US High Growth Tech Stocks to Watch

The United States market has recently experienced declines in major stock indexes, with technology shares exerting downward pressure on the Nasdaq amid concerns about an AI bubble. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience against broader market volatility.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.12% | 23.48% | ★★★★★☆ |

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Palantir Technologies | 27.16% | 29.97% | ★★★★★★ |

| Workday | 11.17% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| HubSpot | 14.30% | 48.34% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.85% | 46.09% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.76% | 116.48% | ★★★★★☆ |

Click here to see the full list of 75 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Gyre Therapeutics (GYRE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gyre Therapeutics, Inc. is a pharmaceutical company focused on developing and commercializing small-molecule drugs for treating organ fibrosis, with a market cap of $698.95 million.

Operations: Gyre focuses on developing and commercializing small-molecule drugs for organ fibrosis, generating revenue primarily from its Gyre Pharmaceuticals segment, which reported $107.27 million. The company is engaged in the pharmaceutical industry with a market cap of approximately $698.95 million.

Gyre Therapeutics has demonstrated a robust performance with third-quarter sales increasing to $30.56 million from $25.49 million year-over-year, and net income rising significantly to $3.61 million from $1.12 million. This growth is underscored by a promising pipeline, including the recent completion of patient enrollment for its Pirfenidone capsules in China, aimed at treating pneumoconiosis—a prevalent occupational disease. Despite facing challenges such as supply chain disruptions and cautious market behavior in China impacting full-year revenue forecasts, Gyre's strategic position in high-growth therapeutic segments and its inclusion in the S&P Global BMI Index highlight its potential resilience and innovation-driven growth trajectory within the biotech landscape.

Allot (ALLT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Allot Ltd. is a company that develops, sells, and markets network intelligence and security solutions across various regions including Israel, Europe, Asia, Oceania, the Americas, the Middle East, and Africa with a market capitalization of $477.74 million.

Operations: The company focuses on providing network intelligence and security solutions, generating revenue primarily from its Optical Networking Equipment segment, which accounts for $98.51 million.

Allot recently reported a significant turnaround with third-quarter earnings showing a rise from a loss last year to profits this year, with sales climbing to $26.41 million from $23.24 million. This performance is part of an upward trajectory, as evidenced by their revised full-year revenue forecast now set between $100 million and $103 million, indicating robust growth and market confidence. Their participation in prominent industry conferences and inclusion in the S&P Global BMI Index further underscore their strategic positioning within the tech sector. This momentum is mirrored in their financials; annualized revenue growth stands at 11.9%, while earnings are expected to surge by 49.2% annually, outpacing broader market trends significantly.

- Dive into the specifics of Allot here with our thorough health report.

Review our historical performance report to gain insights into Allot's's past performance.

Kiniksa Pharmaceuticals International (KNSA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kiniksa Pharmaceuticals International, plc is a biopharmaceutical company that develops and commercializes novel therapies for diseases with unmet needs, focusing on cardiovascular indications globally, with a market cap of $3.15 billion.

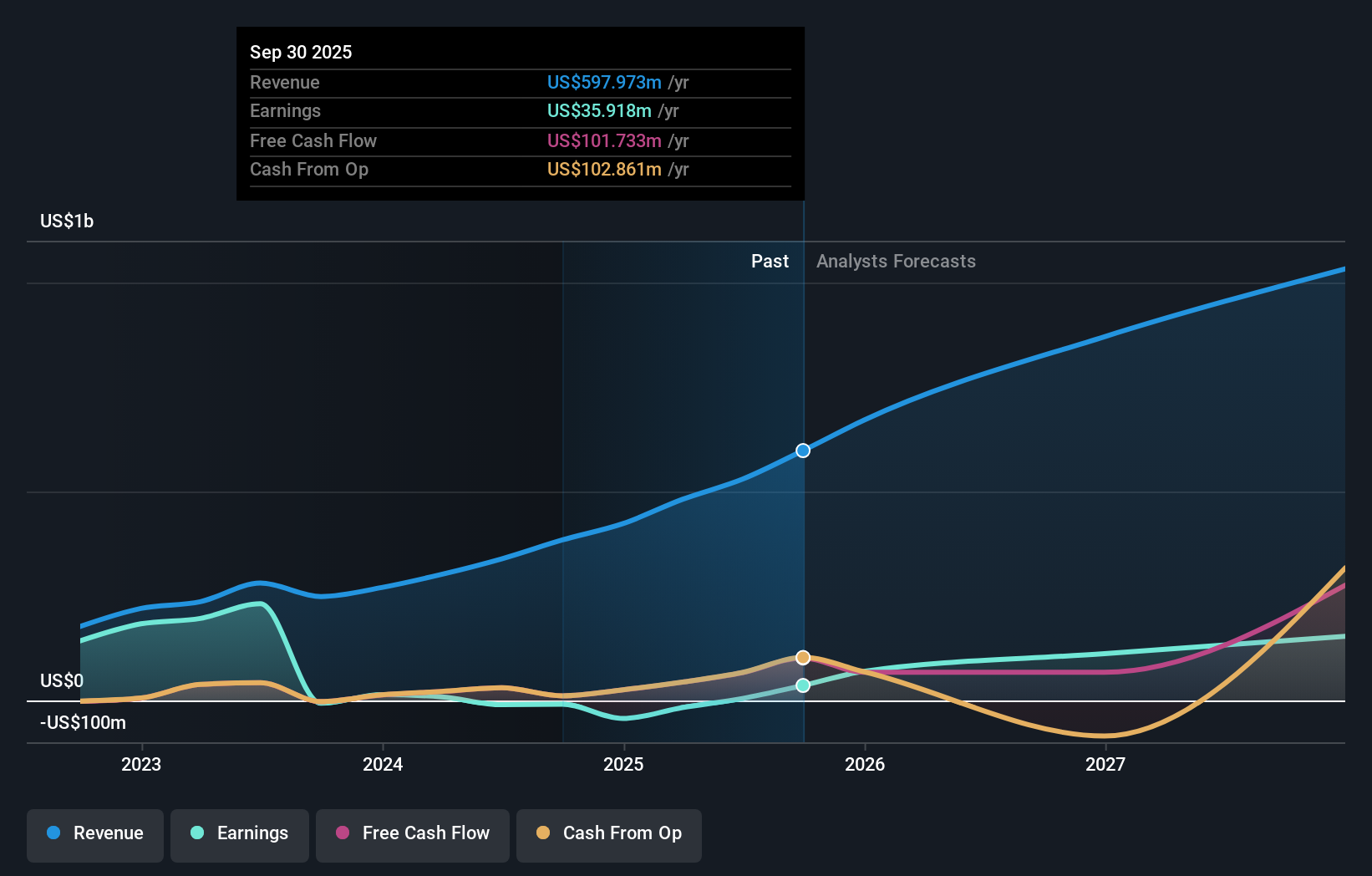

Operations: Kiniksa Pharmaceuticals generates revenue primarily from developing and delivering therapeutic medicines, amounting to $597.97 million. The company focuses on addressing unmet medical needs, particularly in cardiovascular diseases.

Kiniksa Pharmaceuticals International has demonstrated a noteworthy turnaround, transitioning from a net loss to generating $18.44 million in net income for Q3 2025, with revenues soaring to $180.86 million from $112.21 million the previous year. This surge reflects an annualized revenue growth of 17.5% and earnings growth projected at 33.4%, significantly outpacing the US market averages of 10.6% and 16.1%, respectively. The company's strategic presentations at key industry events like the Jefferies London Healthcare Conference underscore its growing influence in biotech, further buoyed by raising its full-year revenue guidance by approximately $45 million amidst this positive momentum.

- Click here and access our complete health analysis report to understand the dynamics of Kiniksa Pharmaceuticals International.

Learn about Kiniksa Pharmaceuticals International's historical performance.

Key Takeaways

- Discover the full array of 75 US High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal