Shake Shack (SHAK): Evaluating the Stock’s Valuation After Management’s Upbeat 2026 Growth and Expansion Outlook

Shake Shack (SHAK) has grabbed fresh attention after CEO Rob Lynch laid out upbeat 2026 goals, pairing a plan to dramatically expand its U.S. footprint with ongoing gains in customer traffic and margins.

See our latest analysis for Shake Shack.

That upbeat roadmap is landing after a volatile stretch. The latest $83.65 share price sits well below its year to date share price return of negative 37.23 percent, yet it stands alongside a three year total shareholder return of 80.12 percent. This combination suggests sentiment may be turning as investors refocus on growth and margin gains.

If Shake Shack's expansion story has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With the share price still lagging analysts’ targets despite double digit revenue and profit growth, the key question now is whether Shake Shack is quietly undervalued or if the market is already pricing in its next growth phase.

Most Popular Narrative: 26.9% Undervalued

With Shake Shack last closing at $83.65 against a narrative fair value of about $114, the current setup frames a sizable upside gap investors are dissecting.

The analysts have a consensus price target of $135.476 for Shake Shack based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $162.0, and the most bearish reporting a price target of just $110.0.

Want to see what kind of revenue climb, margin lift, and future earnings power justify that gap? The projections point to a profit profile more often linked to market darlings than burger chains. Curious which assumptions really move the valuation needle and whether that long term multiple actually holds up? Dive in to unpack the full playbook behind this fair value call.

Result: Fair Value of $114.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer traffic trends and rising beef costs could easily pressure margins and derail the upbeat earnings and valuation narrative that investors are leaning on.

Find out about the key risks to this Shake Shack narrative.

Another Angle on Valuation

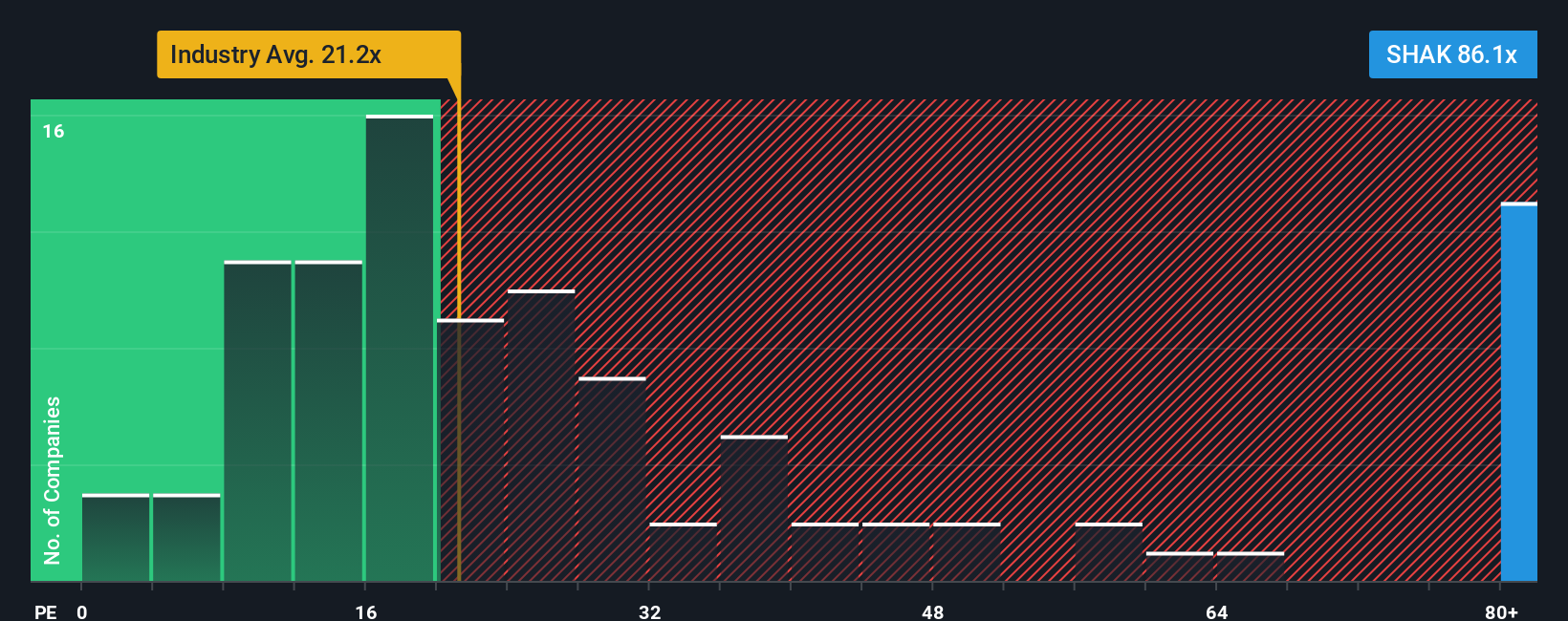

Analysts see around 27 percent upside to fair value, but the earnings multiple paints a tougher picture. At roughly 79 times earnings versus 28 times for peers and a fair ratio of 26.2 times, the stock screens richly valued, leaving little room for stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shake Shack Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Shake Shack.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning a few targeted stock lists on Simply Wall St’s Screener so you are not leaving opportunities on the table.

- Capture potential bargain entries by running through these 908 undervalued stocks based on cash flows that may be mispriced relative to their future cash flows.

- Capitalize on powerful technological shifts by reviewing these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Lock in attractive income streams by checking these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s long term yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal