GA Technologies (TSE:3491) Margin Expansion Reinforces Bullish Growth Narrative After 111% TTM Earnings Jump

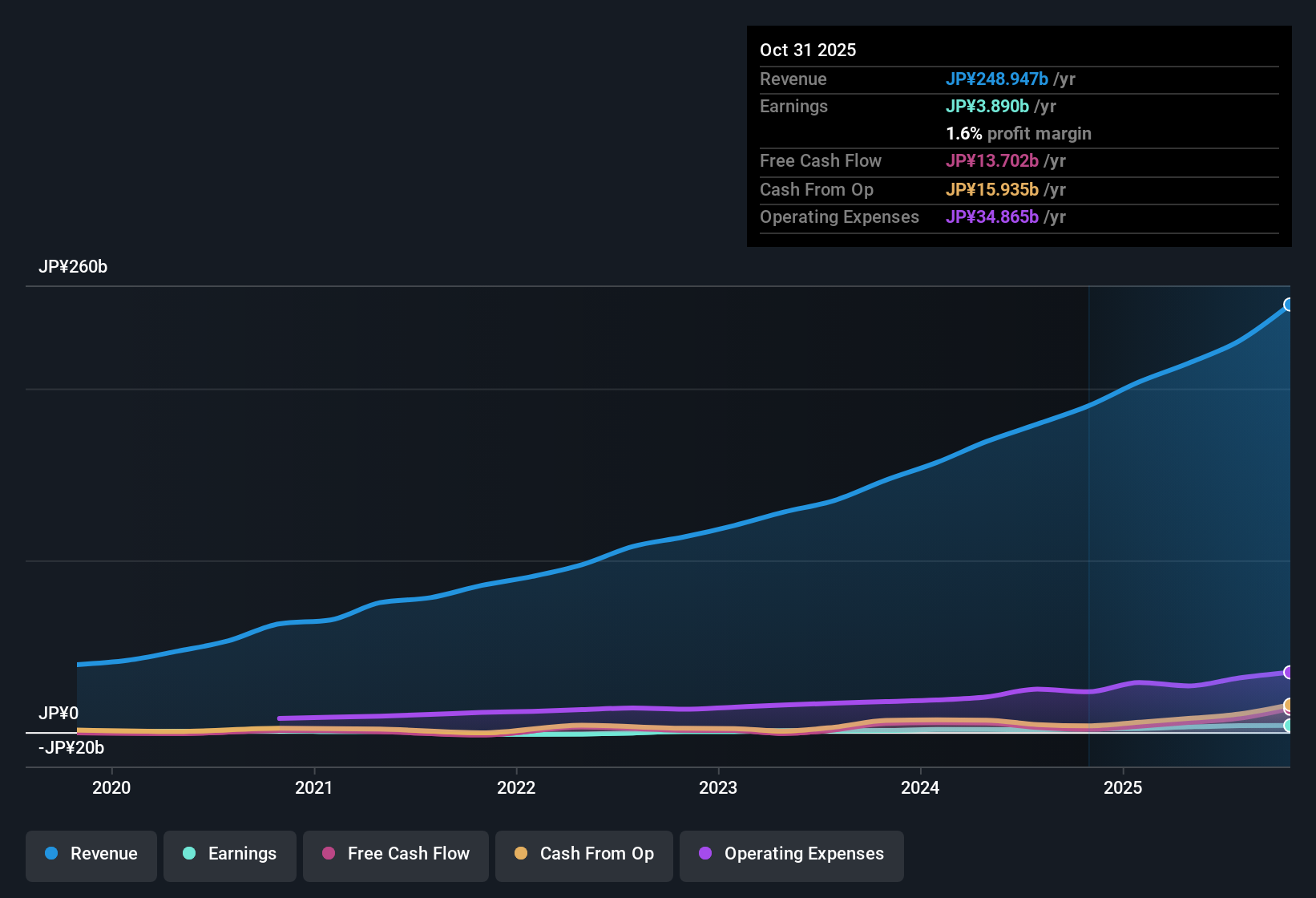

GA technologies (TSE:3491) just wrapped up FY 2025 with fourth quarter revenue of ¥79.4 billion and basic EPS of ¥21.32, capping a year in which trailing twelve month revenue reached ¥248.9 billion and EPS hit ¥97.80. The company has seen revenue climb from ¥189.9 billion to ¥248.9 billion on a trailing basis alongside EPS moving from ¥50.01 to ¥97.80, giving investors a clear view of how the top line and per share earnings have been tracking through this latest print, while net profit margins have quietly become a more important part of the story.

See our full analysis for GA technologies.With the headline numbers on the table, the next step is to see how these results line up with the prevailing narratives around GA technologies, highlighting where the data backs the story and where it might be starting to diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Triple digit profit growth on trailing basis

- On a trailing 12 month view, net income rose from ¥1.8 billion to ¥3.9 billion and EPS moved from ¥50.01 to ¥97.80, while revenue increased from ¥189.9 billion to ¥248.9 billion over the same window.

- What stands out for a bullish angle is that this 111.3% trailing earnings growth sits alongside revenue growth forecasts of about 19.4% per year and earnings growth forecasts of about 23.2% per year, which investors who focus on growth stories may see as:

- Evidence that recent profit gains are not only a one off, given five year annualized earnings growth is 54.9% and revenue has been rising with profits.

- Support for the idea that GA technologies is executing on a scalable model as both quarterly revenue, from ¥58.2 billion in FY 2024 Q4 to ¥79.4 billion in FY 2025 Q4, and full year profit metrics move in the same direction.

Margins still thin at 1.6 percent

- Trailing net profit margin is 1.6%, up from 1.0% a year earlier, based on ¥3.9 billion of net income on ¥248.9 billion of revenue, which means most of each yen of sales is still being used to cover costs.

- Critics who take a more bearish stance can point to this low margin level as a key watch point, even with improvement, because:

- Quarterly net income in FY 2025 ranged from ¥462 million in Q1 to ¥1.7 billion in Q2, showing that profits can move around a lot relative to revenue that stays in the tens of billions of yen each quarter.

- Any slip in revenue growth or cost control could have a noticeable impact on such a slim margin base, especially when the business is also being compared with tech peers that often target much higher profitability.

Valuation screens cheap versus growth

- The shares trade at a trailing P E of 20.2 times, below the peer average of 25.8 times, and the DCF fair value of ¥4,474.86 is well above the current share price of ¥1,919, implying the stock trades about 57.1% below that DCF estimate.

- Supporters of a bullish view argue that this mix of growth and price looks appealing, and the numbers here give them some backing because:

- Forecast earnings growth of about 23.2% per year and revenue growth of about 19.4% per year are being offered at an earnings multiple that is in line with the broader industry but below peers.

- The gap between current price and DCF fair value suggests that, if the company continues to deliver around the recent earnings trajectory, the market may have room to re rate the shares over time.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on GA technologies's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid earnings expansion and an apparently cheap valuation, GA technologies still operates on very slim and volatile profit margins that heighten execution risk.

If swings in profitability on such a thin margin make you uneasy, use our stable growth stocks screener (2102 results) to focus on companies delivering steadier revenue and earnings through changing conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal