Reassessing National Beverage (FIZZ) After Softer Earnings: Does the Stock’s Valuation Reflect Its Volume Declines?

National Beverage (FIZZ) just posted a quarter where sales and case volume slipped, even as pricing and mix nudged profits higher. It was a mixed update that helps explain the recent pressure on the stock.

See our latest analysis for National Beverage.

Investors have been reassessing that resilience, with the share price at $33.85 and a year to date share price return of negative 20.17% alongside a 12 month total shareholder return of negative 27.03%. This suggests momentum is still fading despite price mix gains and ongoing buybacks.

If this cautious setup has you comparing opportunities, it could be a good moment to scan fast growing stocks with high insider ownership for other fast moving names with more conviction behind them.

With shares down sharply, profits flat and only a modest discount to analyst targets, investors now face a key question: is National Beverage a contrarian value play, or is the market already pricing in its growth prospects?

Price-to-Earnings of 17x: Is it justified?

On a headline basis, National Beverage trades on a 17x price to earnings multiple, which looks modest given its last close at $33.85 and recent share price weakness.

The price to earnings ratio compares what investors pay today to each dollar of current earnings and is a common yardstick for branded beverage companies with steady, cash generative profiles. For a mature business with mid single digit profit growth and resilient margins, a mid teens multiple suggests the market is not baking in aggressive acceleration, but also not pricing in a structural decline.

Against peers, that 17x multiple looks undemanding compared both to the peer group average of 27.1x and the broader global beverage industry at 17.6x. This implies investors are assigning little premium for the company’s high return on equity and consistent profitability. If sentiment stabilises or revenue growth nudges higher, the gap to peer valuations could narrow as the market reassesses what a fair earnings multiple should be for FIZZ’s brand portfolio.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17x (UNDERVALUED)

However, sustained volume declines or a sharper consumer shift toward competing beverages could leave FIZZ stuck with low growth despite its seemingly modest valuation.

Find out about the key risks to this National Beverage narrative.

Another Angle on Value

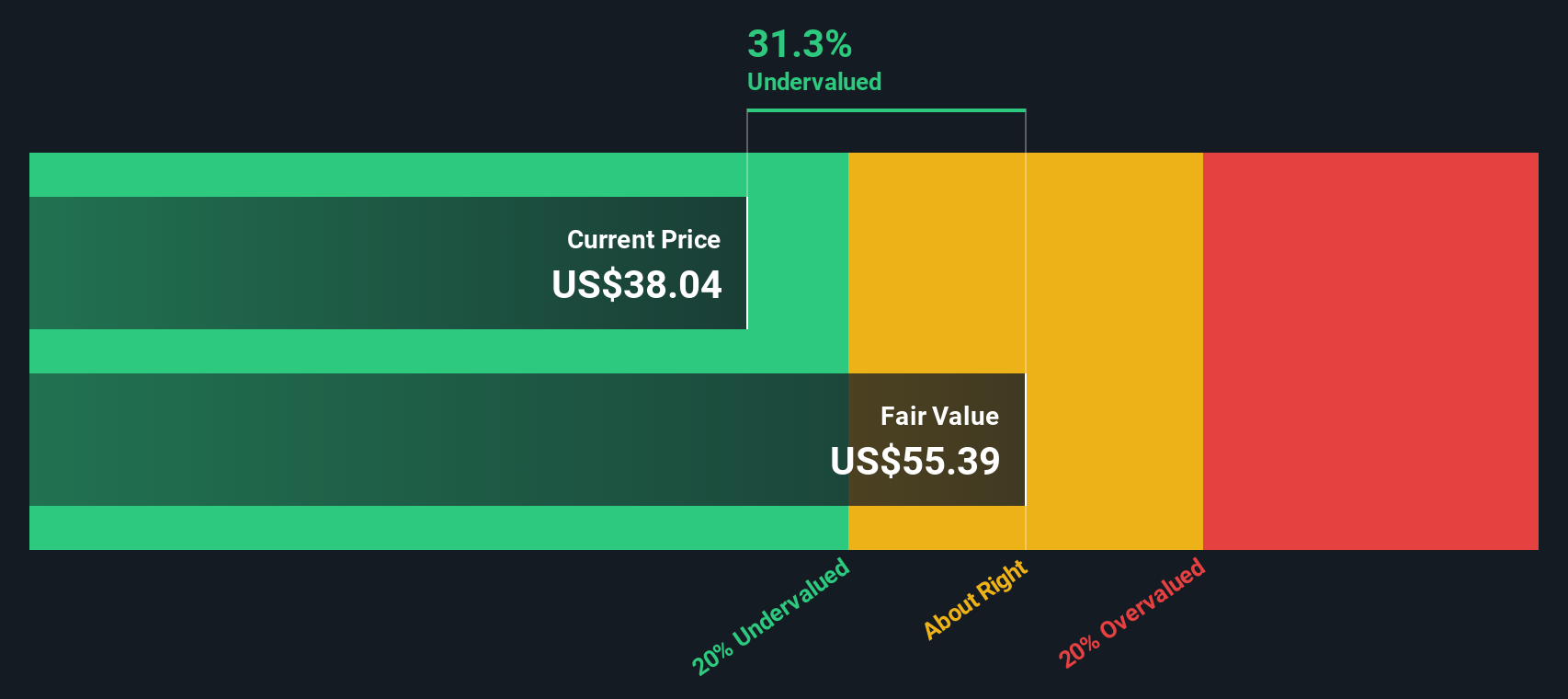

Our DCF model puts fair value for National Beverage nearer $42.14, around 19.7% above the current $33.85 share price. That also points to undervaluation, but from a cash flow lens. If both earnings and cash flows say cheap, what catalyst are investors still waiting for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Beverage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Beverage Narrative

If you would rather dig into the numbers yourself and draw your own conclusions, you can build a customised view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding National Beverage.

Looking for more investment ideas?

Before you move on, lock in a few fresh angles for your watchlist using the Simply Wall Street Screener so you do not miss tomorrow’s winners.

- Capture potential turnaround plays by targeting companies trading below their cash flow value through these 907 undervalued stocks based on cash flows and position yourself early in any re-rating.

- Tap into secular growth by scanning these 30 healthcare AI stocks for innovators using artificial intelligence to transform diagnostics, treatment pathways, and medical efficiency.

- Capitalize on income opportunities by reviewing these 13 dividend stocks with yields > 3% and focus on businesses pairing attractive yields with the capacity to sustain and grow payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal