3 Asian Stocks Estimated To Be Up To 44.9% Below Intrinsic Value

As global markets react to central bank policy shifts and economic indicators, Asian stock markets have experienced a mix of performance trends, with some indices retreating due to profit-taking after recent gains. In this environment, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.70 | CN¥25.23 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$434.00 | NT$867.46 | 50% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2332.00 | ¥4579.99 | 49.1% |

| NEXON Games (KOSDAQ:A225570) | ₩12310.00 | ₩24452.29 | 49.7% |

| Mobvista (SEHK:1860) | HK$15.65 | HK$30.74 | 49.1% |

| KoMiCo (KOSDAQ:A183300) | ₩84100.00 | ₩166235.75 | 49.4% |

| JINS HOLDINGS (TSE:3046) | ¥5500.00 | ¥10946.86 | 49.8% |

| Cowell e Holdings (SEHK:1415) | HK$27.82 | HK$55.55 | 49.9% |

| CaoCao (SEHK:2643) | HK$37.00 | HK$73.93 | 49.9% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥260.52 | CN¥515.42 | 49.5% |

Let's take a closer look at a couple of our picks from the screened companies.

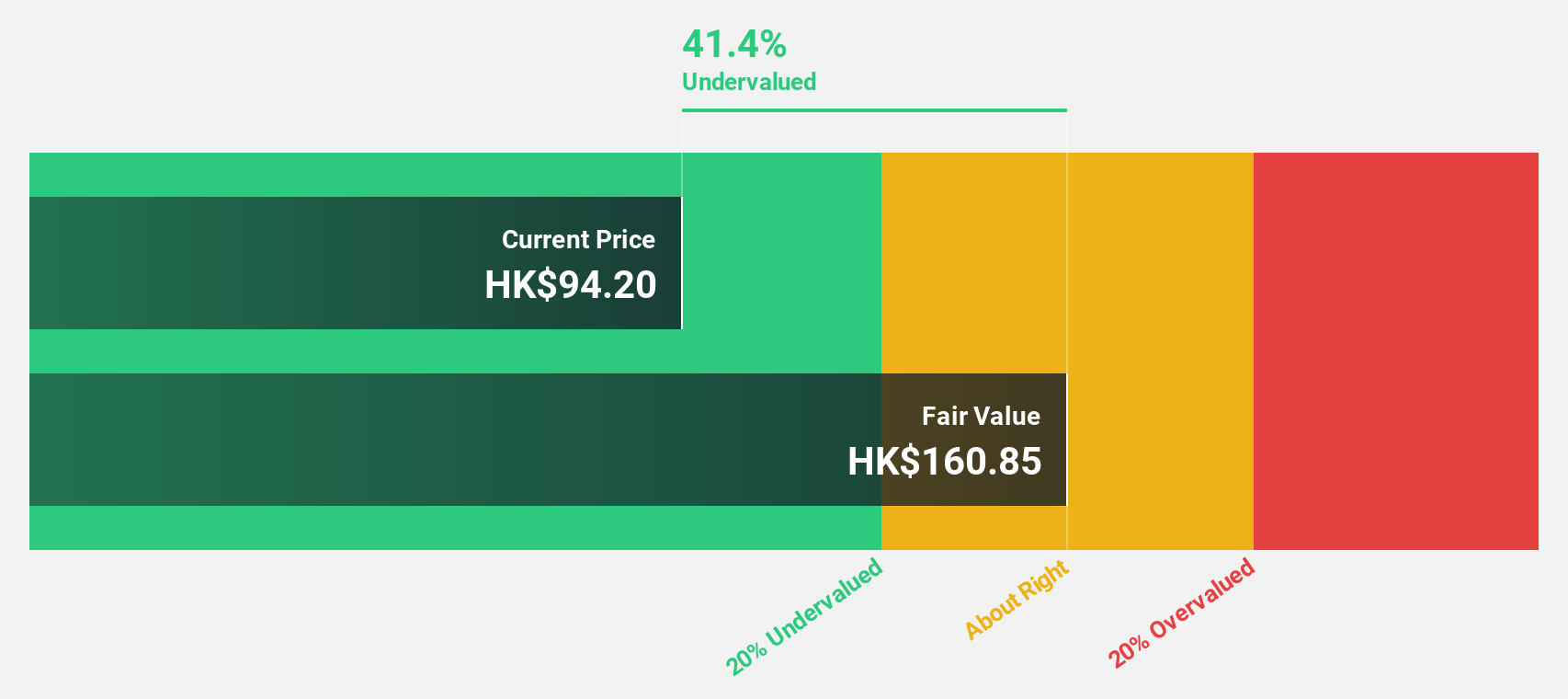

Auntea Jenny (Shanghai) Industrial (SEHK:2589)

Overview: Auntea Jenny (Shanghai) Industrial Co., Ltd. operates in the food and beverage industry with a market capitalization of approximately HK$10.10 billion.

Operations: The company's revenue is primarily generated from its restaurants segment, amounting to CN¥3.45 billion.

Estimated Discount To Fair Value: 40.3%

Auntea Jenny (Shanghai) Industrial is trading at HK$96, significantly below its estimated fair value of HK$160.84, suggesting potential undervaluation based on discounted cash flows. Earnings are forecast to grow at 21.7% annually, outpacing the Hong Kong market's 12.2%. Despite recent share price volatility, the company affirmed a dividend of RMB 6.76 per 10 shares and approved significant governance changes by abolishing the Board of Supervisors in favor of an audit committee-led oversight structure.

- Upon reviewing our latest growth report, Auntea Jenny (Shanghai) Industrial's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Auntea Jenny (Shanghai) Industrial with our comprehensive financial health report here.

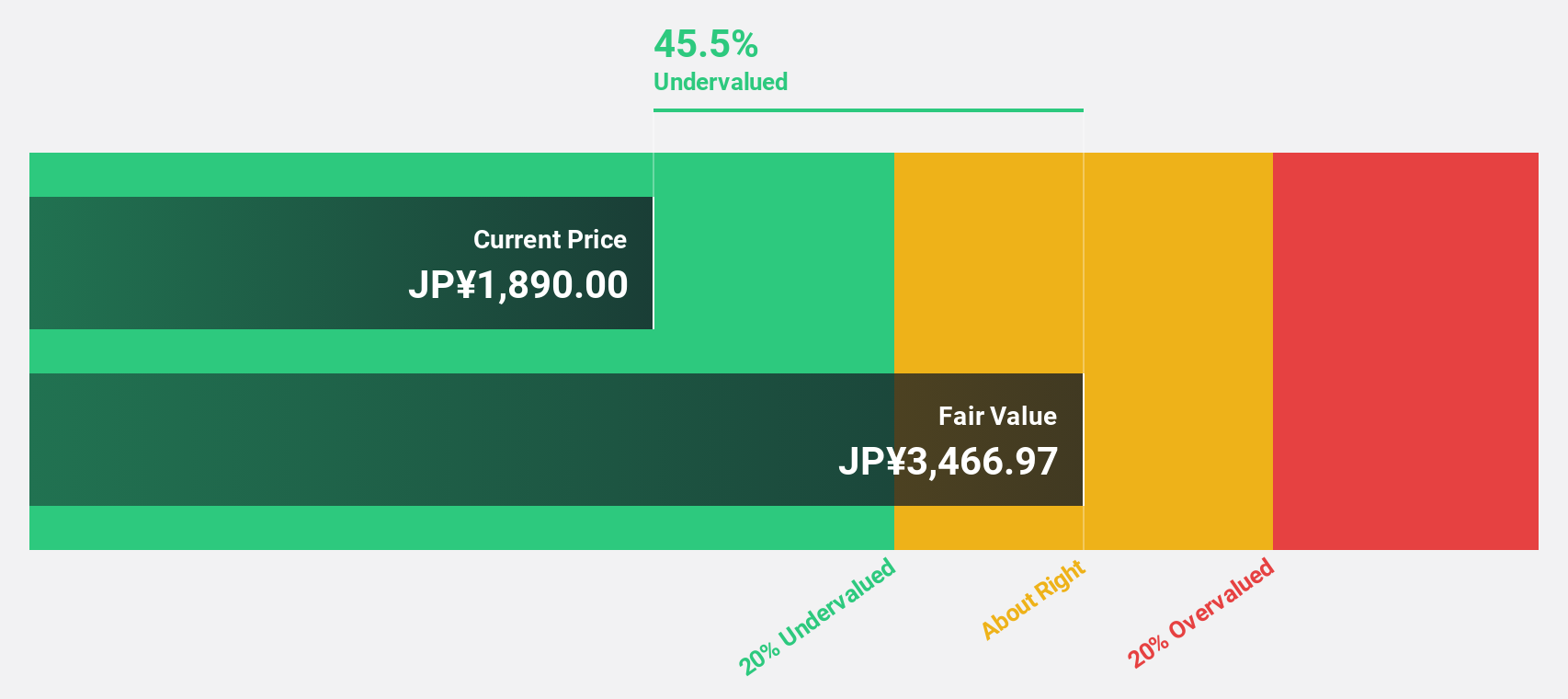

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. is a company that produces and sells sweets both in Japan and internationally, with a market cap of ¥282.92 billion.

Operations: The company's revenue is primarily derived from its Shukrei segment at ¥33.51 billion, followed by the KCC segment at ¥22.40 billion, the Kotobukiseika Group at ¥15.41 billion, and Sales Subsidiaries contributing ¥7.40 billion.

Estimated Discount To Fair Value: 44.9%

Kotobuki Spirits is trading at ¥1832, well below its estimated fair value of ¥3325.19, highlighting its undervaluation based on discounted cash flows. Earnings are projected to grow 10.3% annually, surpassing the JP market's 8.4%. Despite a less stable dividend history, revenue growth is expected to outpace the market at 7.7% per year versus 4.6%. Analysts agree on a potential stock price increase of 29.2%, with high future return on equity forecasts enhancing appeal.

- The growth report we've compiled suggests that Kotobuki Spirits' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Kotobuki Spirits' balance sheet health report.

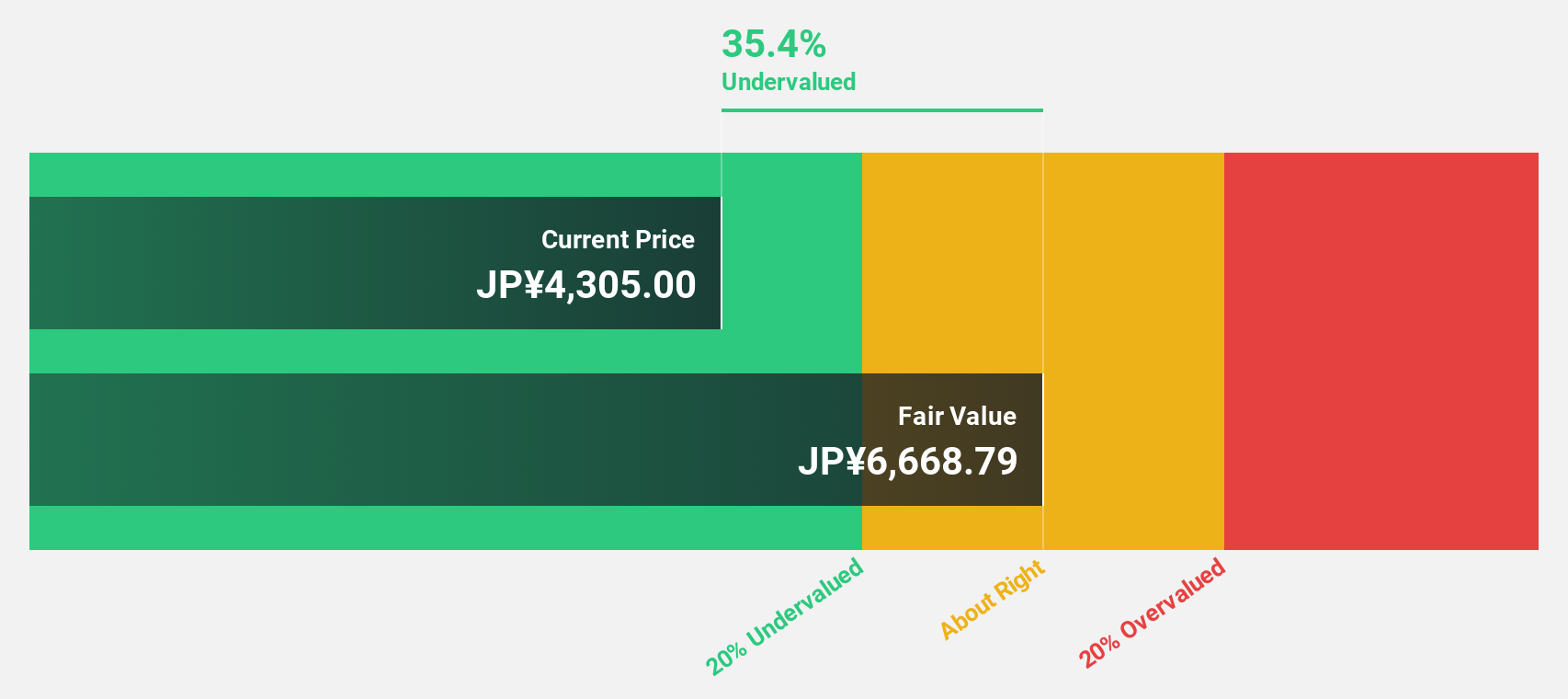

BuySell TechnologiesLtd (TSE:7685)

Overview: BuySell Technologies Co., Ltd. operates in Japan's kimono and branded goods reuse sector, with a market capitalization of ¥134.46 billion.

Operations: The company generates revenue of ¥89.42 billion from its reuse business for kimonos and branded products in Japan.

Estimated Discount To Fair Value: 34.7%

BuySell Technologies Ltd. is trading significantly below its estimated fair value of ¥6681.79, presenting an undervaluation opportunity based on discounted cash flows. Despite a recent dividend reduction to ¥25 per share, the company has revised its earnings guidance upwards for 2025, driven by strong performance in both home visit and in-store purchase businesses. Analysts forecast robust annual earnings growth of 24.7%, exceeding market expectations, with a high return on equity anticipated over the next three years.

- Our growth report here indicates BuySell TechnologiesLtd may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of BuySell TechnologiesLtd.

Taking Advantage

- Delve into our full catalog of 276 Undervalued Asian Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal