Asahi Kasei (TSE:3407): Valuation Check After TSMC Award and New Sustainable Materials Push

Asahi Kasei (TSE:3407) just picked up a 2025 Excellent Performance Award from TSMC for its advanced packaging materials, underscoring how seriously the company is leaning into semiconductor demand tied to AI.

See our latest analysis for Asahi Kasei.

That push into AI oriented semiconductors and portfolio reshaping, from advanced packaging wins with TSMC to exiting lower return HMD production, has coincided with clear momentum, with a roughly 30 percent year to date share price return and a 1 year total shareholder return above 35 percent suggesting investors are warming to the story.

If this mix of AI exposure and strategic pruning appeals, it is worth seeing what else fits the theme, starting with high growth tech and AI stocks.

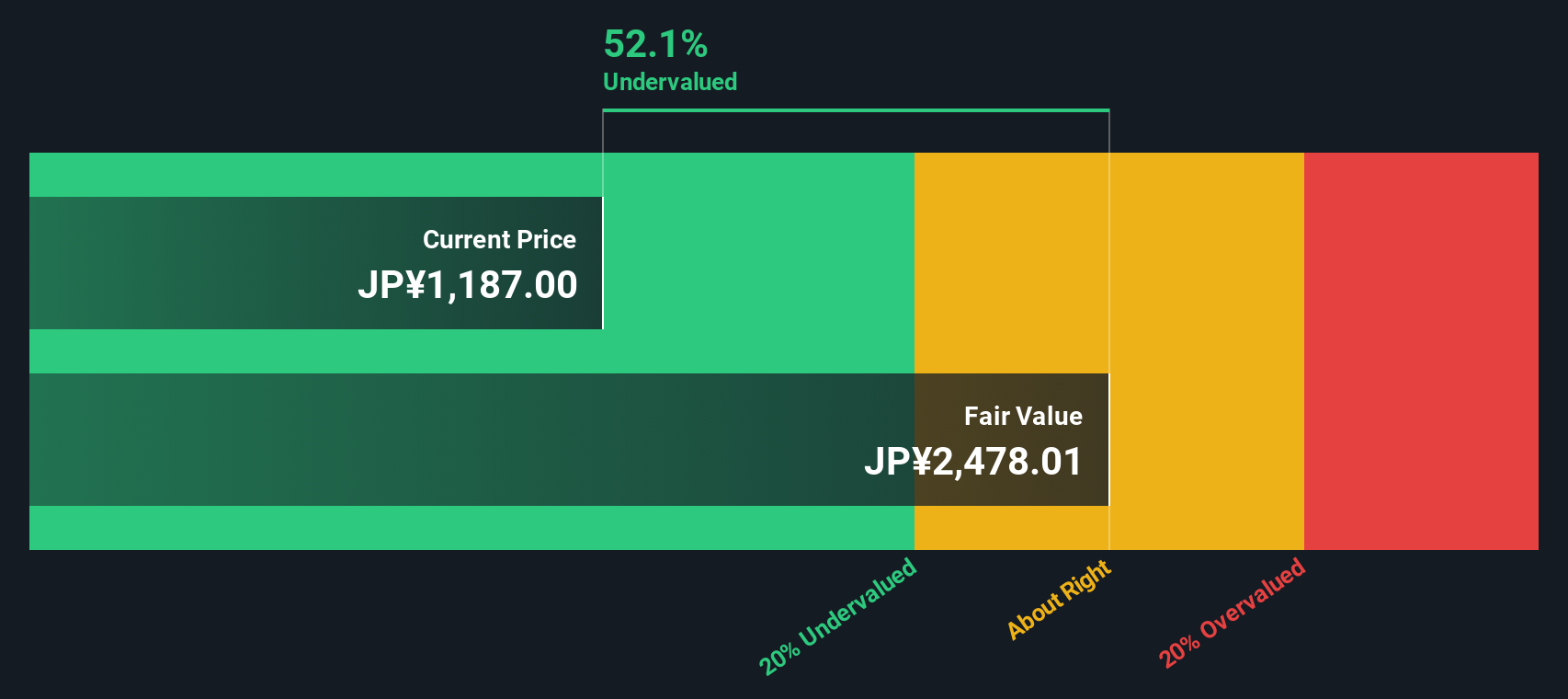

Yet with earnings improving, a solid value score, and shares still trading at a sizable discount to intrinsic value despite a strong rally, is Asahi Kasei quietly undervalued here, or is the market already pricing in that future growth?

Price-to-Earnings of 13.5x: Is it justified?

On a price-to-earnings ratio of 13.5x at a last close of ¥1,405, Asahi Kasei screens cheaper than peers yet slightly richer than the broader Chemicals industry.

The price-to-earnings multiple compares the share price with current earnings, making it a useful shorthand for how much investors are paying for each unit of profit in a diversified, mature business like Asahi Kasei.

Here, the market is assigning a 13.5x earnings multiple, which sits below the estimated fair P E ratio of 18.8x, suggesting potential room for re rating if earnings keep tracking forecasts.

Against that backdrop, the stock looks expensive versus the JP Chemicals industry average multiple of 12.6x, but meaningfully cheap compared to a much higher peer average of 37.1x, indicating the market could be underestimating its earnings power if fair value benchmarks prove accurate.

Explore the SWS fair ratio for Asahi Kasei

Result: Price-to-Earnings of 13.5x (UNDERVALUED)

However, sustained margin pressure in legacy chemicals or a slowdown in AI driven semiconductor investment could quickly cap further re rating potential.

Find out about the key risks to this Asahi Kasei narrative.

Another View Using Our DCF Model

Our DCF model paints a far more dramatic picture, implying fair value around ¥2,720 versus today’s ¥1,405, or roughly a 48 percent discount. If those cash flow assumptions hold, is the market overlooking a deep value opportunity or just pricing in execution risk more realistically?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asahi Kasei for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asahi Kasei Narrative

If you see the numbers differently, or would rather dig into the figures yourself, you can build a complete view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Asahi Kasei.

Ready for your next investing edge?

Do not stop at one opportunity; use the Simply Wall St Screener to uncover focused ideas that can sharpen your strategy and help you stay ahead of the crowd.

- Target stable income streams by reviewing mature businesses in these 13 dividend stocks with yields > 3% that may keep paying you even when markets turn choppy.

- Position yourself for breakthrough innovation by scanning these 27 quantum computing stocks shaping the future of advanced computing and long term disruption.

- Explore potential mispriced opportunities by filtering for these 907 undervalued stocks based on cash flows where market pessimism could be creating tomorrow’s strongest rebounds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal