Asian Penny Stocks To Watch In December 2025

As global markets react to the Federal Reserve's recent interest rate cuts, concerns about technology stock valuations and AI infrastructure spending have surfaced, affecting indices like the Nasdaq Composite. Amid these broader market dynamics, penny stocks in Asia present a unique opportunity for investors seeking growth potential at lower price points. While the term "penny stock" may seem outdated, it still captures the essence of investing in smaller or newer companies that might offer significant returns when backed by strong financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.56 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.10 | SGD445.82M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.96 | THB2.98B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.108 | SGD56.54M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.50 | SGD13.77B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$5.00 | HK$22.11B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.21 | ₱843.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 971 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

CNMC Goldmine Holdings (Catalist:5TP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CNMC Goldmine Holdings Limited is an investment holding company focused on the exploration and mining of gold deposits in Malaysia, with a market capitalization of SGD445.82 million.

Operations: The company's revenue is primarily generated from its mining operations, amounting to $88.33 million.

Market Cap: SGD445.82M

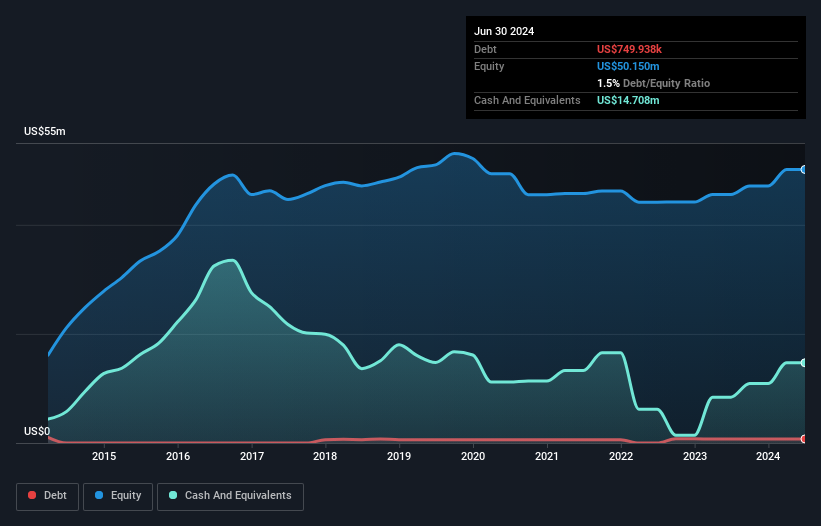

CNMC Goldmine Holdings Limited, with a market capitalization of S$445.82 million, presents a compelling case in the penny stock segment due to its strong financial metrics and growth trajectory. The company has demonstrated significant earnings growth of 210.3% over the past year, surpassing both its five-year average and industry benchmarks. Its high return on equity of 37.8% and improved profit margins reflect robust operational performance. Despite recent share price volatility, CNMC trades at a substantial discount to estimated fair value while maintaining healthy liquidity with more cash than debt and short-term assets exceeding liabilities significantly.

- Dive into the specifics of CNMC Goldmine Holdings here with our thorough balance sheet health report.

- Assess CNMC Goldmine Holdings' future earnings estimates with our detailed growth reports.

Pan Asia Environmental Protection Group (SEHK:556)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pan Asia Environmental Protection Group Limited, with a market cap of HK$534.60 million, operates in the People’s Republic of China selling environmental protection products and equipment through its subsidiaries.

Operations: The company generates revenue of CN¥249.44 million from its environmental protection products and equipment segment.

Market Cap: HK$534.6M

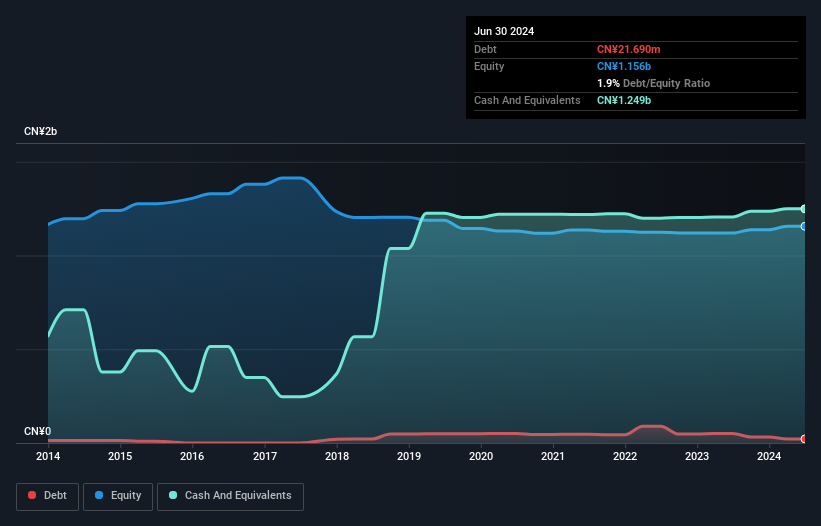

Pan Asia Environmental Protection Group, with a market cap of HK$534.60 million, stands out in the penny stock arena due to its strong financial position and impressive earnings growth. The company has achieved profitability over the past five years, with recent earnings growth of 170.1%, surpassing industry averages. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating robust liquidity management. Despite a low return on equity of 1.3% and high share price volatility, Pan Asia's debt-free status and trading at nearly half its estimated fair value present potential opportunities for investors seeking undervalued stocks in this segment.

- Click here to discover the nuances of Pan Asia Environmental Protection Group with our detailed analytical financial health report.

- Gain insights into Pan Asia Environmental Protection Group's past trends and performance with our report on the company's historical track record.

China Feihe (SEHK:6186)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Feihe Limited is an investment holding company that produces and sells dairy products and raw milk in Mainland China, Canada, and the United States with a market cap of HK$36.74 billion.

Operations: The company generates revenue from its Dairy Products and Nutritional Supplements Products segment, amounting to CN¥19.68 billion, and its Raw Milk segment, which contributes CN¥2.66 billion.

Market Cap: HK$36.74B

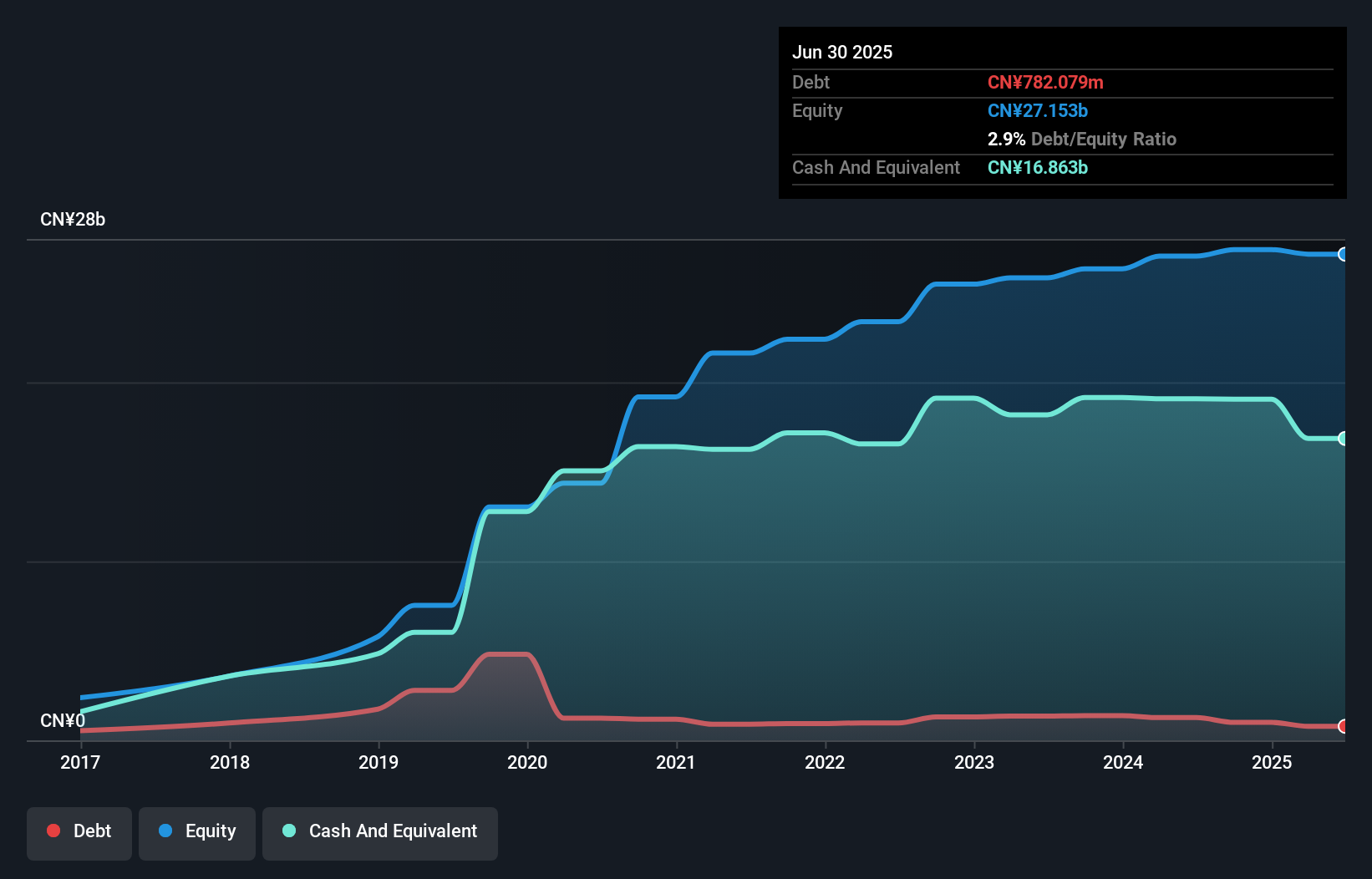

China Feihe, with a market cap of HK$36.74 billion, has a seasoned management team averaging 12.5 years in tenure and an experienced board with 9.6 years on average. Despite negative earnings growth of -24.5% last year, the company is trading at 55.5% below its estimated fair value and analysts anticipate a potential price rise of 27.3%. The company's short-term assets (CN¥20.4 billion) comfortably cover both short-term (CN¥5.3 billion) and long-term liabilities (CN¥1.4 billion). However, its dividend yield of 6.83% is not well covered by free cash flows, suggesting caution for income-focused investors.

- Jump into the full analysis health report here for a deeper understanding of China Feihe.

- Examine China Feihe's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Gain an insight into the universe of 971 Asian Penny Stocks by clicking here.

- Ready For A Different Approach? These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal