Ferrovial’s Forthcoming Inclusion in the Nasdaq-100 Might Change The Case For Investing In Ferrovial (BME:FER)

- Ferrovial has announced that it will join the Nasdaq-100 Index on December 22, 2025, following its U.S. listing in May 2024 and years of North American infrastructure activity, including the New Terminal One project at JFK Airport.

- This index inclusion significantly raises Ferrovial’s profile with U.S. and global investors and could broaden its shareholder base as it pursues further North American expansion.

- With Ferrovial set to enter the Nasdaq-100, we’ll assess how this added index visibility reshapes the company’s North American growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Ferrovial Investment Narrative Recap

To own Ferrovial, you need to believe in its ability to grow and recycle capital through North American infrastructure concessions, particularly toll roads and airports. Joining the Nasdaq-100 should support that story by raising its visibility, but it does not change the key near term swing factors: execution on major projects and the risk that earnings, which consensus expects to decline over the next few years, remain pressured or prove more volatile than recent results suggest.

The most relevant recent announcement alongside the Nasdaq-100 inclusion is Ferrovial’s new share repurchase program of up to €800 million, or about 2.04% of its share capital, running to October 2026. This sits alongside an active dividend stream and may matter for investors focused on how Ferrovial balances buybacks, project investment and its already meaningful debt load as it leans further into North American growth.

Yet while index inclusion supports visibility, investors also need to be aware of the earnings decline forecasts and Ferrovial’s debt coverage...

Read the full narrative on Ferrovial (it's free!)

Ferrovial's narrative projects €10.5 billion revenue and €843.2 million earnings by 2028. This implies 3.9% yearly revenue growth and an earnings decrease of about €2.5 billion from €3.3 billion today.

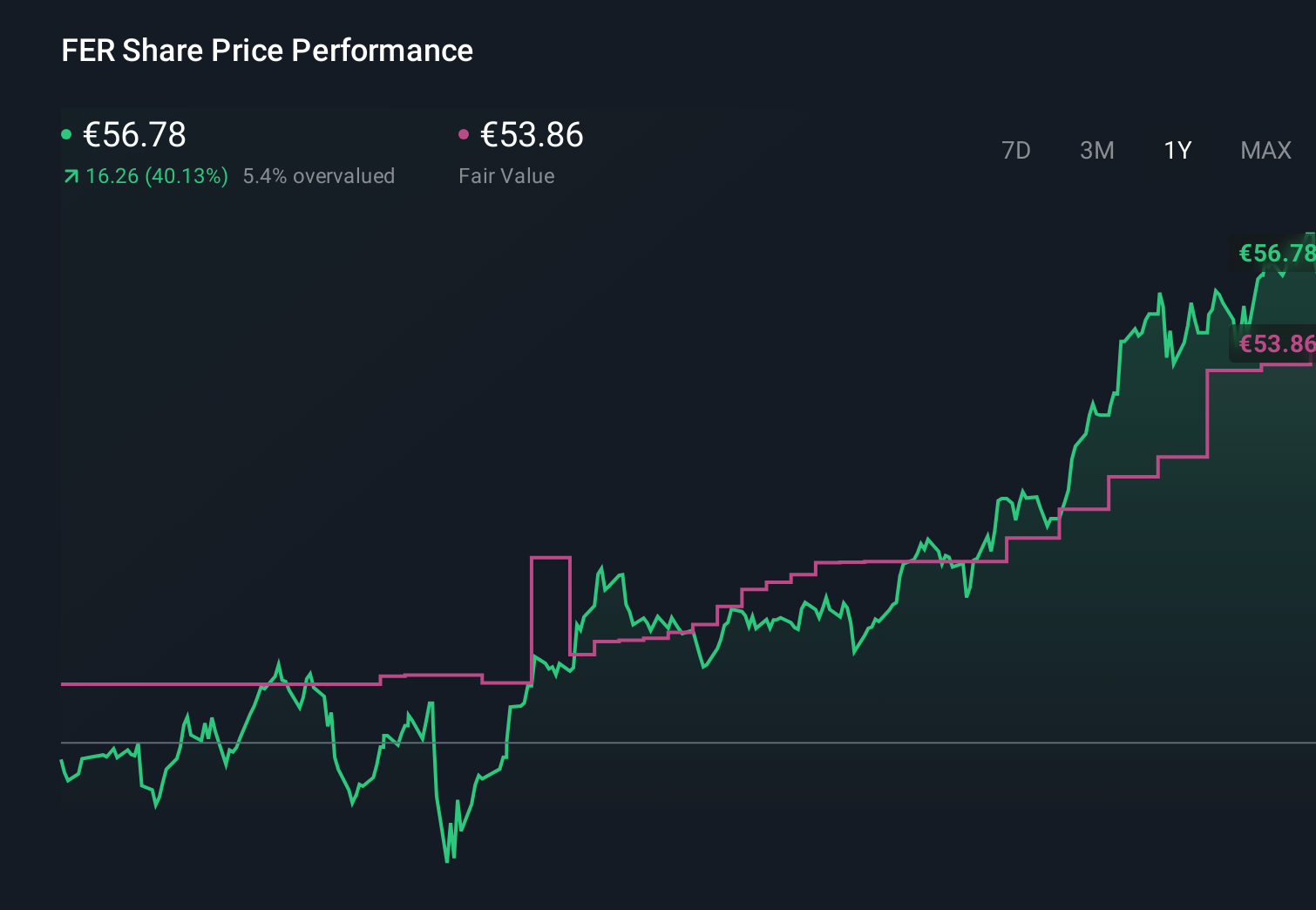

Uncover how Ferrovial's forecasts yield a €53.86 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates cluster between €45.18 and €53.86, under the current share price, showing how differently individual investors can view Ferrovial. Set against expectations for declining earnings over the next three years, this spread of views underlines why you may want to compare several independent assessments before forming your own stance.

Explore 3 other fair value estimates on Ferrovial - why the stock might be worth 22% less than the current price!

Build Your Own Ferrovial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ferrovial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ferrovial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ferrovial's overall financial health at a glance.

No Opportunity In Ferrovial?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal