What Rayonier (RYN)'s Special Dividend and New Shelf Registration Mean For Shareholders

- In October 2025, Rayonier Inc. declared a special dividend of US$1.40 per common share, which was paid on December 12, 2025, and subsequently filed an omnibus shelf registration covering multiple securities, including debt, common and preferred shares, warrants, subscription rights, stock purchase contracts, and units.

- This combination of an immediate cash return to shareholders and expanded flexibility to raise capital in the future reflects Rayonier’s twin focus on rewarding investors while preserving options to fund its long-term timberland and real asset growth plans.

- Next, we’ll examine how the special dividend, in particular, may reshape Rayonier’s investment narrative and capital allocation profile.

Find companies with promising cash flow potential yet trading below their fair value.

Rayonier Investment Narrative Recap

To own Rayonier, you need to believe in the long-term value of productive timberland and the company’s ability to turn that into resilient cash flows, even as timber and real estate markets cycle. The US$1.40 special dividend and new shelf registration do not materially change the near term story, where a key catalyst is execution on higher margin land-based solutions and real estate projects, and a major risk remains exposure to climate and weather volatility across its Southern timber portfolio.

Among recent announcements, the US$1.40 per share special dividend stands out because it temporarily boosts cash returns at a time when Rayonier’s share price has lagged and earnings are expected to decline over the next few years. For investors focused on the catalysts around solar, carbon and higher value real estate, the special dividend may be less important than how effectively Rayonier reinvests the rest of its capital into projects like Wildlight, Heartwood and emerging carbon opportunities.

Yet against this backdrop, Rayonier’s heightened vulnerability to more frequent and severe storms is something investors should be aware of...

Read the full narrative on Rayonier (it's free!)

Rayonier's narrative projects $514.9 million revenue and $105.0 million earnings by 2028. This implies a 25.4% yearly revenue decline and an earnings decrease of $263.6 million from $368.6 million today.

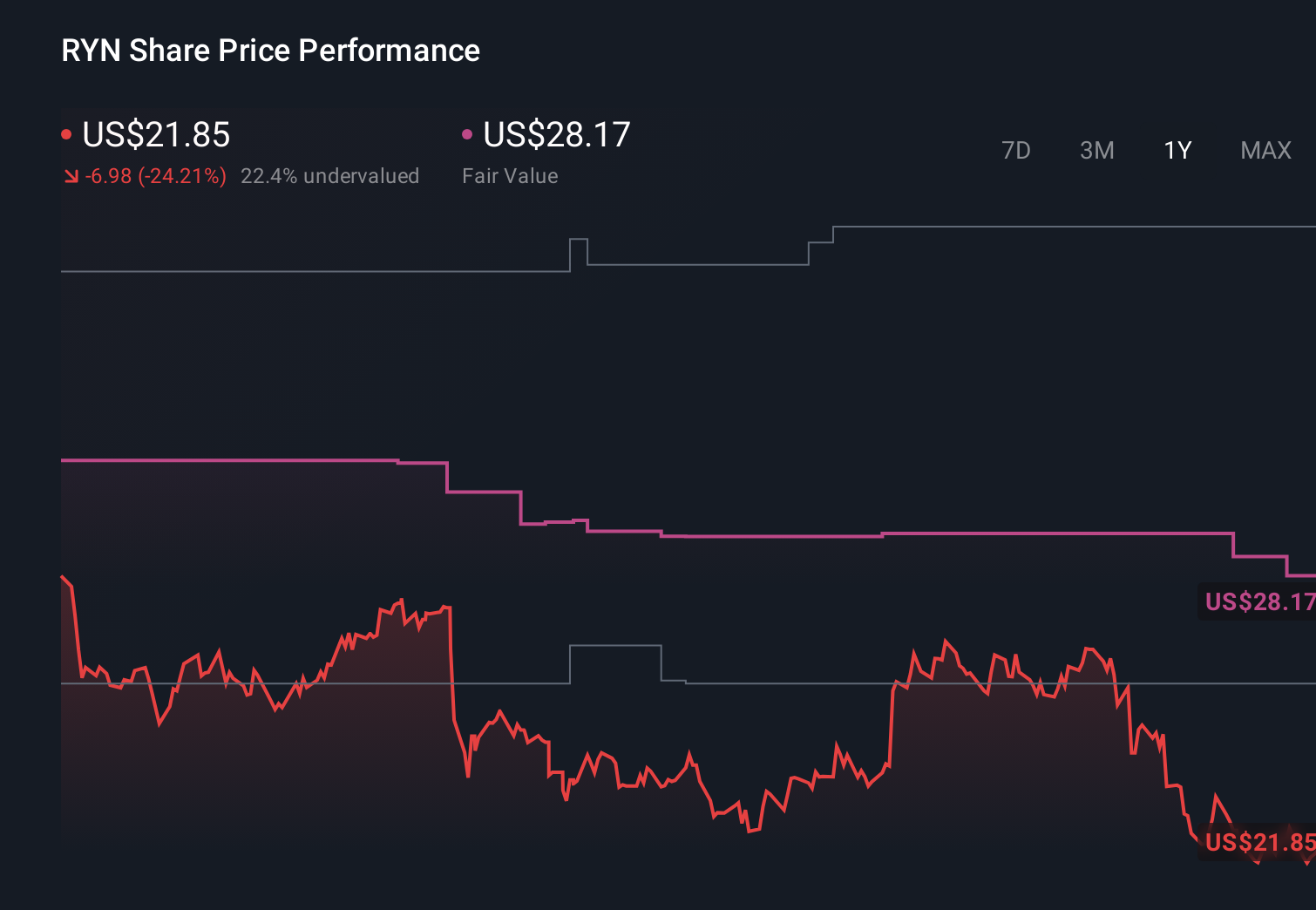

Uncover how Rayonier's forecasts yield a $28.17 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$3 to US$46 per share, underscoring how far apart individual views can be. Set against this, the recurring concern about climate driven weather risks to Rayonier’s Southern timberlands gives you a concrete issue to weigh as you compare these different perspectives.

Explore 6 other fair value estimates on Rayonier - why the stock might be worth over 2x more than the current price!

Build Your Own Rayonier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rayonier research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Rayonier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rayonier's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal