Global Market's Trio Of Stocks Estimated Below Intrinsic Value

As global markets navigate a period of mixed performance, with U.S. indices hitting all-time highs amid interest rate cuts and European markets showing varied results, investors are increasingly focused on identifying opportunities that may be undervalued. In this context, understanding the intrinsic value of stocks becomes crucial, as it allows investors to potentially capitalize on discrepancies between market price and fundamental worth amidst evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.016 | €5.96 | 49.4% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.65 | €138.89 | 49.9% |

| KoMiCo (KOSDAQ:A183300) | ₩81900.00 | ₩166235.75 | 50.7% |

| KIYO LearningLtd (TSE:7353) | ¥694.00 | ¥1379.13 | 49.7% |

| Kitron (OB:KIT) | NOK67.70 | NOK135.14 | 49.9% |

| Global Security Experts (TSE:4417) | ¥2926.00 | ¥5786.02 | 49.4% |

| Cyber_Folks (WSE:CBF) | PLN205.00 | PLN408.69 | 49.8% |

| Cowell e Holdings (SEHK:1415) | HK$27.82 | HK$55.55 | 49.9% |

| CCC (WSE:CCC) | PLN126.15 | PLN250.26 | 49.6% |

| CaoCao (SEHK:2643) | HK$37.00 | HK$73.93 | 49.9% |

Let's review some notable picks from our screened stocks.

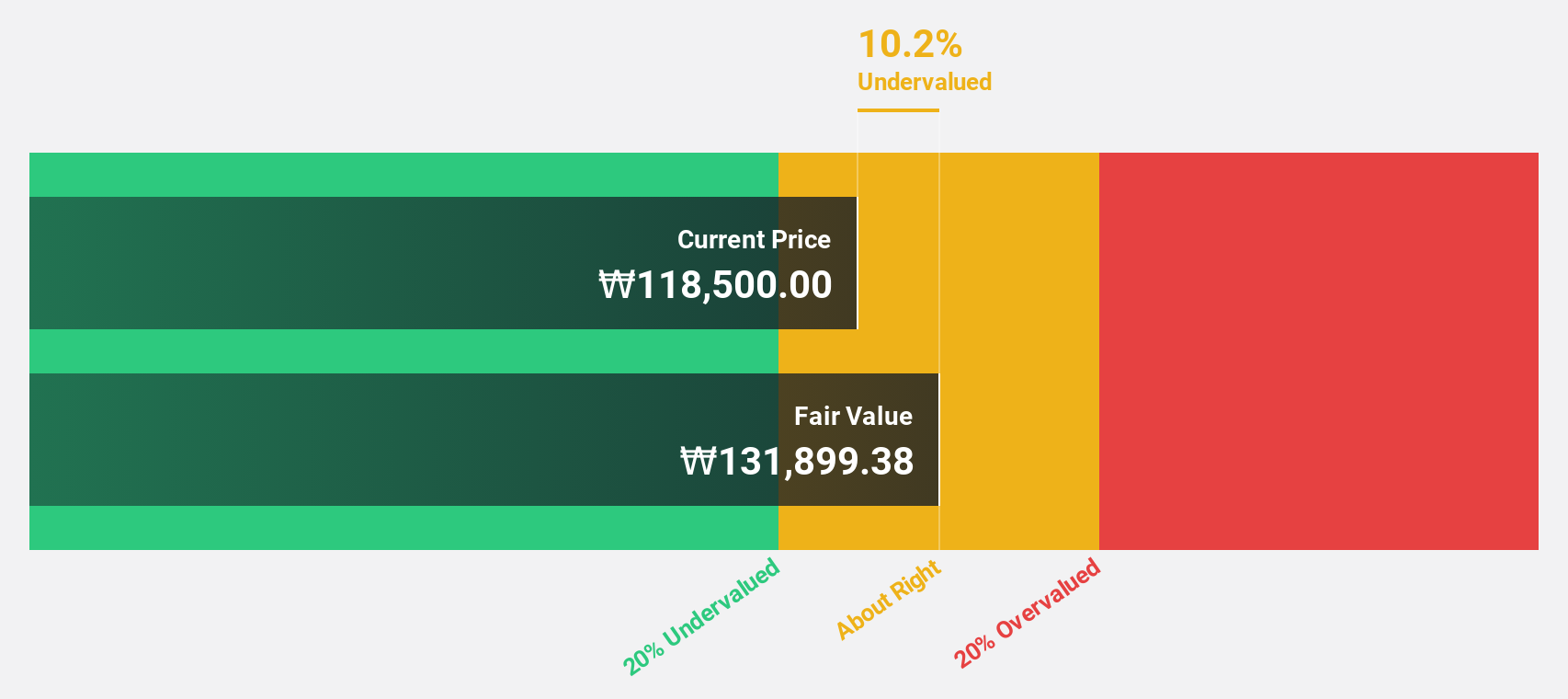

Seers Technology (KOSDAQ:A458870)

Overview: Seers Technology Co., LTD. offers telemedicine solutions with patient monitoring services in South Korea and has a market cap of approximately ₩1.46 trillion.

Operations: Seers Technology generates revenue through its telemedicine solutions and patient monitoring services in South Korea.

Estimated Discount To Fair Value: 10.9%

Seers Technology is trading at ₩117,500, below its estimated fair value of ₩131,871.64. The company's revenue is forecast to grow significantly faster than the market at 62.2% annually, with earnings expected to increase by 78.76% per year. While the stock's share price has been volatile recently, its return on equity is projected to be very high in three years at 57.7%. Seers was recently added to the S&P Global BMI Index.

- In light of our recent growth report, it seems possible that Seers Technology's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Seers Technology.

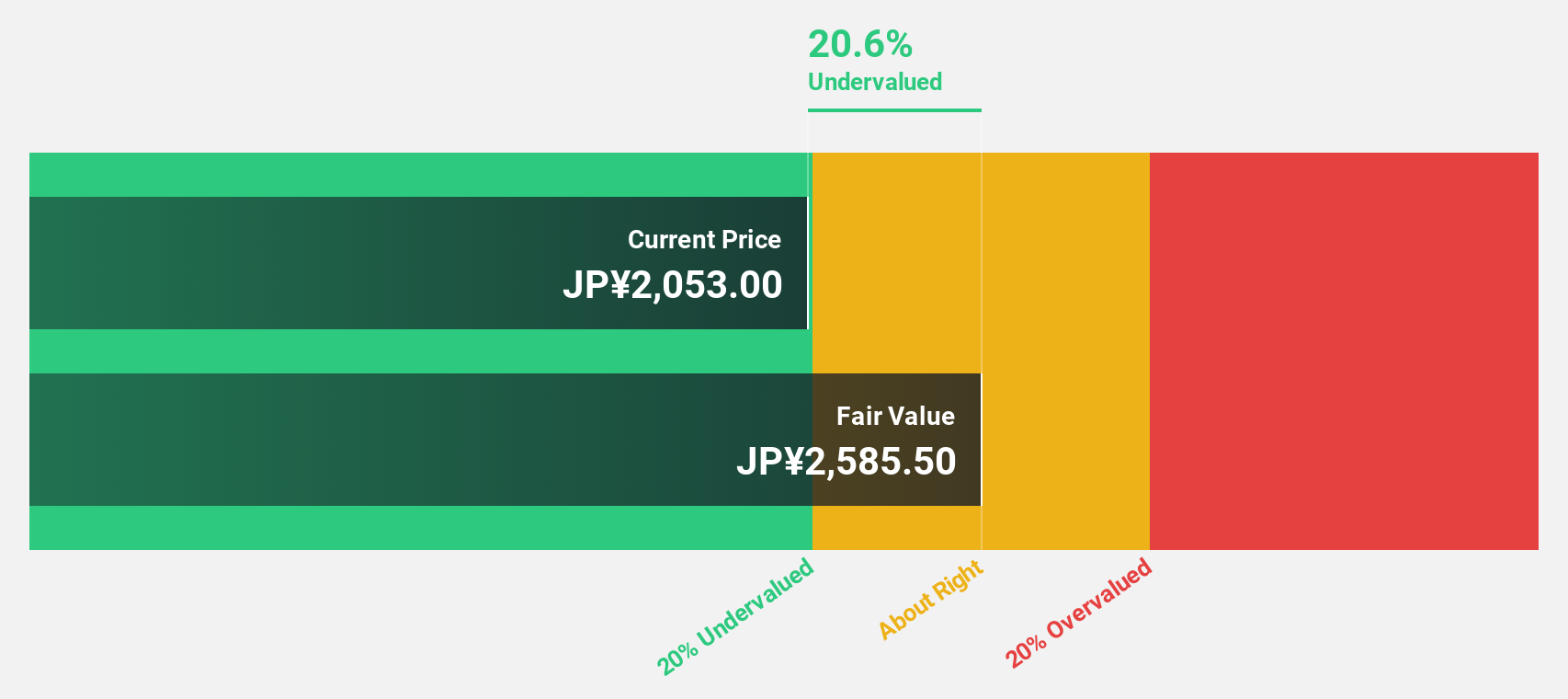

Mandom (TSE:4917)

Overview: Mandom Corporation is involved in the manufacturing and sales of cosmetics and perfumes across Japan, Indonesia, and other international markets, with a market cap of ¥113.70 billion.

Operations: The company's revenue is derived from the manufacturing and sales of cosmetics and perfumes in Japan, Indonesia, and other international markets.

Estimated Discount To Fair Value: 1.2%

Mandom is trading at ¥2,519, slightly below its fair value estimate of ¥2,829.16. Earnings are projected to grow significantly at 35.42% annually, outpacing the JP market's growth rate of 8.4%. Revenue is expected to increase by 6.1% per year, above the market average but not rapidly enough to be considered high growth. Despite these positives, return on equity remains low at a forecasted 6.4%. Recent board meetings focused on tender offers and corporate governance strategies.

- Our comprehensive growth report raises the possibility that Mandom is poised for substantial financial growth.

- Click here to discover the nuances of Mandom with our detailed financial health report.

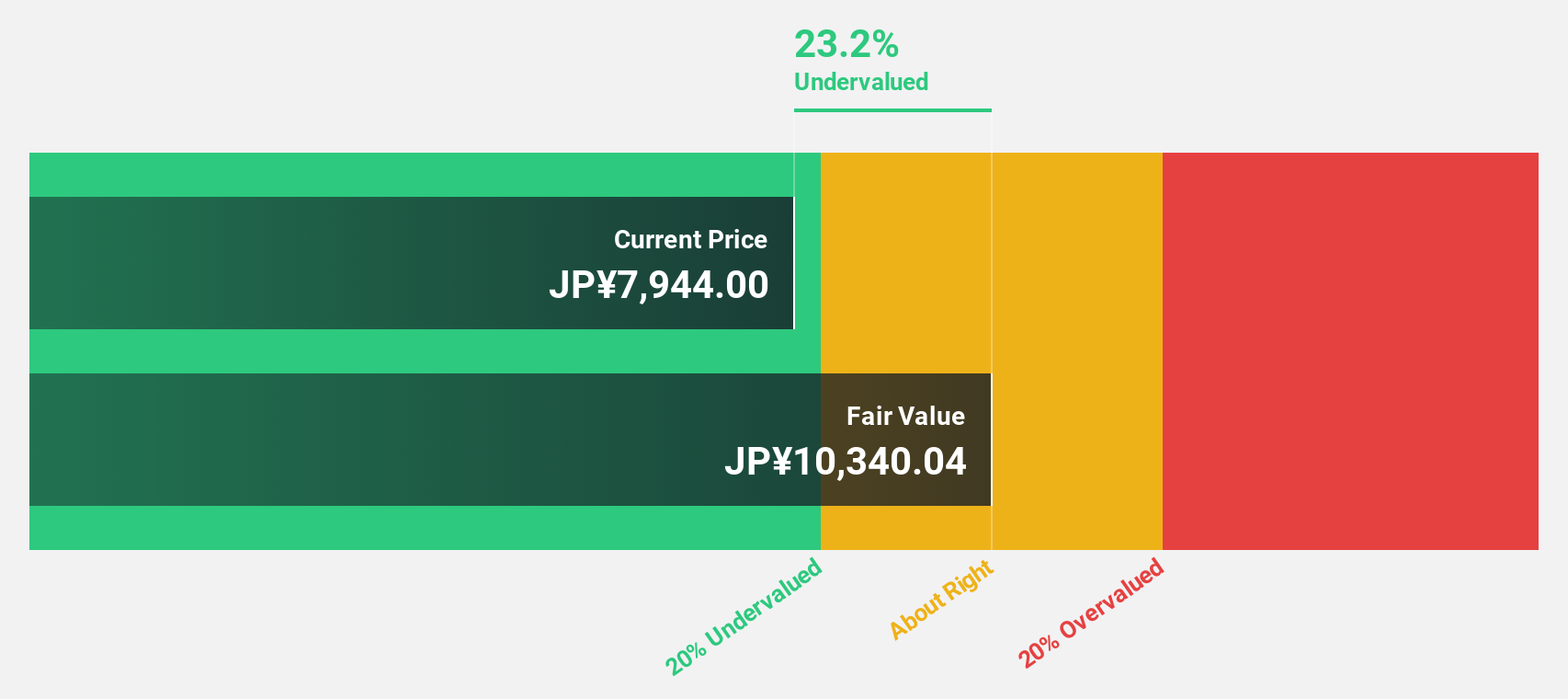

Baycurrent (TSE:6532)

Overview: Baycurrent, Inc. is a Japanese company offering consulting services with a market capitalization of ¥1.01 trillion.

Operations: The company's revenue is derived entirely from its Consulting Business, amounting to ¥130.42 billion.

Estimated Discount To Fair Value: 36.7%

Baycurrent is trading at ¥6,644, significantly below its estimated fair value of ¥10,430.95. Analysts forecast earnings growth of 20.4% annually over the next three years, surpassing the JP market's 8.4%. Revenue growth is expected to be robust but slower than 20% per year. Despite recent share price volatility and leadership changes with Yoshiyuki Abe returning as President, Baycurrent remains a compelling option for those seeking undervalued stocks based on cash flows.

- Our earnings growth report unveils the potential for significant increases in Baycurrent's future results.

- Dive into the specifics of Baycurrent here with our thorough financial health report.

Summing It All Up

- Embark on your investment journey to our 501 Undervalued Global Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal