3 Reliable Dividend Stocks Offering Yields Up To 9%

As the U.S. markets grapple with pressures from AI stocks and looming economic data, investors are increasingly seeking stability amid volatility. In such an environment, dividend stocks can offer a reliable income stream, making them an appealing choice for those looking to balance growth potential with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.56% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.20% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.80% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.27% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.73% | ★★★★★★ |

| Ennis (EBF) | 5.45% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.49% | ★★★★★☆ |

| Dillard's (DDS) | 4.60% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.94% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.09% | ★★★★★★ |

Click here to see the full list of 110 stocks from our Top US Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

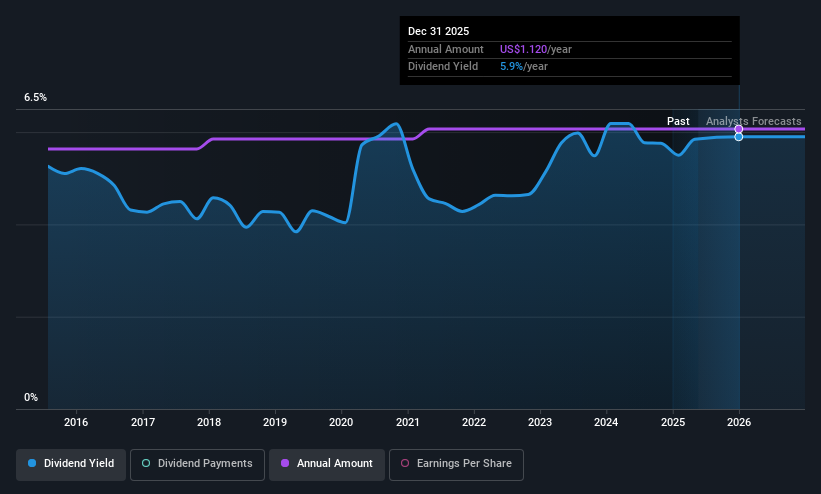

Citizens & Northern (CZNC)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Citizens & Northern Corporation is a bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate clients, with a market cap of $391.46 million.

Operations: Citizens & Northern Corporation generates its revenue primarily from its Community Banking segment, which accounts for $109.63 million.

Dividend Yield: 5.1%

Citizens & Northern offers a stable dividend yield of 5.09%, placing it in the top 25% of U.S. dividend payers. Recent affirmations include a quarterly cash dividend of $0.28 per share, supported by a reasonable payout ratio of 63.9%. Earnings showed modest growth, with net interest income rising to US$22.26 million for Q3 2025, and net income at US$6.55 million, suggesting continued support for its reliable and growing dividends over the past decade despite minor shareholder dilution recently.

- Dive into the specifics of Citizens & Northern here with our thorough dividend report.

- According our valuation report, there's an indication that Citizens & Northern's share price might be on the expensive side.

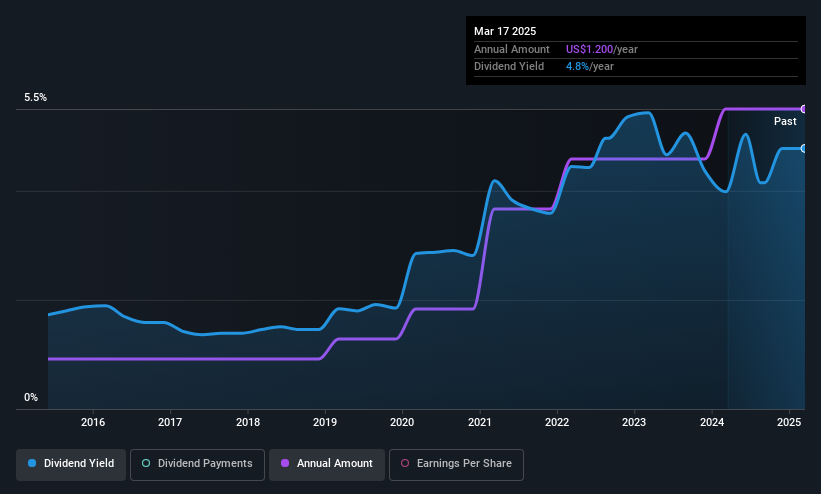

CompX International (CIX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CompX International Inc. manufactures and sells security products and recreational marine components primarily in North America, with a market cap of $300.19 million.

Operations: CompX International Inc.'s revenue is derived from two main segments: $121.76 million from Security Products and $37.25 million from Marine Components.

Dividend Yield: 9%

CompX International's dividend yield of 9.03% ranks it among the top 25% of U.S. dividend payers, with a stable and reliable history over the past decade. The company recently declared a quarterly dividend of $0.30 per share, though its high cash payout ratio of 183.3% raises sustainability concerns as dividends aren't covered by free cash flows despite earnings coverage at a 76.5% payout ratio. Earnings have shown modest growth, supporting continued payouts for now.

- Delve into the full analysis dividend report here for a deeper understanding of CompX International.

- In light of our recent valuation report, it seems possible that CompX International is trading behind its estimated value.

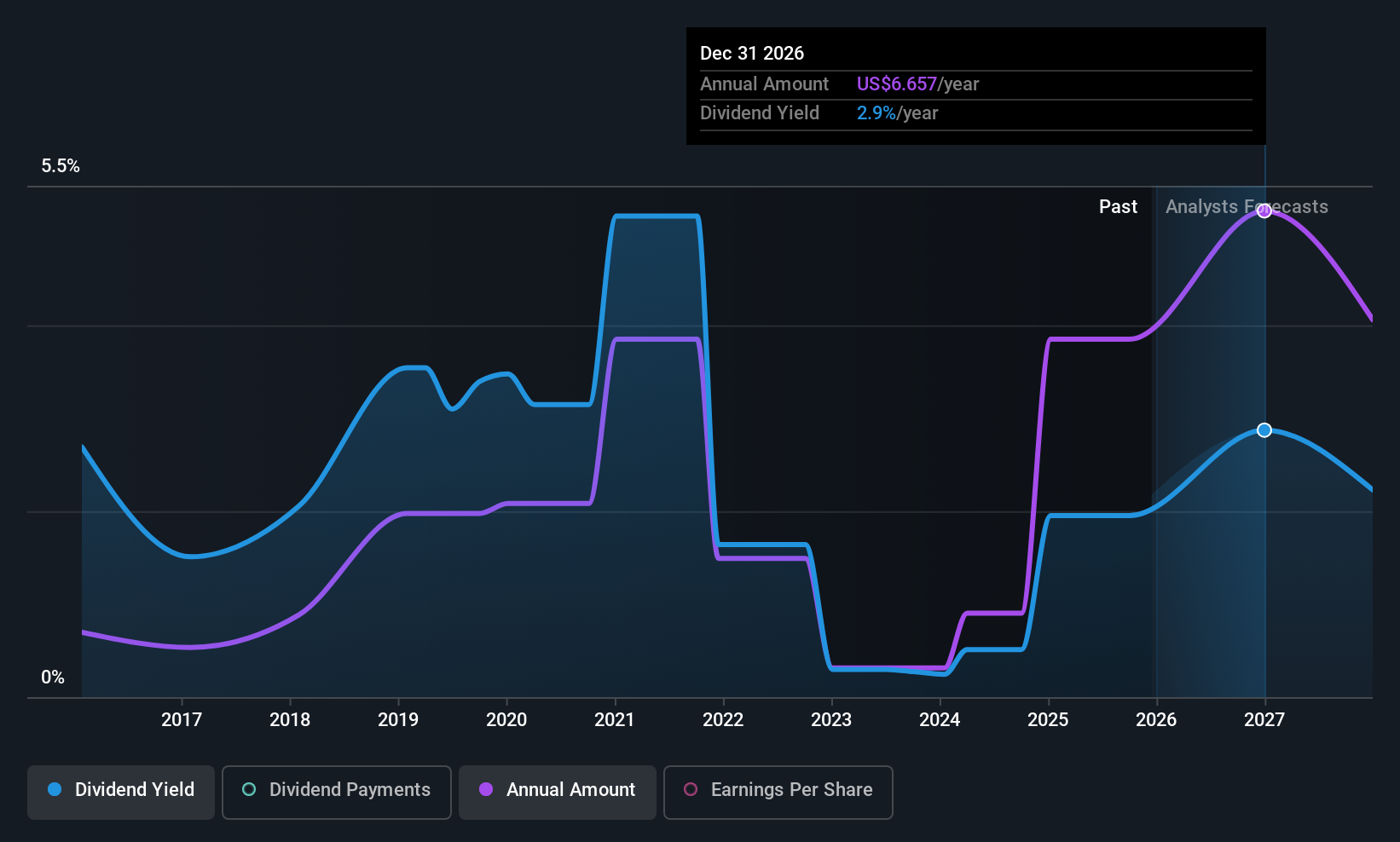

Progressive (PGR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Progressive Corporation operates as an insurance company in the United States and has a market cap of approximately $137.72 billion.

Operations: Progressive's revenue is primarily derived from its Personal Lines including Property segment at $69.76 billion and Commercial Lines at $11.14 billion, with a Segment Adjustment of $4.23 billion.

Dividend Yield: 5.9%

Progressive's recent annual dividend declaration of US$13.50 per share, alongside a quarterly dividend of US$0.10, reflects its strong capital position and commitment to shareholder returns. Despite a history of volatile and unreliable dividends, the company's payout ratios remain sustainable, with earnings coverage at 26.8% and cash flow coverage at 47.8%. Progressive's partnerships expand its insurance offerings, contributing to revenue growth from US$55 billion to US$64.93 billion year-over-year, supporting future dividend stability despite past volatility concerns.

- Unlock comprehensive insights into our analysis of Progressive stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Progressive is priced lower than what may be justified by its financials.

Next Steps

- Click here to access our complete index of 110 Top US Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal