eXp World Holdings (EXPI): Valuation Check After eXp Realty’s New Tech and Brokerage Leadership Moves

eXp World Holdings (EXPI) is back in focus after its core brokerage, eXp Realty, reshuffled its leadership bench. The company elevated tech and brokerage insiders while its prior chief technology officer exits for a new role.

See our latest analysis for eXp World Holdings.

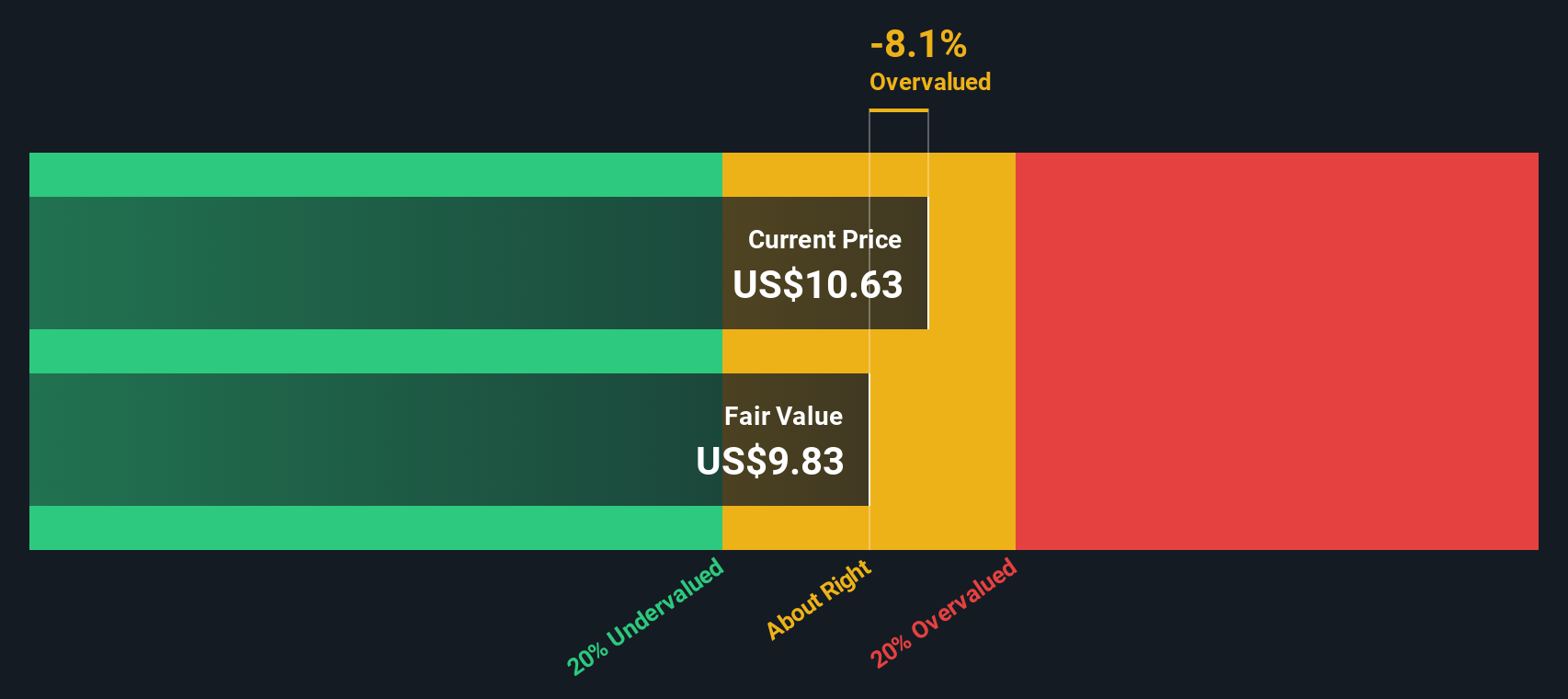

The leadership shakeup lands at a time when the share price sits around $10.60 and recent short term share price returns have been soft. Meanwhile, the longer term total shareholder return remains deeply negative, suggesting sentiment is cautious and momentum is still fading despite solid top line growth.

If these changes have you rethinking where growth and leadership execution might really pay off, it could be worth exploring opportunities in fast growing stocks with high insider ownership next.

With shares still well below their five year highs despite renewed leadership focus on technology and operations, the key question now is whether eXp World Holdings is mispriced value or if the market already anticipates a profitable rebound.

Most Popular Narrative: 18.5% Undervalued

With the narrative fair value pinned at $13 against a last close of $10.60, the current gap assumes investors are overlooking a specific recovery path.

Strategic emphasis on deploying advanced technology including investments in AI productivity tools, custom GPTs, automation, and flexible CRM offerings enhances agent efficiency and scalability, creating operating leverage that could support net margin expansion.

Curious how modest revenue growth can still justify a premium future earnings multiple? The narrative leans on a delicate mix of margin uplift, profitability timing, and share count assumptions. Want to see exactly how those moving parts add up to today's fair value?

Result: Fair Value of $13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commission pressure and slowing agent growth could undermine margin expansion, limit transaction volumes, and challenge expectations for a tech-driven profitability rebound.

Find out about the key risks to this eXp World Holdings narrative.

Another Lens on Value

Our DCF model paints a cooler picture than the $13 narrative fair value, pointing instead to fair value closer to $7.37, which would make eXp World Holdings look overvalued at today’s $10.60 price. Is the market rightly pricing long term optionality, or leaning too hard on optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eXp World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eXp World Holdings Narrative

If you are not fully aligned with these assumptions or would rather rely on your own analysis, you can quickly build a personalized view in under three minutes, Do it your way.

A great starting point for your eXp World Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with just one stock. Give yourself an edge by scanning fresh opportunities across sectors so the next big winner does not slip past you.

- Catch early-stage growth stories by targeting these 3612 penny stocks with strong financials that already show stronger balance sheets and fundamentals than most of their peers.

- Tap into the structural shift toward intelligent automation by focusing on these 30 healthcare AI stocks where data, medicine, and algorithms intersect.

- Boost your potential income stream by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal