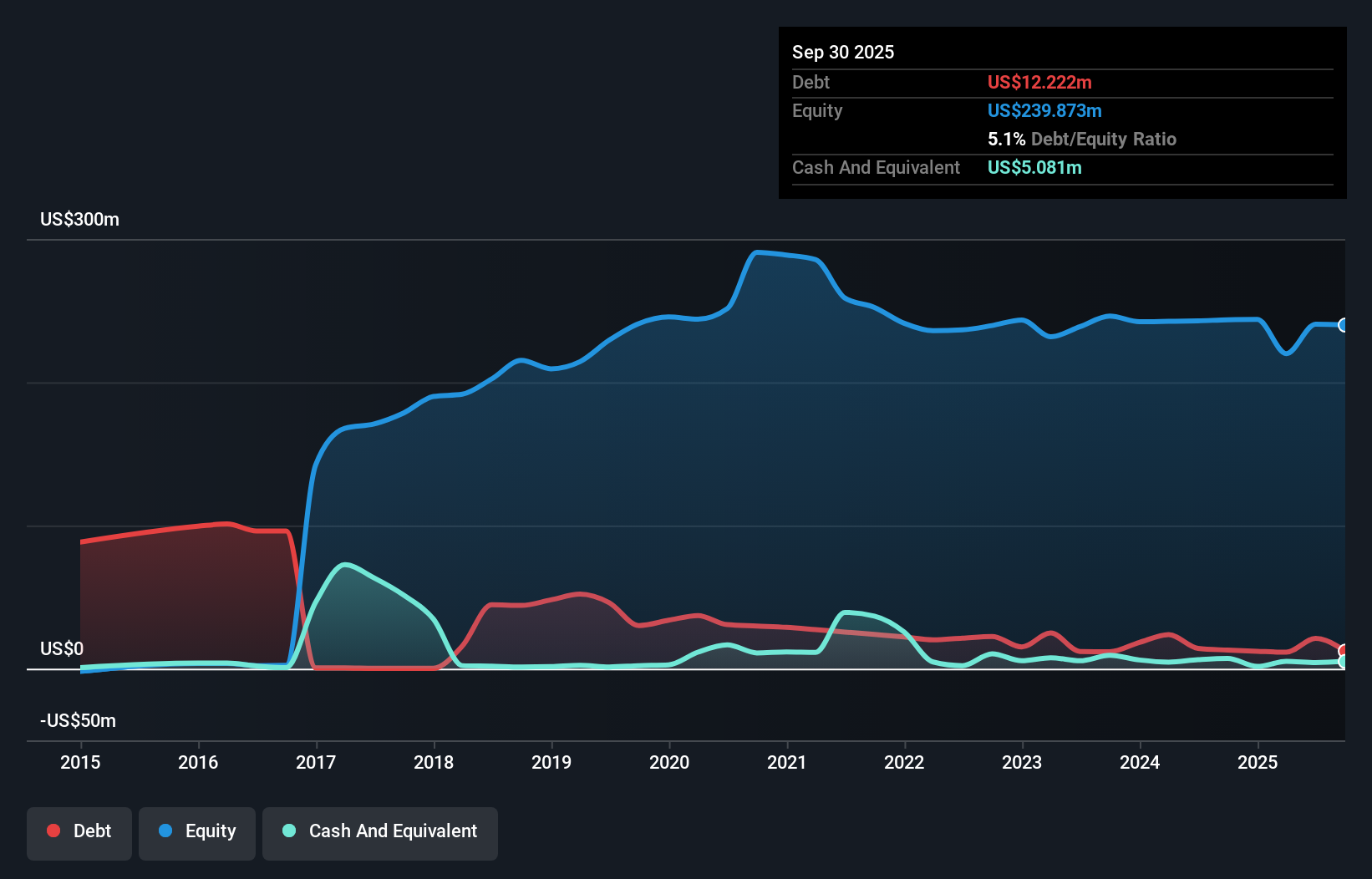

Oramed Pharmaceuticals Inc., with a market cap of US$122.59 million, presents an intriguing case in the penny stock realm due to its robust financial position and recent profitability. The company is debt-free, with short-term assets of US$136.1 million comfortably covering both short- and long-term liabilities. Over the past year, Oramed's earnings surged by 882.1%, significantly outpacing industry averages, while maintaining a low price-to-earnings ratio of 2.8x compared to the broader US market's 19x. Despite limited revenue streams (US$2 million), its strategic Rights Agreement and dividend declaration signal confidence in future growth prospects.

- Click here to discover the nuances of Oramed Pharmaceuticals with our detailed analytical financial health report.

- Learn about Oramed Pharmaceuticals' historical performance here.

Smart Sand (SND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Smart Sand, Inc. offers mine to wellsite proppant supply and logistics solutions for frac sand customers, with a market cap of $174.61 million.

Operations: The company's revenue is primarily derived from its Sand segment, contributing $331.32 million, with an additional $4.16 million from Smartsystems.

Market Cap: $174.61M

Smart Sand, Inc., with a market cap of US$174.61 million, has recently turned profitable, reporting third-quarter revenue of US$92.78 million and net income of US$3 million. The company maintains a satisfactory net debt to equity ratio of 3% and has reduced its debt over the past five years. Despite low return on equity at 1.6%, Smart Sand's seasoned board and management team provide stability, while short-term assets exceed both short- and long-term liabilities. Recent announcements include a special cash dividend and share buybacks totaling 2.55% under its repurchase plan, reflecting shareholder value initiatives amidst fluctuating earnings growth trends.

- Get an in-depth perspective on Smart Sand's performance by reading our balance sheet health report here.

- Explore historical data to track Smart Sand's performance over time in our past results report.

MariMed (MRMD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MariMed Inc. is involved in the cultivation, production, and sale of branded cannabis products both in the United States and internationally, with a market cap of $43.52 million.

Operations: The company's revenue primarily comes from its cultivation, processing, and sale of branded cannabis products, generating $157.38 million.

Market Cap: $43.52M

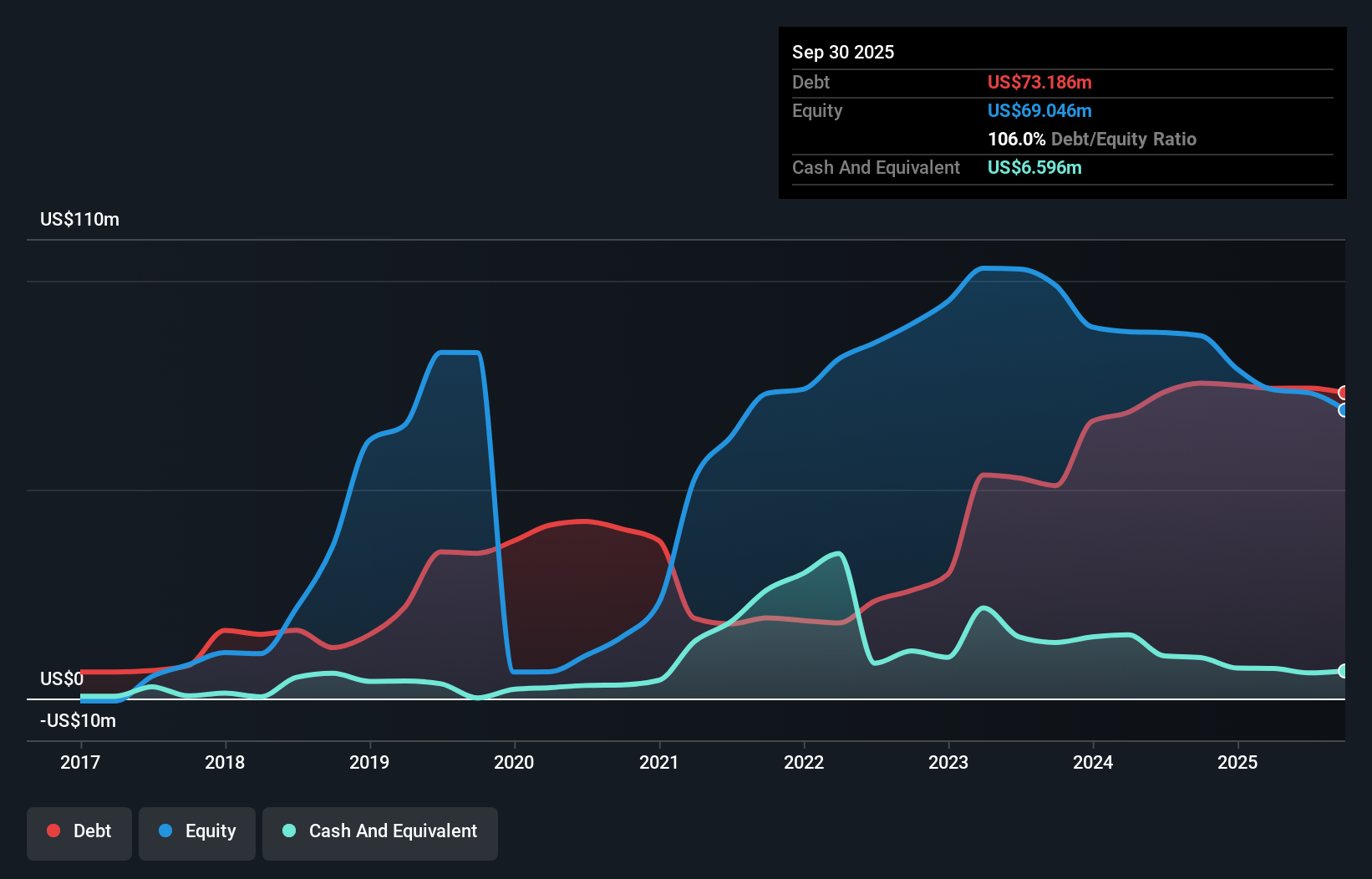

MariMed Inc., with a market cap of US$43.52 million, is navigating the challenging penny stock landscape by expanding its product lineup and market reach. Recent initiatives include launching new products like Bundle Up Betty's and entering the hemp-derived THC market through strategic partnerships, which could enhance brand visibility. Despite these efforts, MariMed remains unprofitable with a net loss of US$2.95 million for Q3 2025 and increasing losses over five years. The company's high net debt to equity ratio of 96.4% poses financial risks, although it benefits from an experienced board and management team guiding its strategy forward.

- Click here and access our complete financial health analysis report to understand the dynamics of MariMed.

- Review our growth performance report to gain insights into MariMed's future.

Key Takeaways

- Unlock more gems! Our US Penny Stocks screener has unearthed 339 more companies for you to explore.Click here to unveil our expertly curated list of 342 US Penny Stocks.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal