McDonald's (MCD) Valuation Check as New 2026 Franchising Standards and $5 Deals Draw Investor Focus

McDonald's (MCD) just put a clearer stake in the ground for 2026 by tightening global franchising standards around pricing and value, while also leaning into subsidized 5 dollar meals to protect traffic in an inflation squeezed consumer landscape.

See our latest analysis for McDonald's.

Those tougher value standards and subsidized 5 dollar deals are landing against a backdrop of steady gains, with McDonald's 90 day share price return of 5.09 percent and a five year total shareholder return of 68.79 percent suggesting momentum is quietly building rather than fading.

If this kind of defensive growth story appeals to you, it could be a good moment to explore other resilient consumer names through fast growing stocks with high insider ownership and see what else is setting up for the next leg higher.

With the stock hovering just below consensus targets despite solid mid single digit revenue and high single digit earnings growth, investors now face a key question: is McDonald's still quietly undervalued, or is the market already baking in its 2026 breakout narrative?

Most Popular Narrative Narrative: 3.8% Undervalued

With McDonald's last closing at 318.73 dollars against a narrative fair value of 331.20 dollars, the current price implies only a modest upside, resting on specific growth and margin assumptions that investors need to unpack.

The company's ongoing refranchising and asset light model, paired with disciplined global cost management and G&A efficiencies enabled by new centralized platforms, reinforces stable free cash flow and structurally higher operating margins, increasing the company's ability to return capital to shareholders and boosting long term earnings growth.

Curious how steady mid single digit sales growth, rising profit margins, and a richer future earnings multiple can still justify upside from here? The most followed narrative lays out a detailed roadmap that leans on accelerating cash generation, shrinking share count, and a richer valuation than the broader hospitality space. Want to see exactly which long term profit and revenue projections need to come true for that fair value to hold?

Result: Fair Value of $331.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure on lower income diners, along with sustained cost inflation in beef and labor, could still derail the expected margin and earnings trajectory.

Find out about the key risks to this McDonald's narrative.

Another View, Ratio Signals Suggest Caution

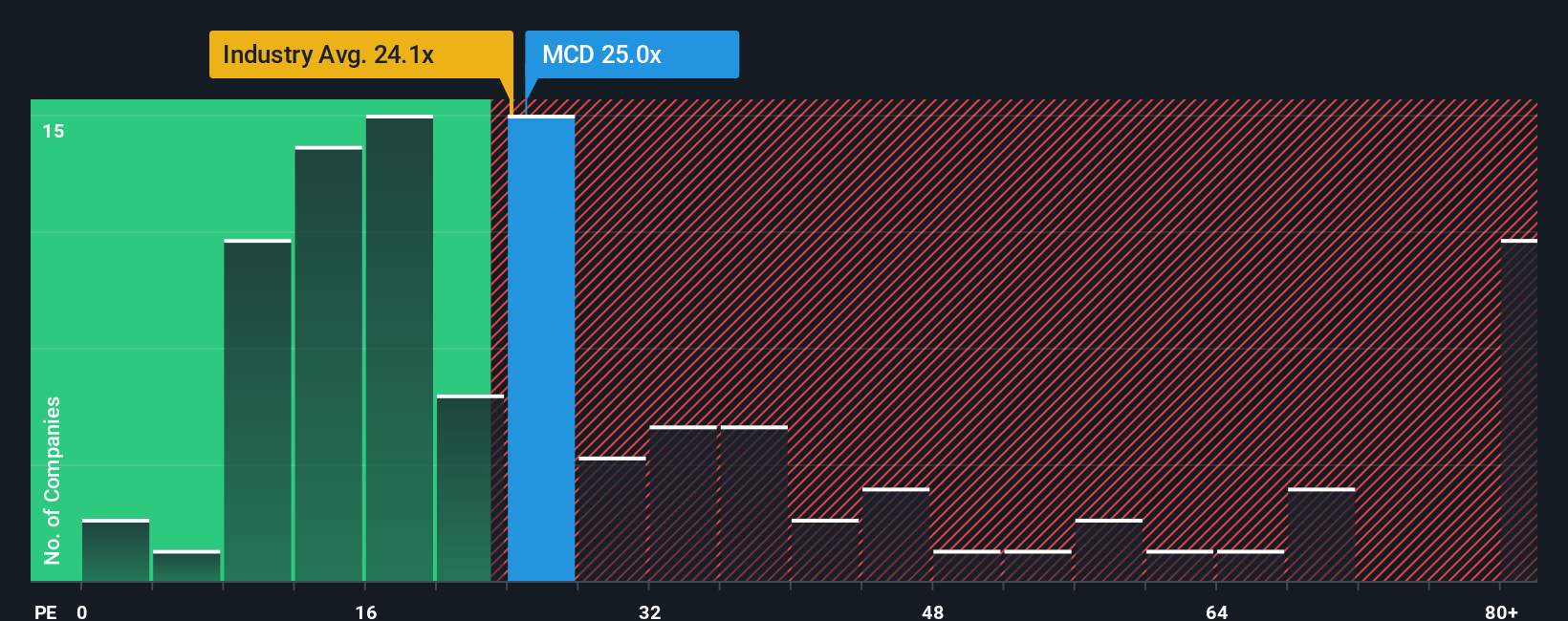

While the narrative fair value frames McDonald's as modestly undervalued, the earnings multiple tells a more cautious story. The stock trades at about 27 times earnings, richer than the US Hospitality sector at 23.7 times, but still below a fair ratio of 30.7 times implied by fundamentals and peers.

That gap cuts both ways, hinting at room for upside if sentiment improves, but also signaling limited margin of safety if growth underwhelms, especially with revenue and earnings expected to trail the broader US market. Which signal do you trust more for the next three years?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out McDonald's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own McDonald's Narrative

If this framework does not quite match your view, or you would rather dig into the numbers yourself, you can quickly build a custom narrative in just a few minutes: Do it your way.

A great starting point for your McDonald's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at McDonald's. Your next smart move could be hiding in plain sight, waiting in the Simply Wall Street Screener for you to act.

- Capitalize on mispriced opportunities by using these 908 undervalued stocks based on cash flows that align solid fundamentals with attractive entry points before the crowd catches on.

- Ride structural shifts in technology by targeting these 26 AI penny stocks positioned to benefit from accelerating adoption of automation and intelligent software.

- Secure income potential by focusing on these 13 dividend stocks with yields > 3% that combine meaningful yields with the resilience to sustain payouts through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal