Does ALLETE’s Steady 2025 Climb Still Offer Value After Dividend Model Signals Premium Pricing

- Wondering if ALLETE is still a quietly reliable value play in a choppy utilities market, or if most of the upside has already been priced in? This breakdown is for investors who care less about headlines and more about what the numbers actually say.

- The stock has inched up about 0.6% over the last week and month, and is up 4.6% year to date, while longer term investors have seen gains of 8.6% over 1 year, 20.4% over 3 years, and 44.3% over 5 years. This reflects a steady climb that suggests a mix of dependable growth and moderate re rating.

- Recent news around ALLETE has largely centered on its role in regulated utilities and renewables, including ongoing investment in transmission and clean energy projects that shape how investors think about its long term earnings stability. At the same time, sector wide discussion about interest rates, grid reliability, and decarbonization policy has kept utilities like ALLETE in focus as potential ballast in diversified portfolios.

- Despite that backdrop, ALLETE scores just 0 out of 6 on our valuation checks, which means the market price does not look obviously cheap on traditional metrics. Next we will unpack what different valuation approaches say about the stock, and then circle back to an even better way of thinking about ALLETE’s true worth by the end of the article.

ALLETE scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ALLETE Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividend payments and discounting them back into today’s dollars. It is best suited to mature, steady dividend payers like regulated utilities.

For ALLETE, the model starts with an annual dividend per share of $2.99. With a return on equity of about 4.18% and a high payout ratio of roughly 77.9%, the implied dividend growth rate is modest, at around 0.9% a year. That low growth reflects a business returning most of its earnings to shareholders instead of aggressively reinvesting.

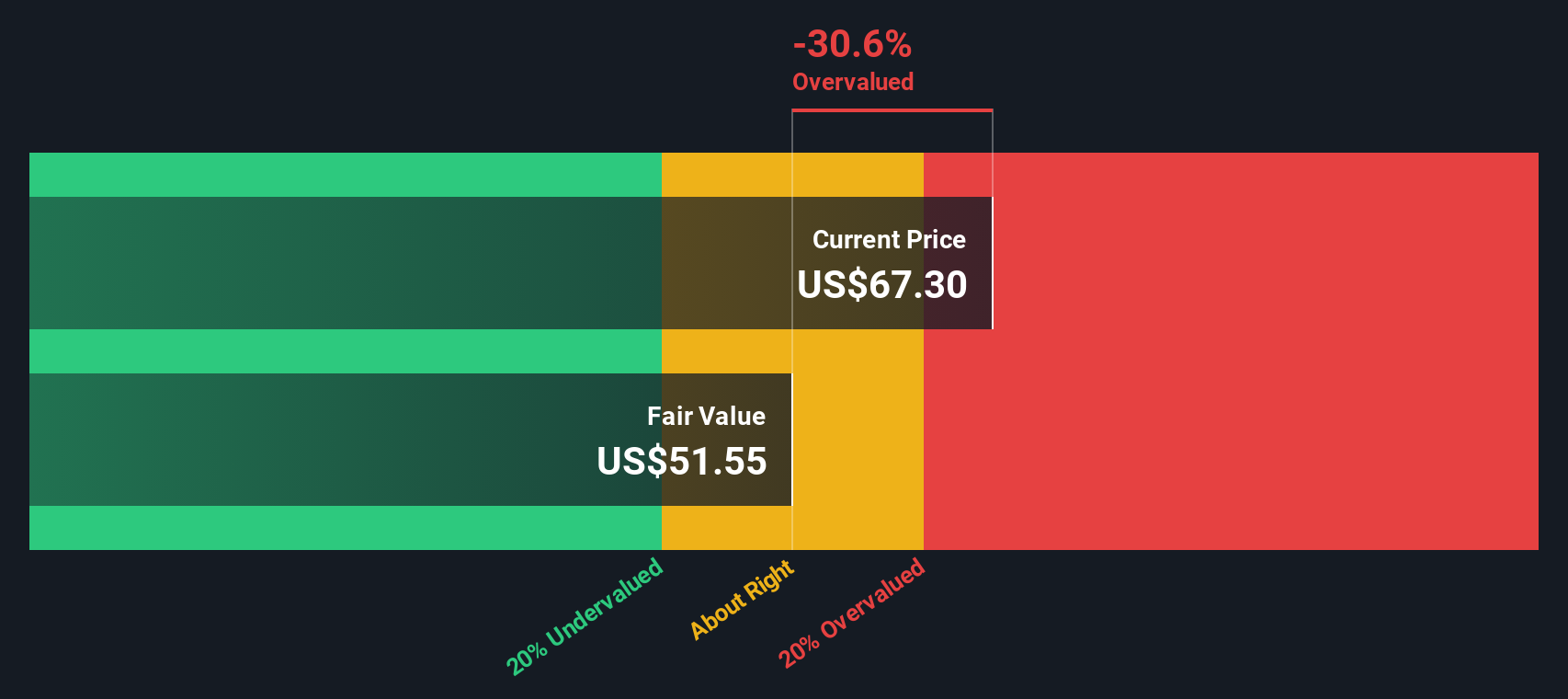

Using these inputs, the DDM arrives at an intrinsic value of about $49.61 per share. Compared with the current market price, this implies ALLETE is roughly 36.9% overvalued on a dividend basis, which indicates that investors are paying a premium for its stability and income stream.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests ALLETE may be overvalued by 36.9%. Discover 908 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ALLETE Price vs Earnings

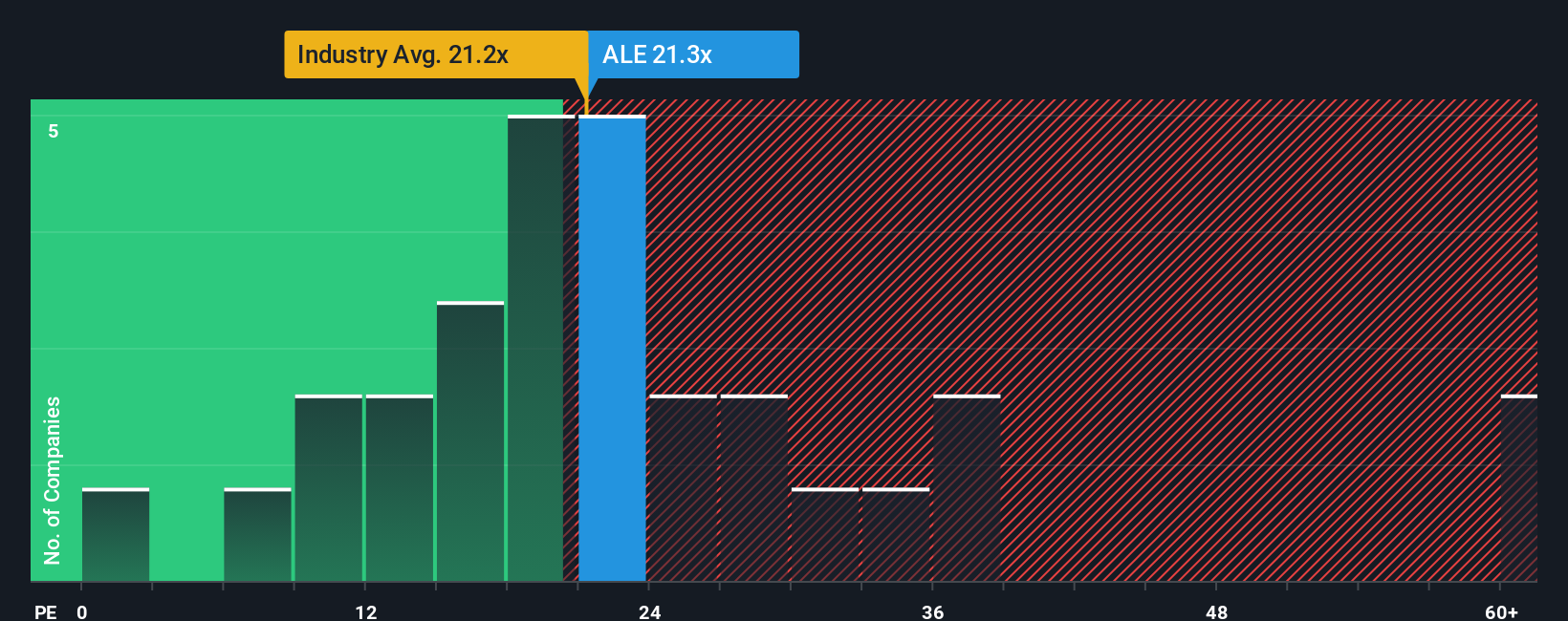

For a consistently profitable utility like ALLETE, the price-to-earnings (PE) ratio is a practical way to judge valuation because it links what investors pay today to the company’s current earning power. In general, faster, safer growers can justify higher PE multiples, while slower growth, higher risk, or more cyclical earnings usually warrant lower ones.

ALLETE currently trades on a PE of about 23.8x. That is modestly above both the broader Electric Utilities industry average of roughly 20.0x and its direct peer group, which sits near 22.1x, suggesting the market is willing to pay a small premium for its earnings profile. Simply Wall St’s Fair Ratio for ALLETE comes in at around 23.4x, a proprietary estimate of what the PE should be once you factor in its growth outlook, profitability, size, industry positioning, and specific risks.

This Fair Ratio is more informative than a simple peer or sector comparison because it tailors the “right” multiple to ALLETE’s fundamentals rather than assuming all utilities deserve the same PE. With the current 23.8x multiple sitting only slightly above the 23.4x Fair Ratio, the stock appears priced roughly in line with its underlying characteristics.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ALLETE Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that helps you connect your personal view of ALLETE’s future to a clear fair value estimate. A Narrative is your story behind the numbers, where you set assumptions for revenue growth, profit margins, and risk, then see how those inputs translate into a financial forecast and an estimated intrinsic value. Narratives are available on Simply Wall St’s Community page, where millions of investors share and compare their views using the same easy, guided structure. By comparing each Narrative’s Fair Value to the current share price, you can quickly see whether a particular view implies ALLETE is a buy, hold, or sell, and those valuations update dynamically as new earnings, news, or guidance is released. For example, one ALLETE Narrative on the Community page might assume slower growth and see limited upside, while another assumes stronger renewable expansion and a higher long term margin, leading to a much higher fair value estimate.

Do you think there's more to the story for ALLETE? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal