IPO News | Jin Zhiwei reports that the main board of the Hong Kong Stock Exchange has topped the domestic AI digital employee solutions market for three consecutive years

The Zhitong Finance App learned that, according to the Hong Kong Stock Exchange's disclosure on December 15, Zhuhai Jinzhiwei Artificial Intelligence Co., Ltd. (“Jin Zhiwei”) submitted a statement to the main board of the Hong Kong Stock Exchange, with Cathay Pacific Junan Finance Co., Ltd. and Bank of China International Asia Limited as co-sponsors.

According to the prospectus, Jin Zhiwei is an AI enterprise focusing on providing artificial intelligence (“AI”) digital employee solutions and enterprise-level intelligent solutions. Through self-developed AI solutions, it helps enterprises accelerate their digital intelligence transformation. By deeply integrating AI algorithms, big language models (“big language models”), and robotic process automation (“RPA”) technology with industry scenarios, the company has enabled various tasks to be handled by AI digital employees and agents.

According to Frost & Sullivan, the company has served many leading companies in many industries and achieved a leading position in the market. In terms of market share, Jin Zhiwei topped the list in China's AI digital employee solutions market for three consecutive years from 2022 to 2024. The company also ranked first in the number of large and medium-sized enterprises served in this market throughout the track record period. The company's leading position in the market is particularly reflected in the financial services sector, ranking first in the market share for three consecutive years from 2022 to 2024.

As of June 30, 2025, according to the number of authorizations granted to customers by the company's AI solutions, Jin Zhiwei has deployed more than 1.8 million AI digital employees. These AI digital employees are involved in more than 10 industries, including financial services, government affairs, and manufacturing, and have served more than 1,300 high-quality customers (including more than 120 Fortune Global 500 and “Fortune” China 500 companies).

Jin Zhiwei is still far ahead in the field of financial services. As of June 30, 2025, the company has provided services to more than 240 banks (covering the six largest state-owned banks in China), more than 130 securities companies (covering more than 90% of China's securities companies), and more than 170 other major financial institutions. The company's leading market position and recognition in the financial services industry reflects the comprehensive capabilities of the company's solutions in terms of safety, reliability and service assurance.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the six months ended June 30, the company recorded revenue of 203 million yuan (RMB, same below), 217 million yuan, 243 million yuan, and 459.77 million yuan respectively.

Mouri

In 2022, 2023, 2024, and 2025 for the six months ended June 30, the company recorded gross profit of 854.99 million yuan, 9.018 million yuan, 130 million yuan, and 238.63 million yuan respectively.

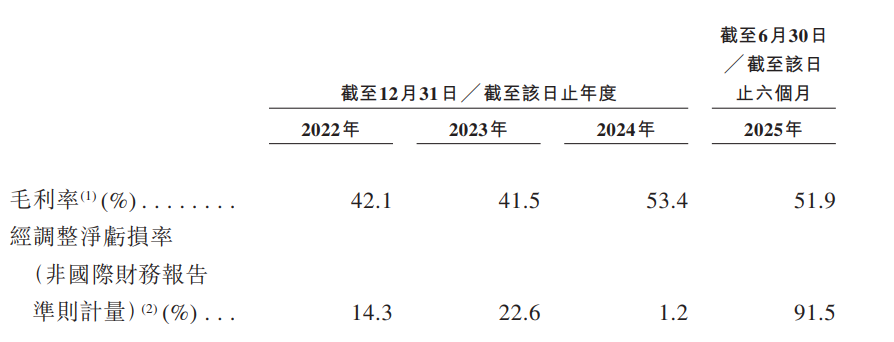

gross profit margin

For the six months ended June 30 in 2022, 2023, 2024, and 2025, the company's corresponding gross profit margins were 42.1%, 41.5%, 53.4%, and 51.9%.

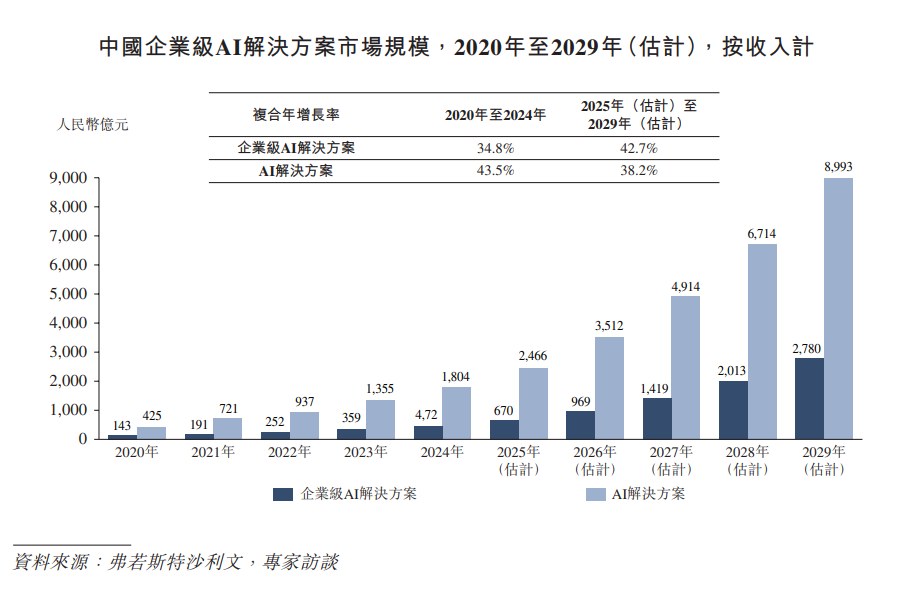

Industry Overview

China's AI solutions market continues to expand. The market size of enterprise-grade AI solutions grew from RMB 14.3 billion in 2020 to RMB 47.2 billion in 2024, achieving a compound annual growth rate of 34.8% during this period. Driven by the digital transformation of enterprises and the acceleration of intelligent government construction, it is expected to grow at a compound annual growth rate of 42.7% from 2025 to 2029, reaching RMB 278 billion by 2029.

The enterprise smart solutions market in China is moving from the technology incubation stage to the initial commercialization stage. Between 2023 and 2025, with big models, technological breakthroughs in multi-modal understanding, intellectual reasoning, and task planning. It is expected that 2026 to 2027 will accelerate the commercialization of smart digital employees, and core enterprises will implement initial applications based on an expandable AI agent framework.

It is expected that after entering 2028, with the initial formation of ecological standards and the release of enterprise-level intelligent collaboration requirements, the market will enter a stage of large-scale expansion and accelerate popularity in enterprise-level applications. It is expected to release a market size of RMB 18 billion after commercialization becomes popular in 2027 and grow at a compound annual growth rate of 70.0%, reaching RMB 88.4 billion by 2030.

Furthermore, the global AI digital employee solutions market has maintained rapid growth in recent years, growing from RMB 11.8 billion in 2020 to RMB 29.1 billion in 2024, achieving a compound annual growth rate of 25.3% during this period. Thanks to the integrated application of technologies such as enterprise process automation and generative AI, AI digital workers have gradually evolved into intelligent bodies with semantic understanding and decision-making capabilities, and the scope of application in financial services, government affairs, manufacturing, and retail continues to expand. The global market is expected to grow at a CAGR of 40.0% from 2025 to 2029, reaching RMB 128.7 billion by 2029.

The Chinese market is one of the fastest growing regions in the world. China's AI digital workforce solutions market grew from RMB 1.8 billion in 2020 to RMB 6.5 billion in 2024, with a compound annual growth rate of 37.5% from 2020 to 2024. Driven by the acceleration of the digital construction of government and enterprises and the deepening application of large language models, AI digital workers are becoming an important tool to promote the intelligent transformation of enterprises. The Chinese market is expected to grow at a compound annual growth rate of 51.0% from 2025 to 2029, reaching RMB 51 billion by 2029, further increasing its share of the global market.

Board Information

The Board consists of 11 directors, including 5 executive directors, 2 non-executive directors and 4 independent non-executive directors.

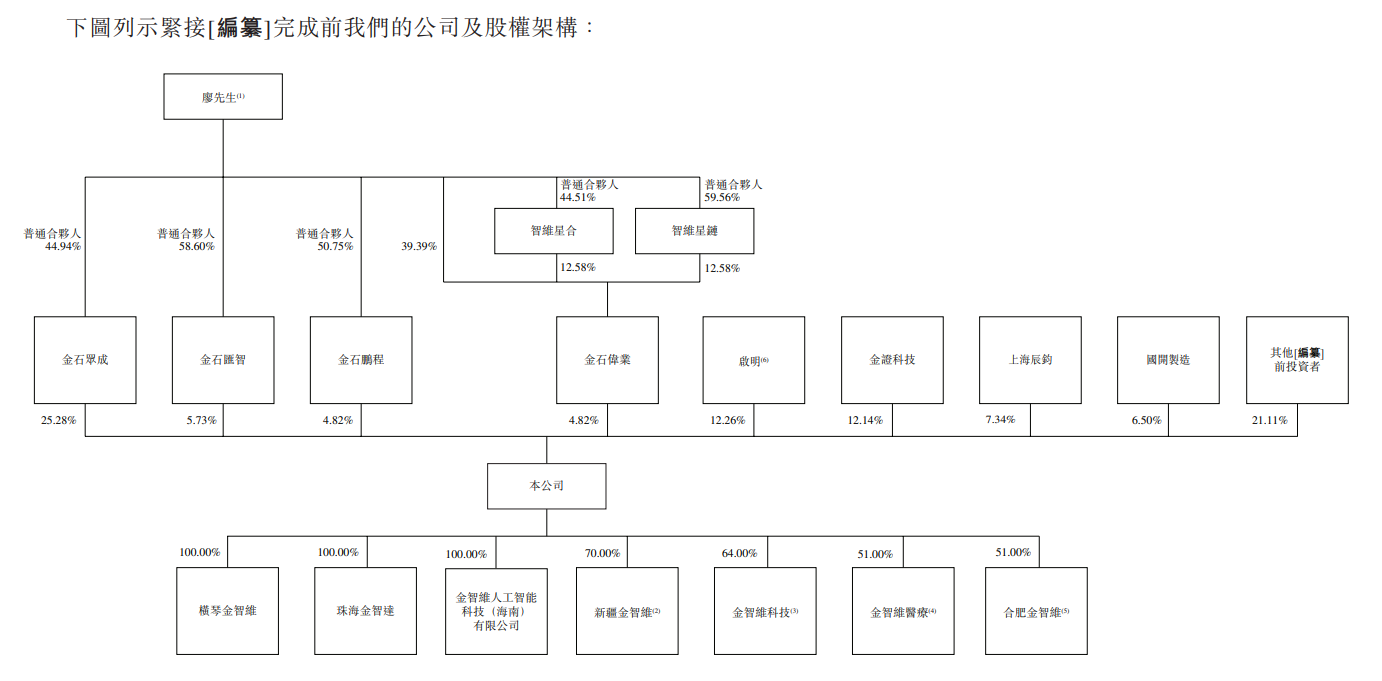

Shareholding structure

As of December 9, 2025, Mr. Liao has the right to exercise the voting rights attached to approximately 40.65% of the company's total issued share capital through his controlled entities (i.e. Jinshi Zhongcheng, Jinshi Huizhi, Jinshi Pengcheng, Jinshi Weiye, Zhiwei Xinghe and Zhiwei Starlink).

As of December 9, 2025, Mr. Liao is the sole general partner of Jinshi Zhongcheng, Jinshi Huizhi, Jinshi Pengcheng, Jinshi Weiye, Zhiwei Xingye and Zhiwei Starlink, and is responsible for the management of each such partnership enterprise and exercises voting rights in relation to the shares or limited partnership interests held by each such partnership enterprise in accordance with the partnership agreements between the general partner and limited partner of each such partnership.

Intermediary team

Co-sponsors: Guotai Junan Finance Co., Ltd., Bank of China International Asia Limited.

Company Legal Advisors: Regarding Hong Kong and US Law: Jiayuan Law Firm; Regarding Chinese Law: Shihui Law Firm.

Co-sponsor Legal Adviser: Relevant Hong Kong Law: Jingtian Gongcheng Law Firm Limited Liability Partnership; Related Chinese Law: Jingtian Gongcheng Law Firm.

Reporting accountant and independent auditor: KPMG.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd.

Compliance Advisor: Zhongtai International Finance Co., Ltd.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal