Assessing 1911 Gold (TSXV:AUMB) After Its CA$23 Million Private Placement: What Does the Valuation Suggest?

1911 Gold (TSXV:AUMB) just closed a sizeable private placement, raising roughly CA$23 million through a mix of flow through and non flow through units. This funding move directly targets upcoming development and exploration work.

See our latest analysis for 1911 Gold.

The financing has landed at a time when momentum in the shares has been strong, with a 90 day share price return of 92.45 percent and a year to date total shareholder return of 558.06 percent. This signals that investors are increasingly pricing in future growth potential.

If this kind of early stage surge has your attention, it could be worth scanning for other discovery driven stories through fast growing stocks with high insider ownership to spot what else might be gaining traction.

With the stock already up more than fivefold this year and a fresh CA$23 million now on the balance sheet, is 1911 Gold still trading below its true potential, or has the market already priced in the next leg of growth?

Most Popular Narrative: 97.5% Undervalued

According to the most followed narrative, 1911 Gold's fair value sits far above the last close of CA$1.02, framing the recent rally as only the opening act.

1911 Gold has turned the corner from concept to formal economic work with a PEA underway and a trial mining / bulk-sample plan for mid-2026, the right de-risking steps before construction. With a current basic share count ~262.3M, the project shows strong torque at US$4,500 to US$5,000 gold under your AISC/oz path, but outcomes hinge on PEA/PFS results, bulk-sample performance, financing, and execution.

Want to see what powers that aggressive fair value, from production ramp assumptions to margins more often seen in tier one gold camps, and how they stack over time?

Result: Fair Value of $41.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, trial mining results and potential capex overruns could quickly challenge this upside narrative if grades, recoveries, or funding needs disappoint expectations.

Find out about the key risks to this 1911 Gold narrative.

Another View, Market Multiples Look Stretched

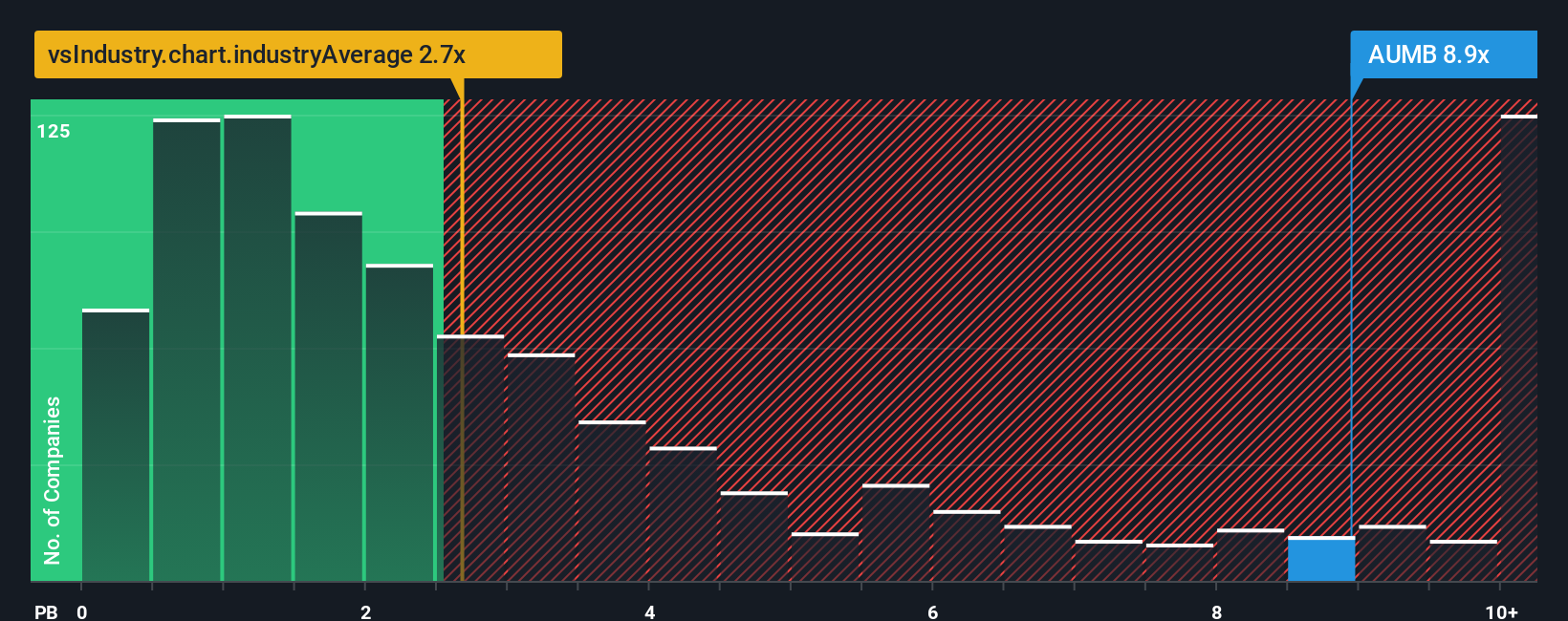

While the narrative fair value points to huge upside, the market is already paying a rich price on a simple balance sheet lens. 1911 Gold trades at about 8.5 times book value versus roughly 2.8 times for the Canadian metals and mining group, implying far less margin for error if the restart stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 1911 Gold Narrative

If you are not aligned with this view, or simply want to dig into the numbers yourself, you can build a fresh take in minutes, Do it your way.

A great starting point for your 1911 Gold research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next watchlist candidates with targeted screeners from Simply Wall St so you do not miss the strongest setups.

- Capture high potential rebounds by scanning these 903 undervalued stocks based on cash flows, where solid businesses may still trade at a meaningful discount to their intrinsic worth.

- Position ahead of breakthroughs by focusing on these 28 quantum computing stocks, which could benefit as real world applications accelerate.

- Boost your income strategy with these 13 dividend stocks with yields > 3%, offering yields above 3 percent while still maintaining underlying business strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal