Costco (COST) Valuation Check After Recent Share Price Pullback

Costco Wholesale (COST) has slipped about 4% over the past month and 7% in the past 3 months, a cooling period that has some long term holders double checking what they actually own here.

See our latest analysis for Costco Wholesale.

Zooming out, Costco’s 1 year total shareholder return of around negative 10% looks soft next to its triple digit 3 year total shareholder return. This suggests momentum has cooled as investors reassess how much to pay for its steady growth.

If Costco’s pause has you rethinking where momentum and conviction overlap, this could be a good moment to explore fast growing stocks with high insider ownership.

With growth still solid and the share price now off its highs, the key question is whether Costco’s premium valuation finally leaves little upside on the table or if this pullback is a fresh entry point before markets price in more growth.

Most Popular Narrative Narrative: 16.2% Undervalued

With Costco Wholesale’s fair value in the most followed narrative sitting noticeably above the recent close at $884.47, the story hinges on whether today’s price fully reflects its future earnings power.

The analysts have a consensus price target of $1,072.667 for Costco Wholesale based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $1,225.0, and the most bearish reporting a price target of just $620.0.

Want to see what justifies paying a growth style multiple for a big box retailer, even as revenue and margins grind higher at a steady pace? The narrative leans on carefully stepped up earnings, firm but not explosive revenue assumptions, and a surprisingly rich future profit multiple that could reset how investors think about Costco’s next chapter. Curious which specific earnings path and long term margin profile are baked into that view, and how a relatively low discount rate amplifies the upside case? The full narrative breaks down the numbers driving that fair value call.

Result: Fair Value of $1,055.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher labor costs and ongoing foreign exchange swings could easily pressure margins and challenge assumptions that Costco’s premium multiple remains comfortably sustainable.

Find out about the key risks to this Costco Wholesale narrative.

Another View: Market Multiple Sends a Different Signal

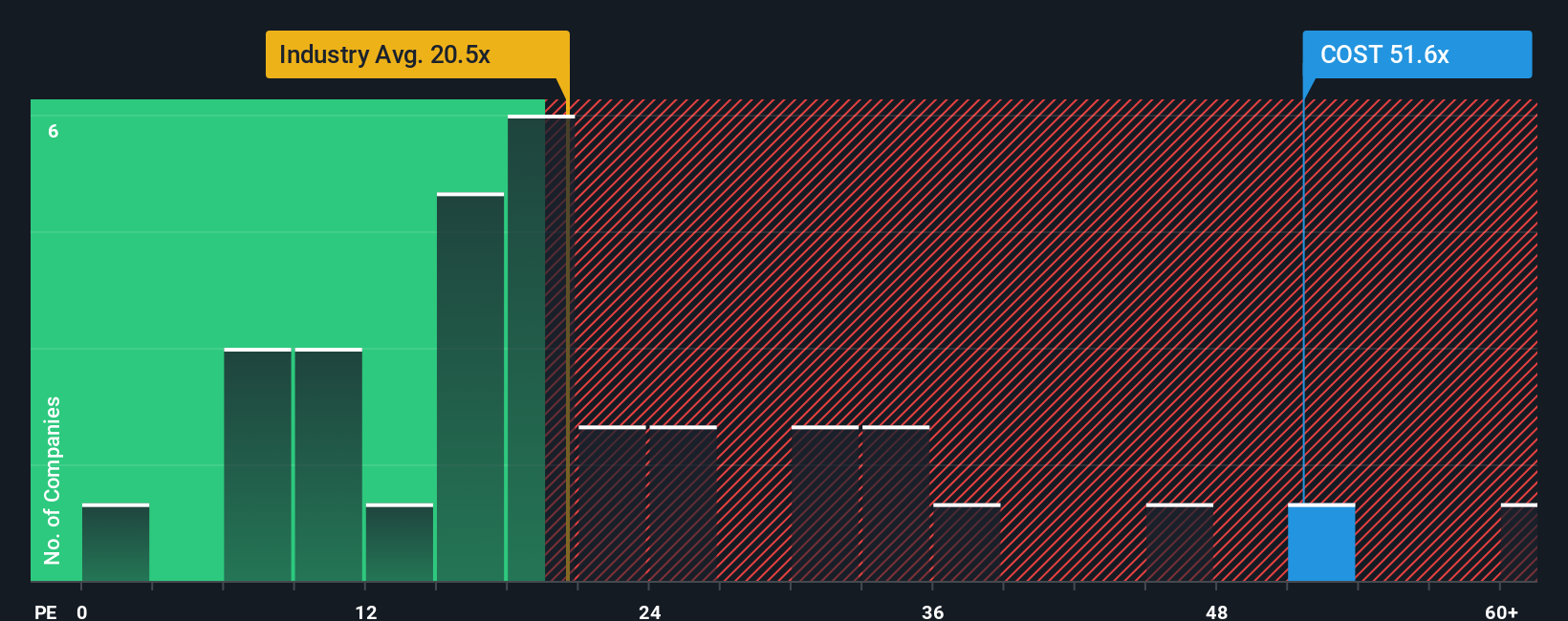

While the narrative points to a 16.2% upside, the market’s own yardstick tells a tougher story. Costco trades on a 47.3x price to earnings ratio versus a fair ratio of 34.6x, and roughly double both peers and the wider US Consumer Retailing industry. That gap suggests less of a bargain and more of a valuation risk, especially if growth expectations cool further. Could the share price drift closer to that fair ratio if sentiment turns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

If this storyline does not quite fit your view or you would rather dig into the numbers yourself, you can build a custom version in just a few minutes: Do it your way.

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing edge?

Do not stop at Costco. Use Simply Wall Street’s powerful screener to uncover fresh opportunities that match your goals before the market fully wakes up.

- Target reliable income by scanning these 13 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash returns.

- Capitalize on market mispricing by hunting through these 909 undervalued stocks based on cash flows where strong cash flows are not yet fully recognized.

- Position yourself early in the next digital shift by reviewing these 80 cryptocurrency and blockchain stocks aligned with blockchain and decentralized finance trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal