Chipotle (CMG) Valuation Check as 4,000th Restaurant Milestone Underscores Long-Term Expansion Ambitions

Chipotle Mexican Grill (CMG) just crossed a big psychological marker, opening its 4,000th restaurant in Manhattan, Kansas, and pairing that milestone with detailed plans for the next leg of its expansion.

See our latest analysis for Chipotle Mexican Grill.

The 4,000th store and fresh share repurchase firepower come after a choppy stretch, with a double digit 1 month share price return but a sharply negative year to date share price return and still solid multi year total shareholder returns. This suggests long term growth optimism is intact even as near term sentiment resets.

If Chipotle’s growth story has you rethinking your restaurant exposure, this is also a good moment to scan fast growing stocks with high insider ownership for other potential long term compounders.

With the stock down sharply year to date but still trading only modestly below analyst targets and intrinsic value estimates, the real question is whether today’s reset reflects undervaluation or whether markets are already discounting Chipotle’s next growth chapter.

Most Popular Narrative: 16.8% Undervalued

With Chipotle’s fair value estimate sitting above the latest 35.94 close, the prevailing narrative leans toward upside if growth and margins deliver.

Analysts are assuming Chipotle Mexican Grill's revenue will grow by 12.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 13.3% today to 14.2% in 3 years time.

Curious how modest sounding tweaks to growth and margins can compound into a much higher valuation multiple? The narrative stitches together revenue momentum, margin lift, and shrinking share count into a tight, surprisingly aggressive earnings path. Want to see exactly how those moving parts combine into today’s fair value call?

Result: Fair Value of $43.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained consumer pullbacks and renewed ingredient tariffs could quickly erode Chipotle’s margin gains, forcing analysts to reassess those optimistic earnings trajectories.

Find out about the key risks to this Chipotle Mexican Grill narrative.

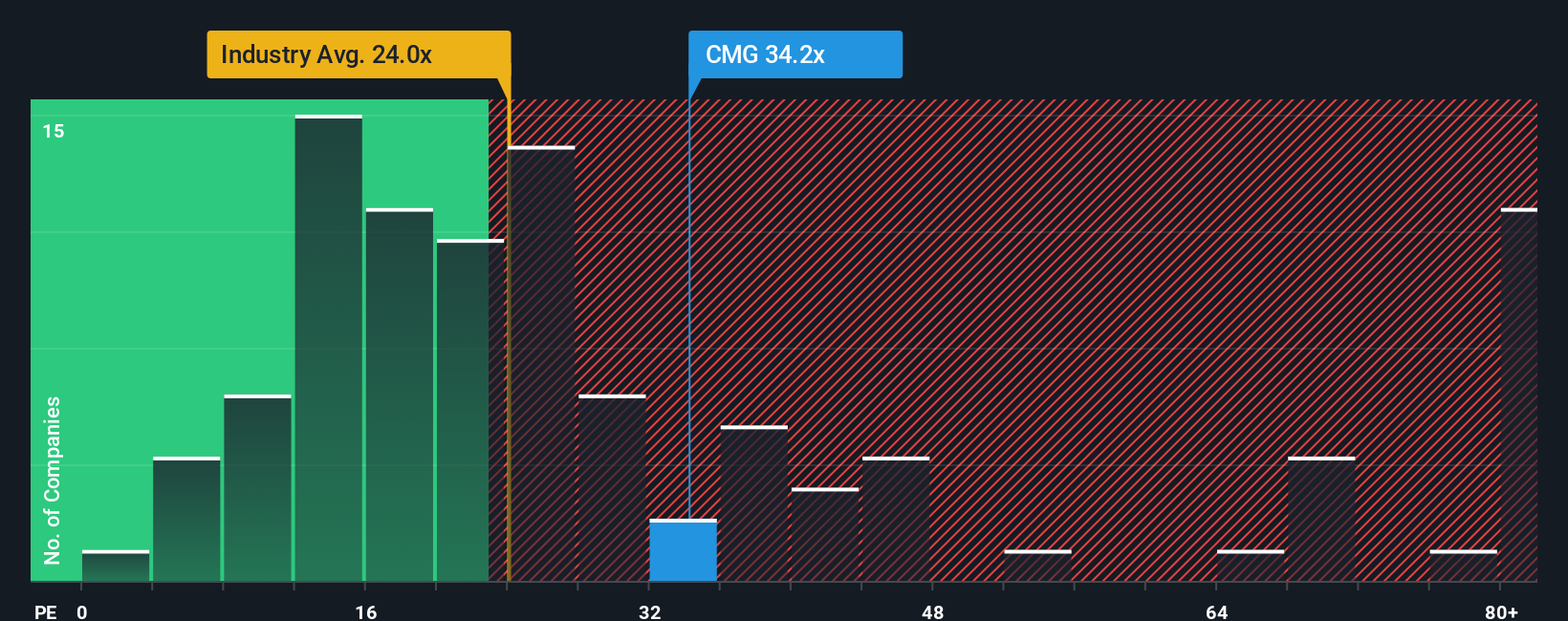

Another View: Market Ratio Check

Step away from fair values and narratives, and the simple earnings ratio looks less generous. Chipotle trades at 30.9 times earnings versus a fair ratio of 26.4, and above the US Hospitality average of 23.7. This suggests investors are still paying a clear premium. How comfortable are you with that cushion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chipotle Mexican Grill Narrative

If you see the story differently or prefer to dive into the numbers yourself, you can craft a personalized view in just minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Chipotle Mexican Grill.

Looking for more investment ideas?

Before you move on, take a moment to uncover other high potential opportunities that could complement, sharpen, or even outperform your Chipotle thesis using targeted stock screeners.

- Capture strong cash flow potential by checking these 908 undervalued stocks based on cash flows that may quietly offer more upside than the market currently credits.

- Capitalize on breakthrough innovation by scanning these 26 AI penny stocks shaping how artificial intelligence transforms entire industries.

- Lock in portfolio income potential by reviewing these 13 dividend stocks with yields > 3% that can help strengthen your returns with reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal