Exploring 3 Undervalued Small Caps In Global With Insider Action

In a global market characterized by the Federal Reserve's interest rate cuts and mixed performances across major indices, small-cap stocks have shown resilience, with the Russell 2000 Index outperforming its larger-cap counterparts. As investors navigate these dynamic conditions, identifying small-cap companies that exhibit strong fundamentals and strategic insider actions can be crucial in uncovering potential opportunities within this segment.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.5x | 0.7x | 41.75% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 40.35% | ★★★★★☆ |

| Eastnine | 11.6x | 7.4x | 49.62% | ★★★★★☆ |

| A.G. BARR | 14.4x | 1.6x | 48.14% | ★★★★☆☆ |

| Centurion | 3.6x | 3.0x | -53.12% | ★★★★☆☆ |

| Vita Life Sciences | 14.6x | 1.6x | 38.79% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.53% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.2x | 0.4x | -398.49% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.5x | 8.24% | ★★★☆☆☆ |

| Nufarm | NA | 0.2x | -117.98% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

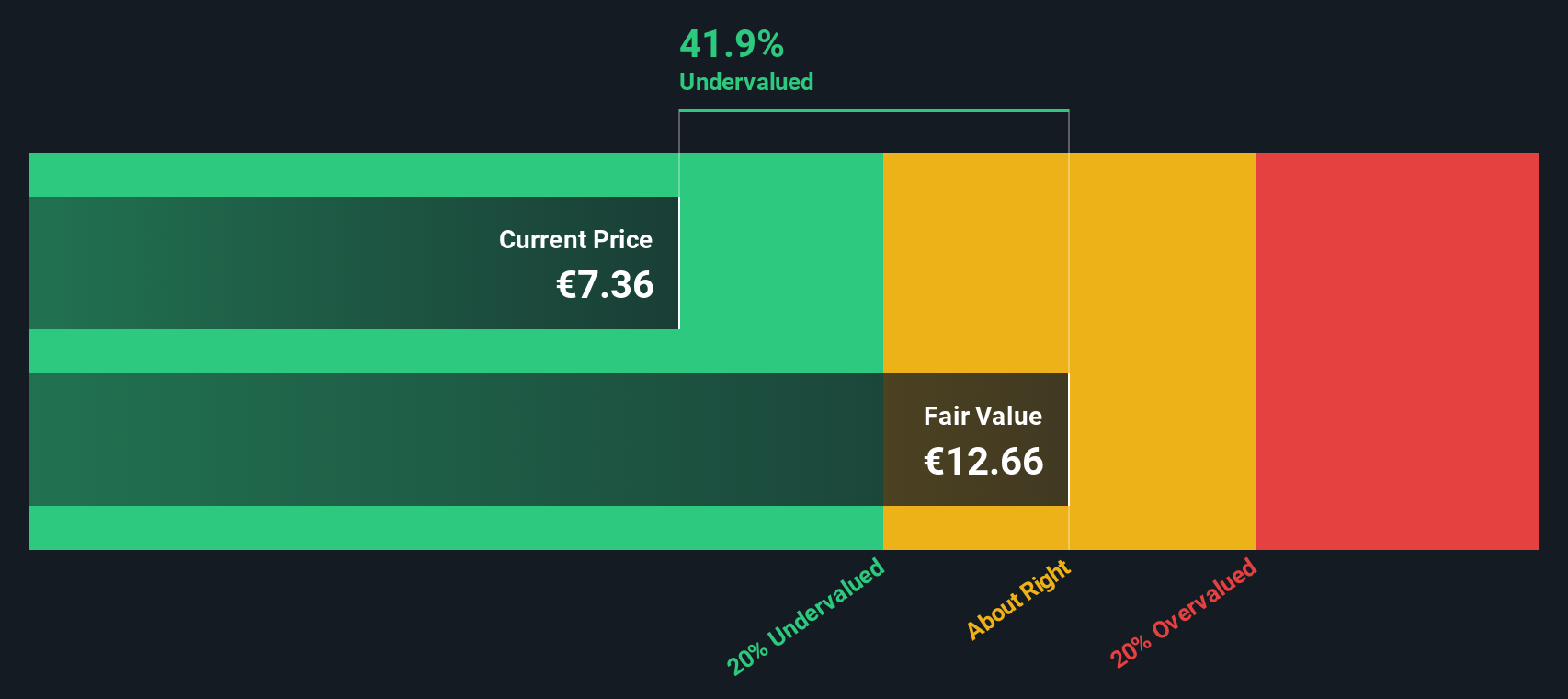

Tokmanni Group Oyj (HLSE:TOKMAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tokmanni Group Oyj is a Finnish retail company that operates a chain of discount stores, with a market capitalization of €1.12 billion.

Operations: Tokmanni Group Oyj generates revenue primarily through its Tokmanni and Dollarstore segments, with Tokmanni contributing €1.24 billion and Dollarstore adding €471.61 million. The company's cost of goods sold (COGS) has increased over time, reaching €1.11 billion by the end of 2025, impacting its gross profit margin which stood at 35.06% in the same period. Operating expenses have also risen to €517.24 million by late 2025, affecting profitability as reflected in a net income margin of 2.05%.

PE: 12.2x

Tokmanni Group, a smaller company in the market, has caught attention due to insider confidence shown by Seppo Saastamoinen's purchase of 80,000 shares worth €565,416. Despite recent earnings guidance revisions and a decision not to pay a second dividend installment for 2024, Tokmanni issued €100 million in senior unsecured notes at a fixed interest rate of 4.75% to support growth initiatives. Earnings are forecasted to grow annually by 22%, suggesting potential for future value despite current volatility and financial challenges.

- Click here and access our complete valuation analysis report to understand the dynamics of Tokmanni Group Oyj.

Gain insights into Tokmanni Group Oyj's past trends and performance with our Past report.

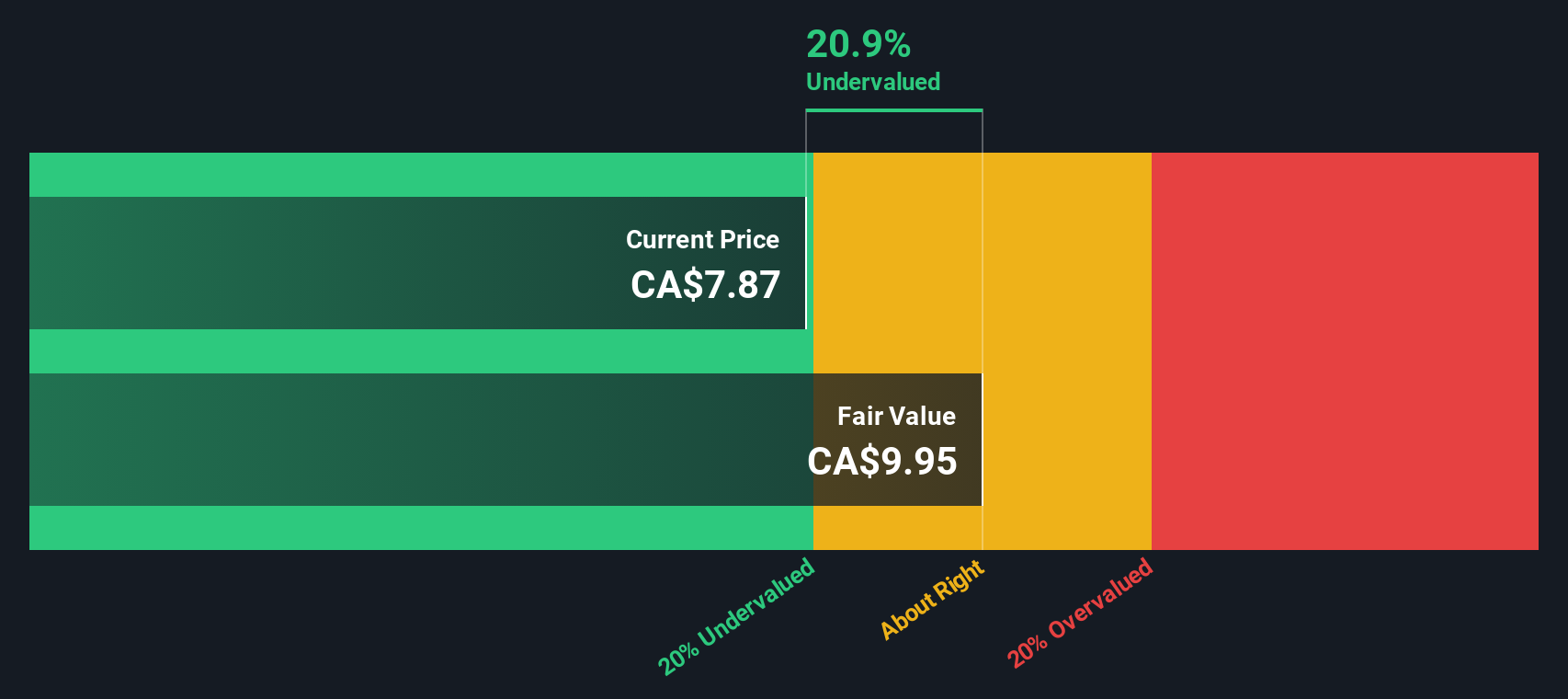

Nexus Industrial REIT (TSX:NXR.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nexus Industrial REIT is a Canadian real estate investment trust focused on owning and managing industrial properties, with a market capitalization of approximately CA$1.03 billion.

Operations: The primary revenue stream for Nexus Industrial REIT is derived from its investment properties, with the most recent reported revenue at CA$176.66 million. The gross profit margin has shown an increasing trend, reaching 73.88% in the latest period. Operating expenses and non-operating expenses are key components of its cost structure, impacting net income outcomes over different periods.

PE: 7.0x

Nexus Industrial REIT, a smaller player in the industrial real estate sector, has recently reported CAD 43.3 million in third-quarter sales with a net income of CAD 3.45 million, bouncing back from last year's loss. While earnings are expected to decline by 2.2% annually over the next three years, revenue is projected to grow at 6.22% per year. Insider confidence is evident as they have been purchasing shares since October 2025, indicating potential value recognition despite higher-risk funding sources and large one-off items affecting earnings quality.

- Unlock comprehensive insights into our analysis of Nexus Industrial REIT stock in this valuation report.

Evaluate Nexus Industrial REIT's historical performance by accessing our past performance report.

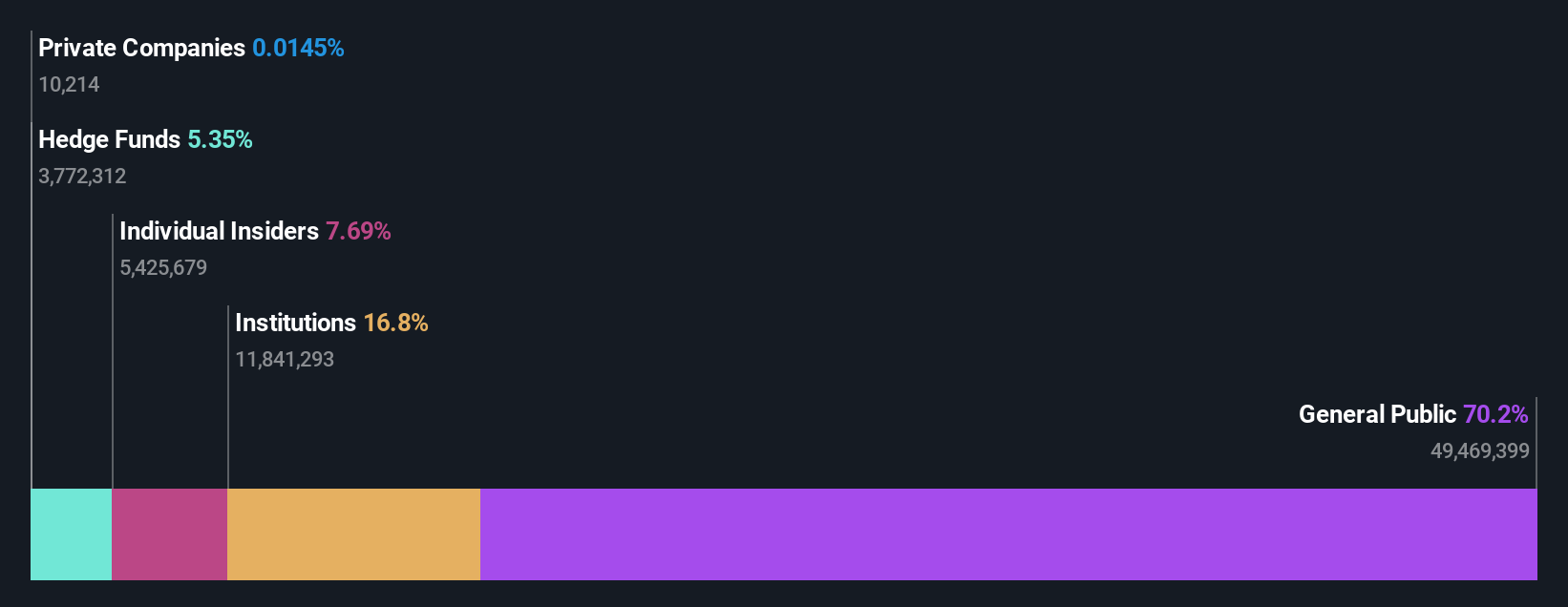

Obsidian Energy (TSX:OBE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Obsidian Energy is a Canadian oil and gas exploration and production company with a focus on developing its assets in the Western Canada Sedimentary Basin, holding a market cap of approximately CA$0.59 billion.

Operations: Obsidian Energy generates revenue primarily from its oil and gas exploration and production activities, with recent quarterly figures showing CA$614.7 million in revenue. The company's cost of goods sold (COGS) for the same period was CA$256.7 million, resulting in a gross profit of CA$358.0 million. Notably, the gross profit margin for this period was 58.24%.

PE: -2.3x

Obsidian Energy, a smaller player in the energy sector, recently closed a private placement of US$175 million in senior unsecured notes at 8.125%, utilizing proceeds to redeem higher-interest debt and reduce credit facility drawdowns. This strategic move reflects efforts to manage liabilities amid declining revenues, which dropped from CAD 197.8 million to CAD 136.8 million year-over-year for Q3 2025. Insider confidence is evident with recent share repurchases totaling CAD 60.95 million, signaling potential optimism for future growth despite current financial challenges.

- Get an in-depth perspective on Obsidian Energy's performance by reading our valuation report here.

Understand Obsidian Energy's track record by examining our Past report.

Make It Happen

- Explore the 143 names from our Undervalued Global Small Caps With Insider Buying screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal