Spotlight On 3 ASX Penny Stocks With Market Caps Under A$300M

The Australian market faced a challenging start to the week, with materials dragging down the ASX despite some sectors like discretionary showing resilience. In such fluctuating conditions, investors often look beyond established names to explore opportunities in smaller or newer companies. While 'penny stocks' might seem like an outdated term, they continue to offer potential for growth and value discovery when backed by strong financials. In this article, we spotlight three penny stocks that stand out due to their robust balance sheets and promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.40 | A$114.64M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.465 | A$69.11M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.785 | A$48.88M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.82 | A$433.41M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.05 | A$225.28M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.25B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.95 | A$136.74M | ✅ 4 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.46 | A$645.2M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 430 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Berkeley Energia (ASX:BKY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Berkeley Energia Limited is involved in the exploration and development of mineral properties in Spain, with a market cap of A$236.27 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$236.27M

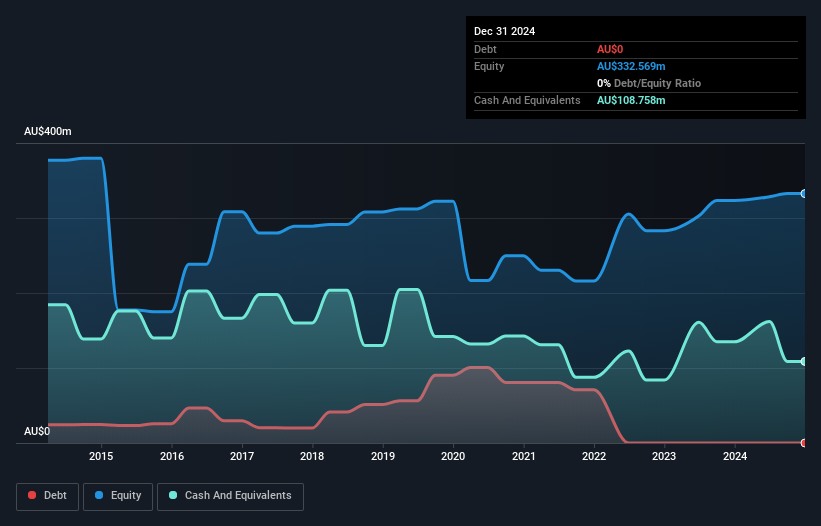

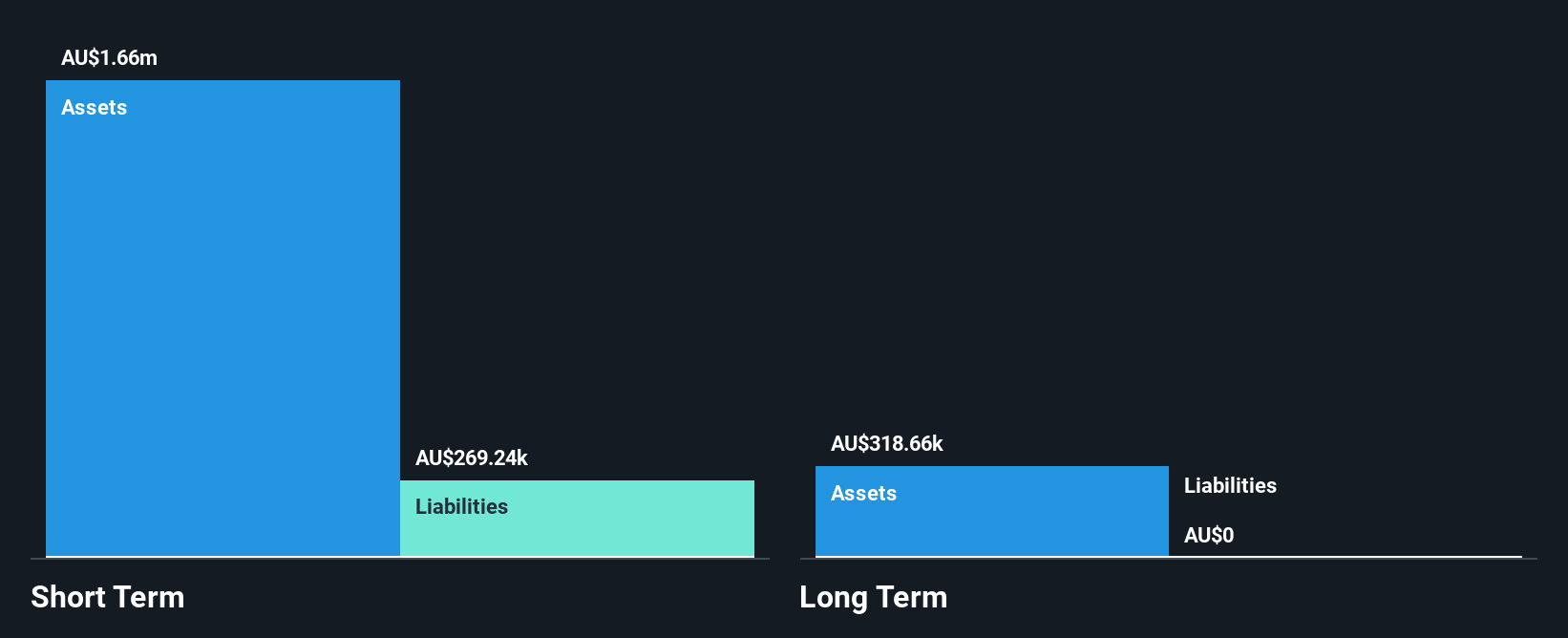

Berkeley Energia Limited, a pre-revenue company with a market cap of A$236.27 million, is actively engaged in mineral exploration in Spain. Recent positive metallurgical test results from the Conchas Project highlight potential recoveries of lithium and rubidium, both critical minerals. The company benefits from strong short-term asset coverage over liabilities and is debt-free, with a cash runway exceeding three years based on current free cash flow trends. Despite being unprofitable, Berkeley has reduced its losses significantly over five years and boasts an experienced management team and board of directors, providing stability amid its strategic initiatives in critical mineral exploration.

- Click here and access our complete financial health analysis report to understand the dynamics of Berkeley Energia.

- Gain insights into Berkeley Energia's historical outcomes by reviewing our past performance report.

Helloworld Travel (ASX:HLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Helloworld Travel Limited is a travel distribution company operating in Australia, New Zealand, and internationally with a market cap of A$297.90 million.

Operations: The company generates revenue through its travel operations with A$149.17 million from Australia, A$33.68 million from New Zealand, and A$3.43 million from the rest of the world.

Market Cap: A$297.9M

Helloworld Travel Limited, with a market cap of A$297.90 million, has shown resilience in the travel sector. The company is debt-free, alleviating concerns over interest payments and enhancing financial stability. Its earnings growth of 7.3% last year outpaced the hospitality industry's decline, although it lags behind its impressive five-year average growth rate of 66.2%. Helloworld's short-term assets comfortably cover both short- and long-term liabilities, indicating strong liquidity management. Despite a low return on equity at 9.7%, the stock trades below estimated fair value and offers good relative value compared to peers within the industry.

- Click here to discover the nuances of Helloworld Travel with our detailed analytical financial health report.

- Learn about Helloworld Travel's future growth trajectory here.

Taruga Minerals (ASX:TAR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taruga Minerals Limited is involved in mineral exploration and development activities in Australia, with a market cap of A$17.13 million.

Operations: The company's revenue is derived entirely from the exploration of minerals, amounting to A$0.08 million.

Market Cap: A$17.13M

Taruga Minerals Limited, with a market cap of A$17.13 million, is a pre-revenue company focused on mineral exploration. Despite its unprofitability and declining earnings over the past five years, Taruga remains debt-free and has sufficient cash runway for over a year based on current free cash flow. The company's short-term assets significantly exceed its liabilities, providing some financial stability amidst high volatility in share price and increased weekly volatility from 29% to 48%. Recent developments include options to acquire gold projects in Papua New Guinea, which could potentially transform its asset base if successfully executed.

- Get an in-depth perspective on Taruga Minerals' performance by reading our balance sheet health report here.

- Understand Taruga Minerals' track record by examining our performance history report.

Make It Happen

- Take a closer look at our ASX Penny Stocks list of 430 companies by clicking here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal