Is FMC Stock a Mispriced Opportunity After a 73% Slide in 2025?

- Wondering if FMC is a beaten down trap or a genuine bargain waiting to be noticed? This is exactly the kind of setup where valuation work can really pay off.

- The stock has barely moved over the last week (up around 0.2%), but that comes after a brutal stretch with the share price down about 5.6% over 30 days, roughly 73% year to date, and more than 86% over five years.

- Much of the recent share price weakness has been tied to ongoing concerns about the crop protection cycle, high channel inventories, and shifting demand patterns from key agricultural markets. All of these factors have weighed on sentiment. At the same time, investors are debating whether structural factors like changing regulations and evolving farming practices will cap FMC's long term growth or simply delay its next upcycle.

- Against that backdrop, FMC actually scores a solid 5/6 on our valuation checks, suggesting that the current price may already be baking in a lot of bad news. Next, we will walk through the main valuation approaches behind that score, and then finish with a more holistic way to think about what FMC is really worth.

Find out why FMC's -73.2% return over the last year is lagging behind its peers.

Approach 1: FMC Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For FMC, the 2 Stage Free Cash Flow to Equity model uses analysts' near term forecasts and then extrapolates longer term cash flows.

FMC's latest twelve month free cash flow is around $401 Million in the red, highlighting how tough current conditions are. However, analyst and model projections anticipate a recovery, with free cash flow expected to rise toward roughly $330 Million by 2029 and then grow modestly into the early 2030s. These projections, all in dollars, are discounted back to today to reflect risk and the time value of money.

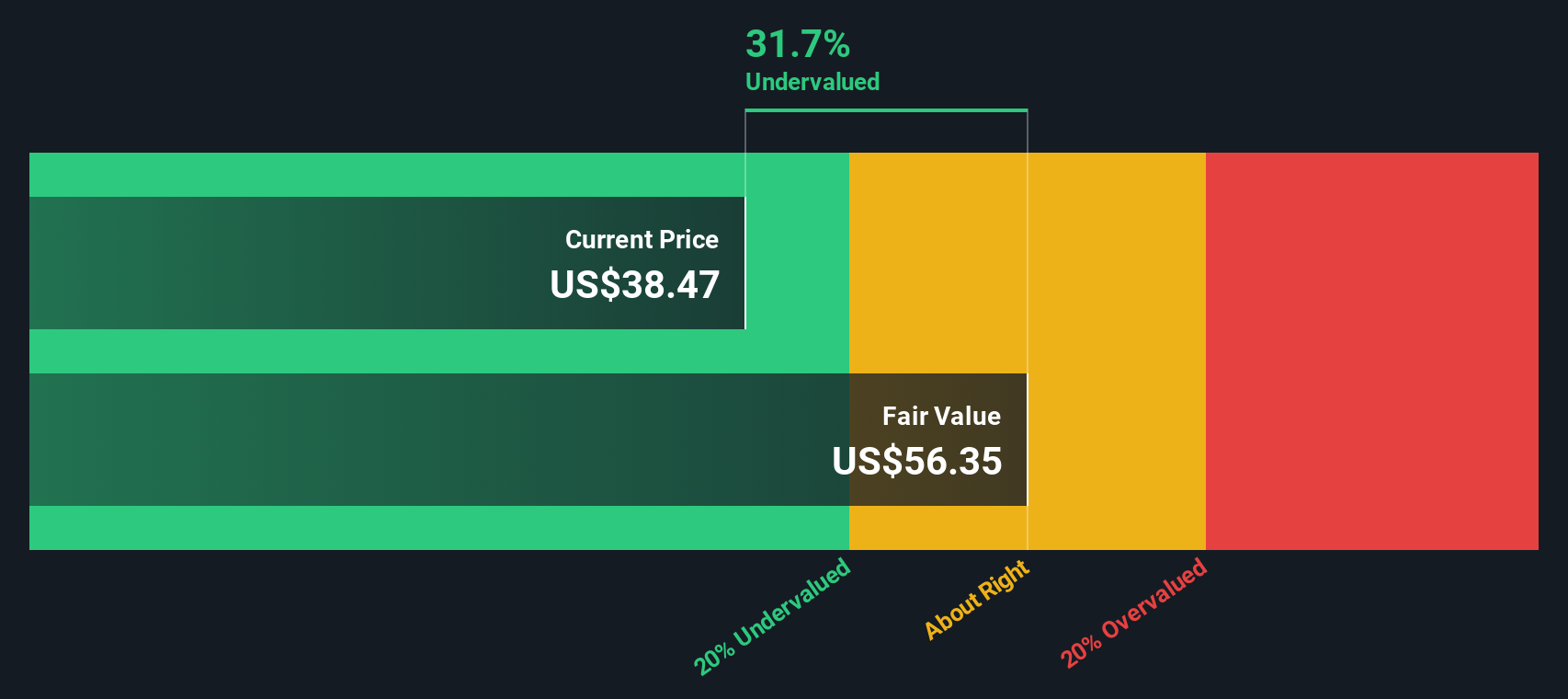

Putting all of those discounted cash flows together yields an estimated intrinsic value of about $25.73 per share. Compared to the current market price, this indicates that the stock is trading at roughly a 49.0% discount, suggesting that a lot of pessimism is already reflected in the valuation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FMC is undervalued by 49.0%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: FMC Price vs Sales

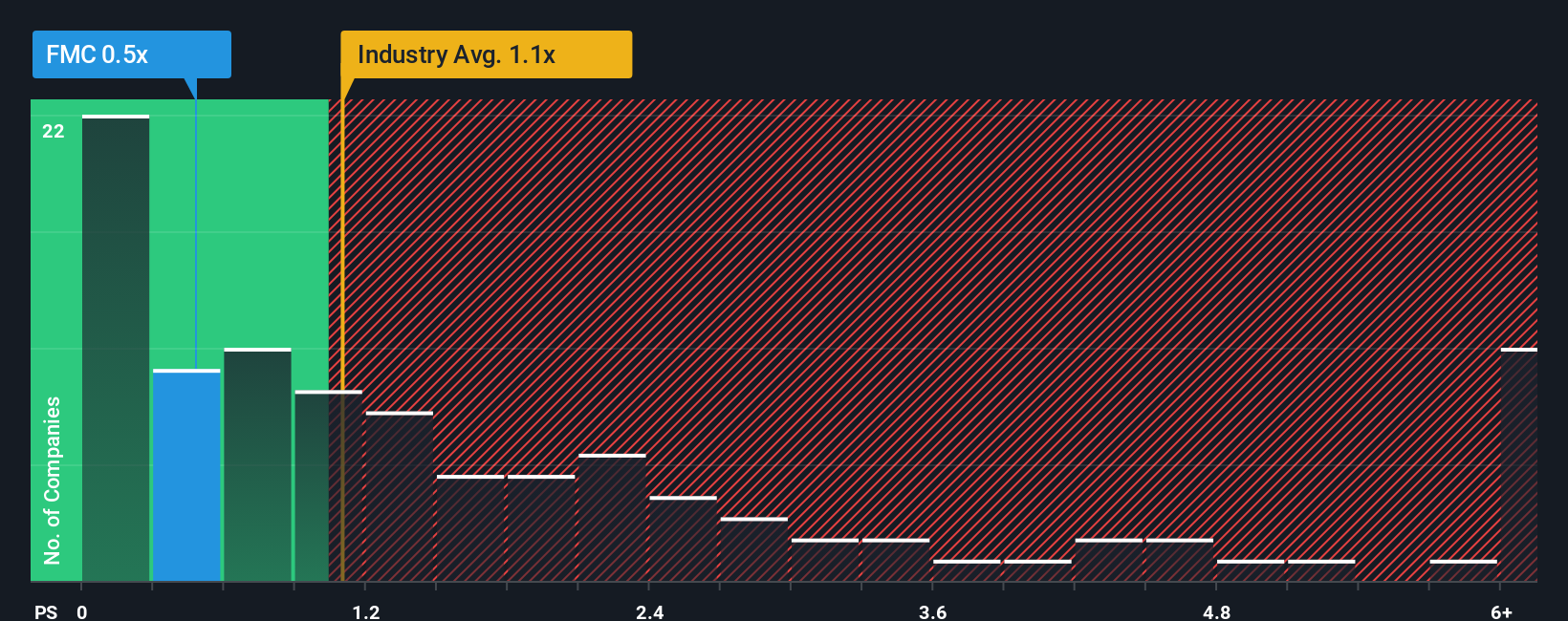

For companies where earnings are volatile or temporarily depressed, the Price to Sales ratio is often a more stable way to gauge value, because revenue tends to move less dramatically than profits through the cycle. Investors usually accept a higher or lower P S multiple depending on a business’s growth outlook and perceived risk, with faster growing and less risky companies typically justifying richer valuations.

FMC currently trades on a P S of about 0.45x, which is not only below the Chemicals industry average of roughly 1.09x, but also well under the peer group average of around 1.28x. Simply Wall St’s proprietary Fair Ratio model goes a step further by estimating what a reasonable P S multiple should be for FMC given its growth profile, margins, risk factors, market cap and industry context.

On that basis, FMC’s Fair Ratio is 1.44x, which is substantially higher than its current 0.45x, implying the market is heavily discounting the business relative to what those fundamentals would suggest.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FMC Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple but powerful framework on Simply Wall St’s Community page that lets you spell out your story for FMC, link it directly to assumptions about future revenue, earnings and margins, and automatically translate that into a Fair Value you can compare with today’s share price to guide buy or sell decisions. It also helps you stay up to date as new news or earnings are released so your view evolves in real time. For example, one FMC Narrative on the platform might lean bullish, assuming faster recovery, stronger margin repair and a Fair Value near the upper end of recent targets around $95. A more cautious Narrative could bake in slower growth, persistent margin pressure and a Fair Value closer to about $18 to $25. The beauty is that both perspectives are visible, quantified and easy to understand without needing to build complex spreadsheets.

Do you think there's more to the story for FMC? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal