The Bull Case For MDA Space (TSX:MDA) Could Change Following New Arctic MILSATCOM Deals And Bond Offering

- In early December 2025, Telesat announced a partnership with the Government of Canada and MDA Space to deliver a multi-frequency Arctic military satellite communications capability, while MDA Space also secured Canadian government contracts, including a CA$44.7 million award for RADARSAT Constellation Mission replenishment satellite components and a CA$250 million, 7.00% senior unsecured notes offering due 2030.

- Together, these defense and Earth observation contracts, alongside new bond financing, highlight how government-backed programs are reinforcing MDA Space’s role in critical national space infrastructure and funding its expansion.

- We’ll now examine how MDA Space’s new Arctic MILSATCOM role with Telesat and Canada could reshape the company’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MDA Space Investment Narrative Recap

To own MDA Space, you generally need to believe that large, long-duration government and commercial space programs will keep filling its expanding manufacturing pipeline and justify heavy capital spending. The new Arctic MILSATCOM role and RADARSAT contracts support that view in the near term, but they do not remove the key risk that big constellation or government orders could slow, be delayed, or be re-scoped, leaving new facilities underutilized and pressuring margins.

Among the recent announcements, the CA$44.7 million RADARSAT Constellation Mission replenishment contract stands out here, because it reinforces MDA Space’s position in Canadian Earth observation just as it takes on the Arctic MILSATCOM work. Together, these government backed programs speak directly to the central catalyst for the stock: converting defense and civil space demand into sustained backlog that keeps the Montreal high volume satellite plant busy and supports the balance sheet alongside the new CA$250 million bond.

Yet while these wins look supportive, investors should also be aware that...

Read the full narrative on MDA Space (it's free!)

MDA Space's narrative projects CA$2.6 billion revenue and CA$271.2 million earnings by 2028. This requires 24.5% yearly revenue growth and a CA$156.5 million earnings increase from CA$114.7 million today.

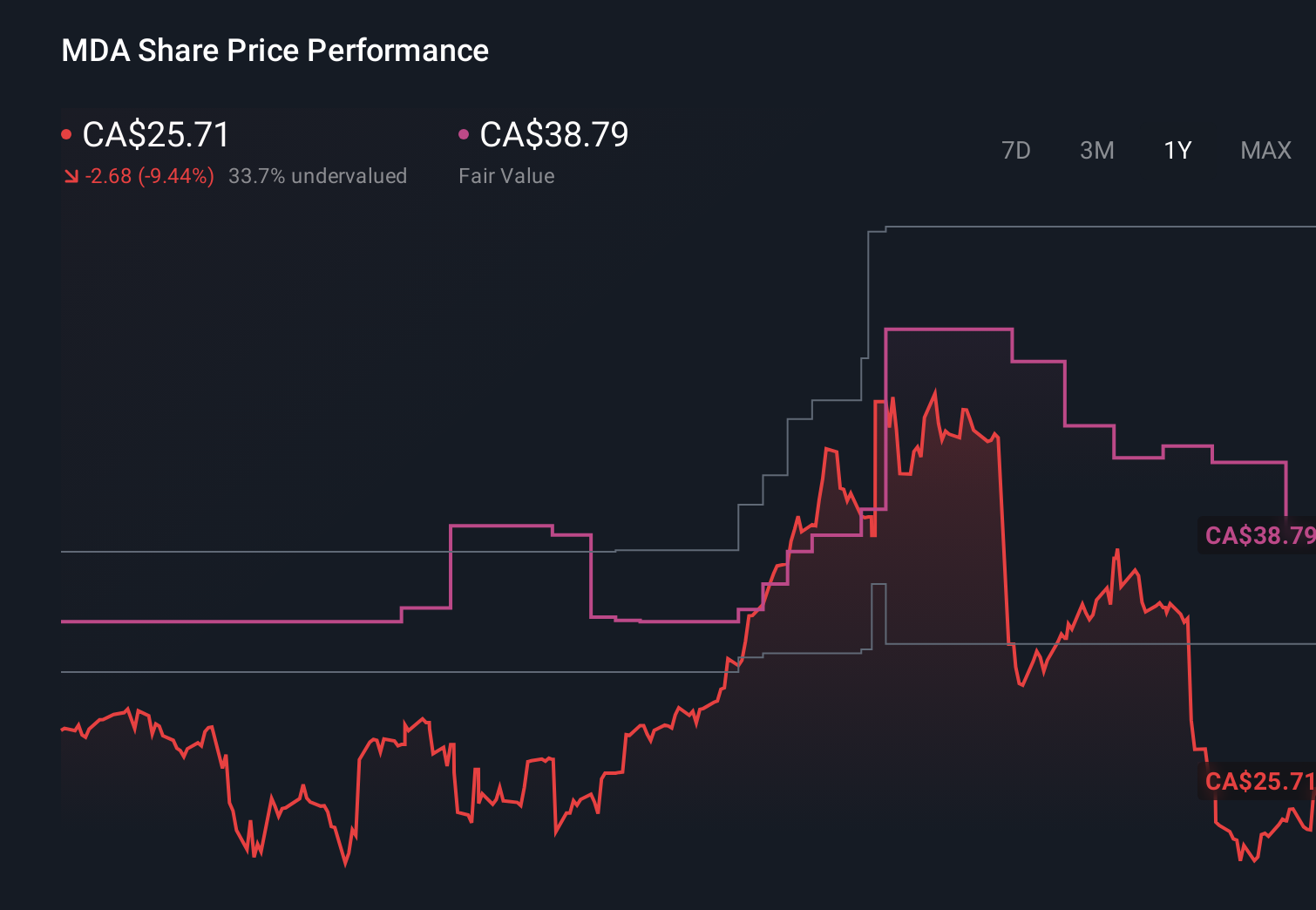

Uncover how MDA Space's forecasts yield a CA$38.79 fair value, a 51% upside to its current price.

Exploring Other Perspectives

Seventeen members of the Simply Wall St Community currently see MDA Space’s fair value anywhere between about CA$6.77 and CA$55, with views spread across the range. Against that backdrop of very different expectations, the key question is whether new defense backed contracts and added debt will fully support the company’s expanded satellite manufacturing capacity over time.

Explore 17 other fair value estimates on MDA Space - why the stock might be worth over 2x more than the current price!

Build Your Own MDA Space Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MDA Space research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MDA Space research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MDA Space's overall financial health at a glance.

No Opportunity In MDA Space?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal