Assessing Lam Research (LRCX) Valuation After Its Strong Recent Share Price Rally

Lam Research (LRCX) has quietly continued to reward patient investors, with the stock up about 11% over the past month and roughly 36% in the past 3 months, outpacing many semiconductor peers.

See our latest analysis for Lam Research.

With the share price now around $164.30 and a powerful year to date share price return of roughly 127%, Lam’s momentum looks firmly intact. This echoes its strong multi year total shareholder returns and improving sentiment around semiconductor capital spending.

If Lam’s run has you rethinking where growth might show up next in chips, it could be worth scanning other high growth tech names through high growth tech and AI stocks.

Yet with Lam now trading slightly above the average analyst price target and recent gains already reflecting solid earnings momentum, investors must decide whether this rally still leaves upside on the table or if the market is simply pulling forward future growth.Most Popular Narrative: 2.5% Overvalued

With Lam Research last closing at $164.30 against a narrative fair value of $160.30, the story implies only a modest valuation premium and leans heavily on future AI driven WFE demand to support that pricing.

Fair Value Estimate has risen slightly, from $158.52 to $160.30, reflecting modestly stronger profitability assumptions.

Discount Rate has fallen slightly, from 10.58% to 10.49%, implying a marginally lower perceived risk profile in the valuation model.

Want to see why a small tweak in margins and growth justifies billions in value, even with a higher forward multiple and mid single digit share shrink? The narrative quietly bakes in compounding earnings, persistent high profitability, and a discount rate that assumes Lam stays a structural winner in AI infrastructure. Curious which specific growth and margin paths make today’s premium look reasonable rather than euphoric?

Result: Fair Value of $160.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising geopolitical tensions and a potential slowdown in wafer fab equipment spending could quickly challenge the AI-driven growth assumptions behind today’s premium.

Find out about the key risks to this Lam Research narrative.

Another Angle on Valuation

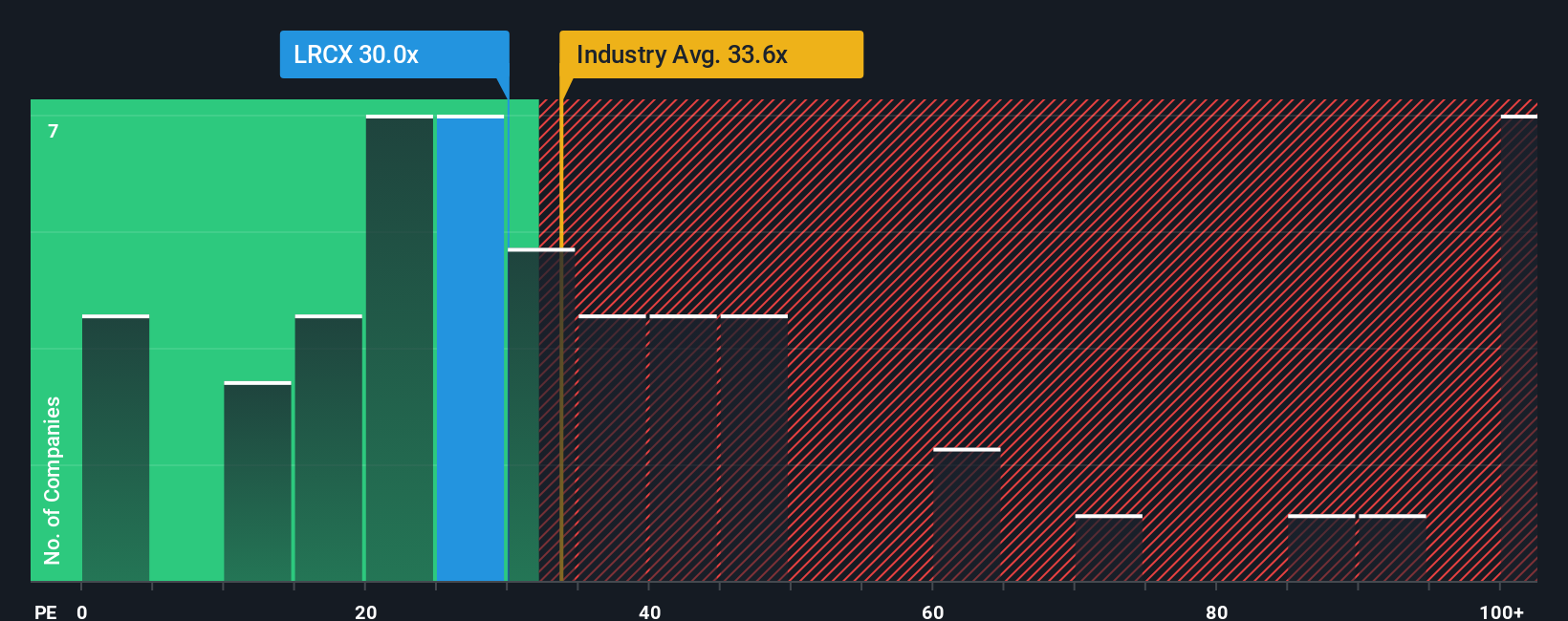

On earnings, Lam looks more stretched. Its P/E of 35.5x sits below the US semiconductor average of 37x and the 39.1x peer group, but above a fair ratio of 31x that our model suggests the market could drift toward. This raises the risk of multiple compression if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lam Research Narrative

If you see things differently or want to stress test your own assumptions with the same tools, you can build a custom narrative in minutes, starting with Do it your way.

A great starting point for your Lam Research research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before the next move in Lam Research, set yourself up with a shortlist of fresh, data backed ideas using the Simply Wall St Screener right now.

- Capture high potential under the radar names by scanning these 908 undervalued stocks based on cash flows that may be quietly mispriced by the market.

- Position ahead of the next wave in automation and machine learning by targeting these 26 AI penny stocks shaping the future of intelligent software and hardware.

- Lock in potential income streams by focusing on these 13 dividend stocks with yields > 3% that can boost your returns with consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal