Skylark Holdings (TSE:3197): Valuation Check After Strong Preliminary Sales and Same‑Store Growth

Skylark Holdings (TSE:3197) just released preliminary November numbers showing monthly sales up 111% year on year, with same store sales at 109%. Year to date, total sales climbed 113%, and same store sales rose 108%.

See our latest analysis for Skylark Holdings.

That upbeat sales momentum seems to be feeding into sentiment, with a roughly 16% 3 month share price return and a hefty 3 year total shareholder return of about 124%. This suggests investors see the recovery as firmly on track.

If Skylark’s trajectory has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other fast moving opportunities with strong insider conviction.

Yet with the share price already up strongly and the stock now trading above consensus targets, is Skylark still flying under the radar, or is the market already pricing in most of its recovery and future growth?

Price-to-Earnings of 46.3x: Is it justified?

On a price-to-earnings basis, Skylark’s ¥3,505 last close implies a rich valuation, leaving the shares looking expensive rather than discounted versus peers.

The price-to-earnings ratio compares today’s share price with the company’s earnings per share, so a higher multiple usually reflects stronger profit growth expectations or perceived quality.

For Skylark, the current price-to-earnings ratio of 46.3x sits slightly above the peer average of 46.1x, implying investors are paying a premium even against already expensive comparables. That premium looks even steeper when set against the SWS fair price-to-earnings estimate of 26.9x; the market could gravitate toward that level if enthusiasm cools.

Relative to the broader Japanese Hospitality industry average of 23.6x, Skylark’s 46.3x multiple is almost double. This underscores how aggressively the market is pricing its earnings profile compared to sector norms.

Explore the SWS fair ratio for Skylark Holdings

Result: Price-to-Earnings of 46.3x (OVERVALUED)

However, sustained valuation froth and any setback in consumer spending or same store momentum could quickly flip sentiment and compress Skylark’s premium multiples.

Find out about the key risks to this Skylark Holdings narrative.

Another View: What Does Our DCF Say?

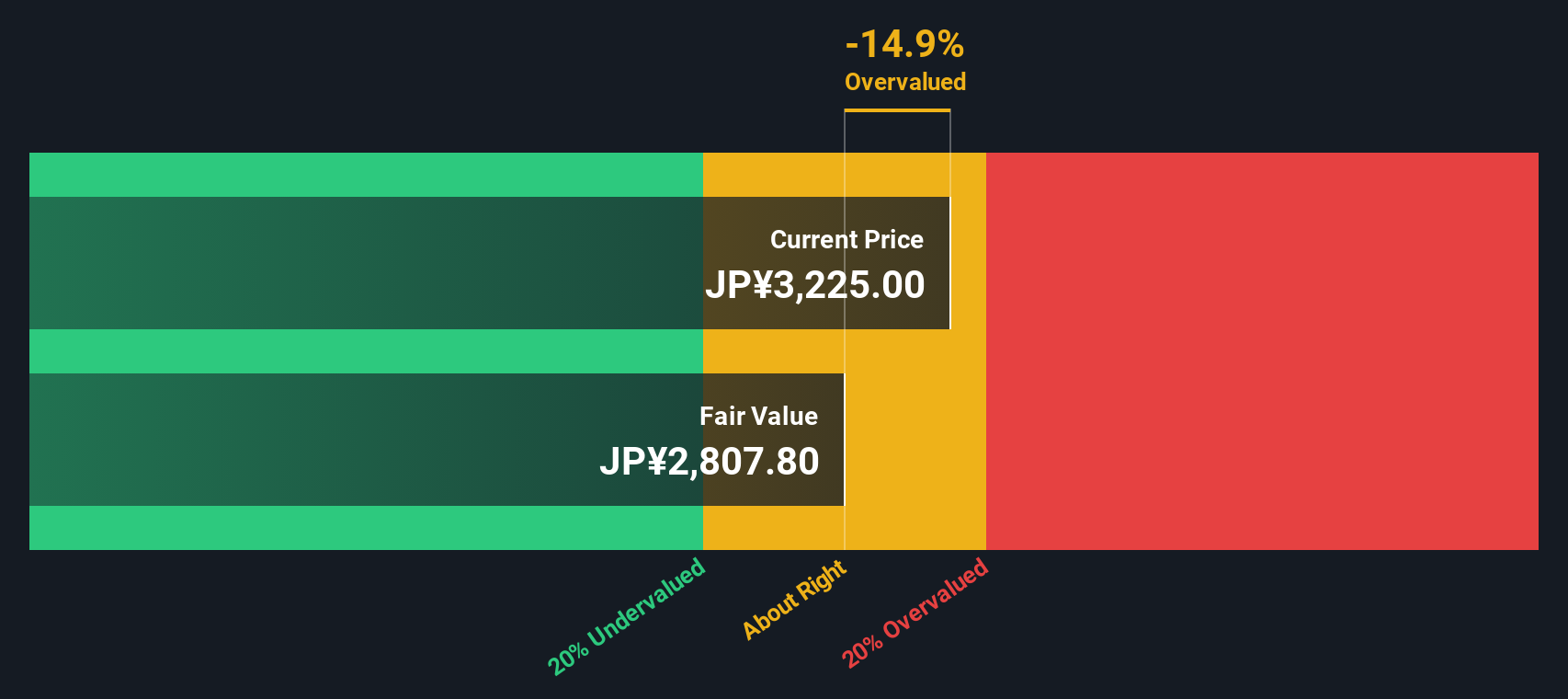

While earnings multiples flag Skylark as expensive, our DCF model also points to caution. With the shares at ¥3,505 versus an SWS fair value estimate of ¥2,903.37, the stock screens as overvalued and raises the question of how much upside is really left if growth cools.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Skylark Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Skylark Holdings Narrative

If you see the numbers differently or would rather dive into the details yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Skylark Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Skylark is just one opportunity, and acting now with a clear game plan across multiple themes can help you spot tomorrow’s winners before the crowd.

- Capture potential mispricings by scanning these 909 undervalued stocks based on cash flows that look attractive on a cash flow basis before sentiment catches up.

- Ride structural trends in medicine and diagnostics by targeting these 30 healthcare AI stocks positioned at the crossroads of data and healthcare innovation.

- Position ahead of digital finance shifts by tracking these 80 cryptocurrency and blockchain stocks building real businesses around blockchain infrastructure and payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal