Investors Interested In W.S. Industries (India) Limited's (NSE:WSI) Revenues

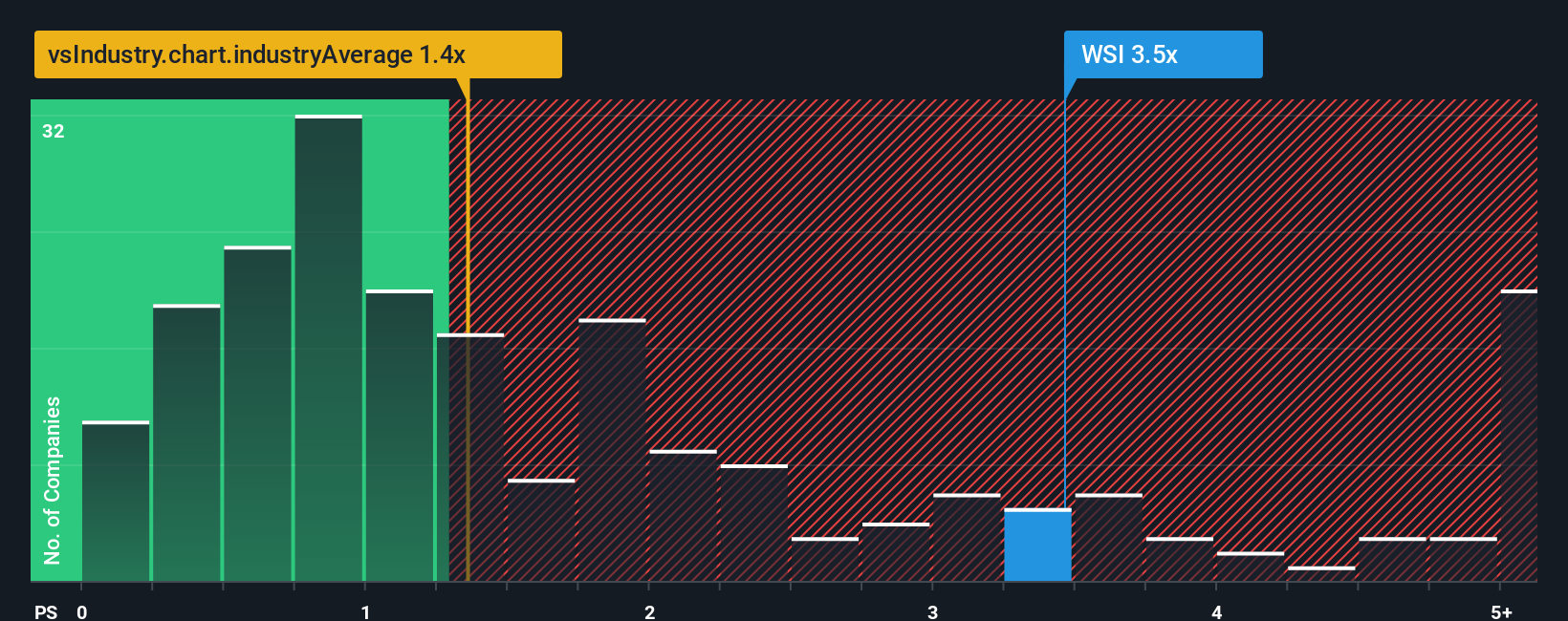

When close to half the companies in the Construction industry in India have price-to-sales ratios (or "P/S") below 1.4x, you may consider W.S. Industries (India) Limited (NSE:WSI) as a stock to avoid entirely with its 3.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for W.S. Industries (India)

What Does W.S. Industries (India)'s P/S Mean For Shareholders?

For instance, W.S. Industries (India)'s receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on W.S. Industries (India)'s earnings, revenue and cash flow.How Is W.S. Industries (India)'s Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as W.S. Industries (India)'s is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 53%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that to the industry, which is only predicted to deliver 15% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why W.S. Industries (India) is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What Does W.S. Industries (India)'s P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that W.S. Industries (India) can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with W.S. Industries (India), and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal