Is Alnylam (ALNY) Using Nasdaq 100 Inclusion To Quietly Redefine Its Capital Allocation Playbook?

- Alnylam Pharmaceuticals recently reshaped its governance and capital structure, with two long-serving directors stepping down, a new independent director appointed, and a partial repurchase of US$34.4 million of its 1.00% convertible senior notes due 2027 at a total cost of US$51.9 million.

- The company’s upcoming inclusion in the Nasdaq 100 Index on December 22, alongside evolving board expertise and debt reduction, could broaden its investor base and refine its long-term growth profile in RNA interference therapeutics.

- We’ll now examine how Alnylam’s addition to the Nasdaq 100 could influence its investment narrative and future growth expectations.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alnylam Pharmaceuticals Investment Narrative Recap

To own Alnylam today, you need to believe RNA interference can keep scaling commercially, with AMVUTTRA and follow‑on programs offsetting pricing pressure and heavy R&D. The upcoming Nasdaq 100 inclusion and modest debt reduction do not materially change the key near term catalyst in TTR amyloidosis or the main risk from intense competition and potential payer pushback on AMVUTTRA’s net pricing.

The most relevant recent move here is Alnylam’s pending addition to the Nasdaq 100 Index, which could increase visibility with large index funds and broaden the shareholder base. That higher profile sits alongside ongoing concerns about AMVUTTRA gross to net pressure and TTR concentration, which remain central to how the market frames both upside and downside around upcoming data and commercial execution.

Yet behind the index inclusion, investors should be aware that AMVUTTRA’s revenue concentration and pricing pressures could...

Read the full narrative on Alnylam Pharmaceuticals (it's free!)

Alnylam Pharmaceuticals' narrative projects $7.0 billion revenue and $1.9 billion earnings by 2028.

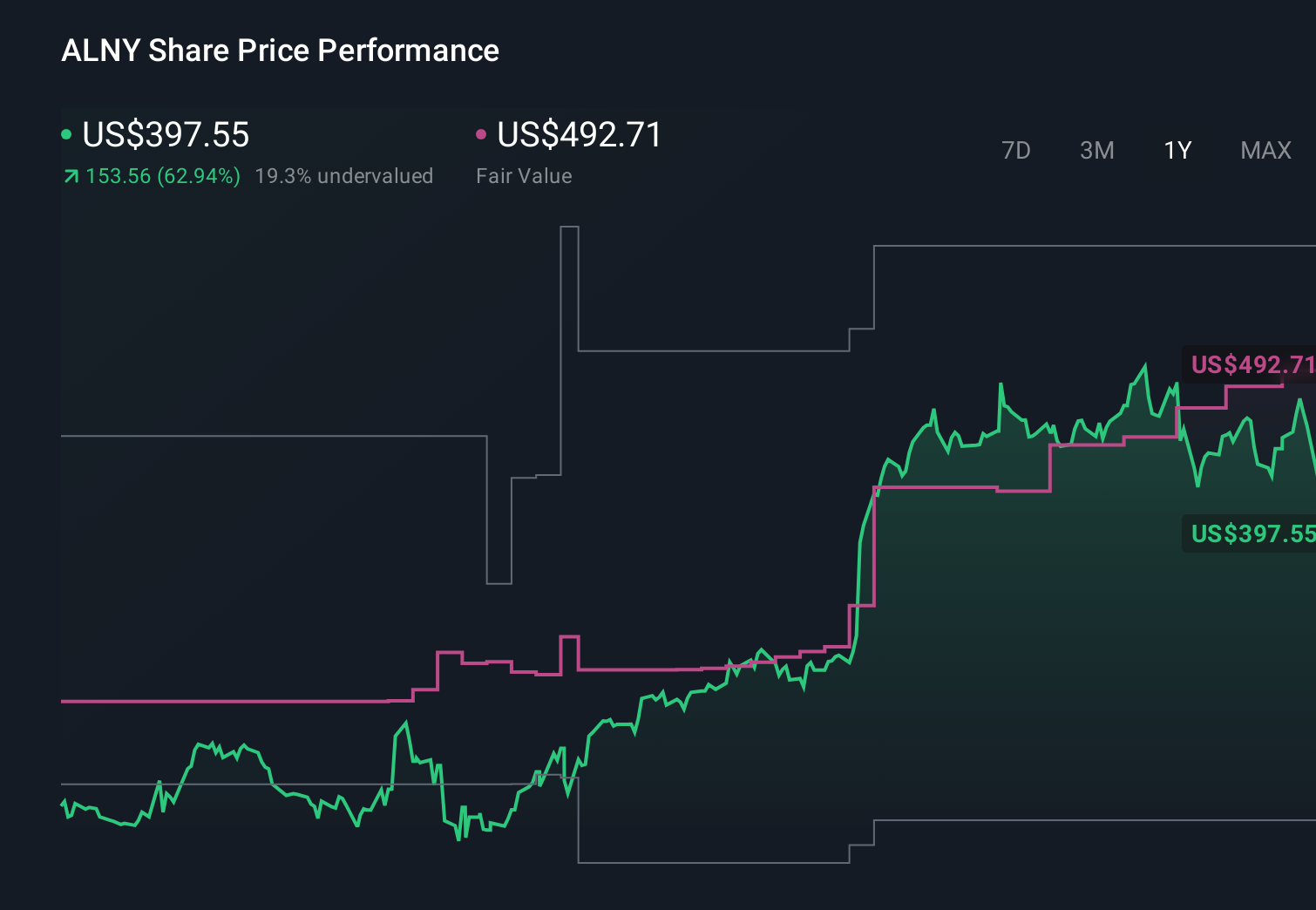

Uncover how Alnylam Pharmaceuticals' forecasts yield a $492.71 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Alnylam between US$259.89 and US$595.39 per share, underscoring how far opinions can spread. You can weigh those against the risk that AMVUTTRA’s heavy revenue concentration and possible net price pressure could constrain the very growth many of these forecasts rely on, and explore several alternative viewpoints before deciding where you stand.

Explore 5 other fair value estimates on Alnylam Pharmaceuticals - why the stock might be worth as much as 52% more than the current price!

Build Your Own Alnylam Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alnylam Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alnylam Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal