Glaukos (GKOS): Reassessing Valuation After Citigroup’s Rating Update and iDose TR Commercial Launch

Glaukos (GKOS) is back in focus after Citigroup maintained its Buy rating and boosted expectations, just as the company kicks off commercialization of its iDose TR glaucoma implant, a product many investors see as a key growth engine.

See our latest analysis for Glaukos.

The stock has bounced hard recently, with a 30 day share price return of 24.10 percent and 90 day share price return of 35.68 percent. However, the year to date share price return remains negative, while the 3 year total shareholder return is still very strong. This suggests momentum is rebuilding as investors reassess Glaukos growth runway around iDose TR and its broader glaucoma portfolio.

If Glaukos iDose launch has you rethinking opportunities in eye care and beyond, it could be a smart moment to explore other innovative healthcare stocks that might fit your strategy.

With shares still trading below Wall Street targets but already reflecting a sharp rebound, are investors getting Glaukos iDose driven growth at a discount, or is the market already baking in the next leg of expansion?

Most Popular Narrative Narrative: 7.3% Undervalued

Compared with Glaukos last close of $111.73, the most followed narrative sees fair value closer to $120.50, implying modest upside from current levels.

Increasing penetration into payer coverage for iDose (with 50%+ of commercial/Medicare lives already covered and others expected to follow) and ongoing margin improvement from higher iDose mix (83% gross margin in Q2) support the potential for sustained net margin and earnings growth as reimbursement solidifies and the product mix shifts toward higher margin, minimally invasive solutions.

Curious how this story turns a loss making business into a high margin compounder so quickly? The answer lies in bold revenue ramp and profit assumptions that could reset expectations for what a glaucoma platform can earn. Want to see exactly how those forecasts stack up year by year?

Result: Fair Value of $120.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if reimbursement improves more slowly than expected, or if there are setbacks in key clinical trials, the bullish assumptions embedded in today’s valuation could quickly be challenged.

Find out about the key risks to this Glaukos narrative.

Another Angle On Valuation

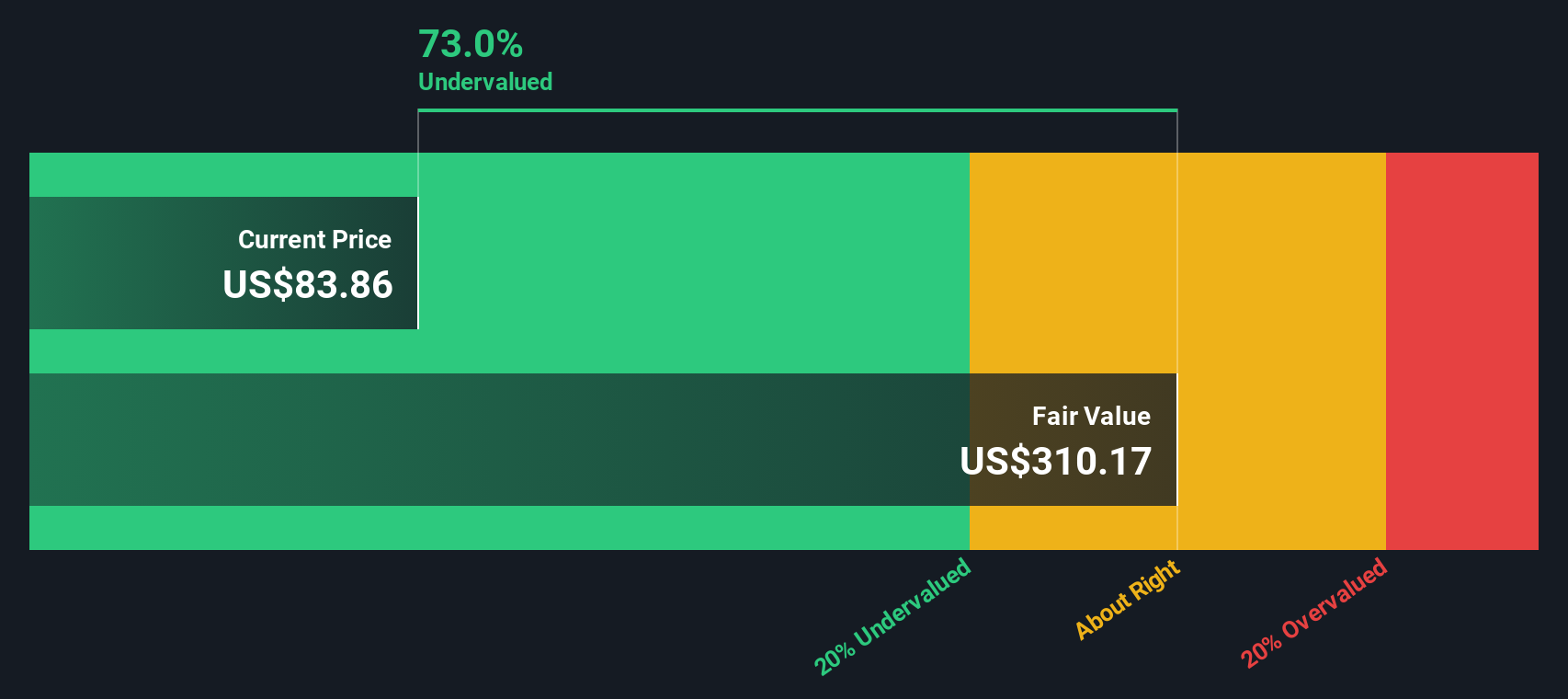

While narratives and analyst targets point to upside, our DCF model is far more aggressive, suggesting Glaukos could be trading around 64 percent below its fair value. If that long term cash flow story is even partly right, are short term worries about pricing and competition creating mispriced risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Glaukos Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way.

A great starting point for your Glaukos research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Glaukos might be your starting point, but you will regret missing the chance to uncover other focused opportunities using the Simply Wall St screener tools today.

- Capitalize on asymmetric upside by targeting under the radar names through these 3617 penny stocks with strong financials before the broader market catches on.

- Position yourself at the frontier of innovation by tapping into these 26 AI penny stocks shaping the next era of intelligent technology.

- Lock in potential value now by filtering for cash flow backed opportunities using these 906 undervalued stocks based on cash flows while prices still look compelling.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal